KKR-backed OneStream sees $4.6B valuation following $490M IPO

CFO Dive

JULY 24, 2024

The company will continue to invest in machine learning, AI and new products such as demand forecasting tools following its $490 million IPO, CFO Bill Koefoed said.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Valuation Related Topics

Valuation Related Topics

CFO Dive

JULY 24, 2024

The company will continue to invest in machine learning, AI and new products such as demand forecasting tools following its $490 million IPO, CFO Bill Koefoed said.

CFO Dive

OCTOBER 3, 2024

The move comes amid speculation that OpenAI may be considering an initial public offering and as its CFO has been actively touting the company’s strategy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

JANUARY 7, 2025

The sale comes as a Morgan Stanley analyst cautioned that Palantir is “trading too far ahead” of its intrinsic value as it looks to take advantage of the generative AI boom.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Barry Ritholtz

OCTOBER 9, 2024

ATM: Valuation is an exercise in faith with Aswath Damodaran. Full transcript below. ~~~ About this week’s guest: Professor Aswath Damodaran of NYU Stern School of Business is known as the Dean of Valuation. . ~~~ About this week’s guest: Professor Aswath Damodaran of NYU Stern School of Business is known as the Dean of Valuation.

Barry Ritholtz

APRIL 8, 2023

A nine-time “Professor of the Year” winner at NYU, Damodaran teaches classes in corporate finance and valuation to MBA students. He has also written several books on corporate finance and equity valuation and has published widely in journals. Damdoran loves “untangling the puzzles of corporate finance and valuation.”

Musings on Markets

DECEMBER 11, 2024

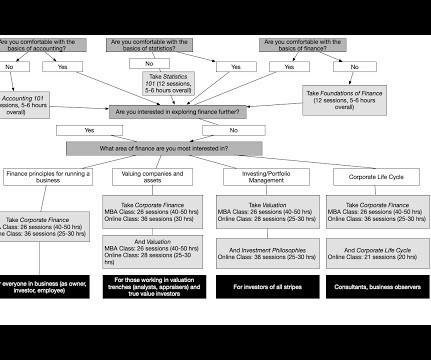

Once I came to NYU in 1986, I continued to teach classes across the finance spectrum, from corporate finance to valuation to investing, and I am glad that I did so. The second is valuation , a class about how to value or price almost anything, with a tool set for those who need to put numbers on assets.

CFO Dive

FEBRUARY 3, 2022

If 2022 is the year investors start applying more scrutiny to the companies they fund, the value of your intangible assets can be the difference in getting, or not getting, the price you want.

CFO News Room

FEBRUARY 3, 2023

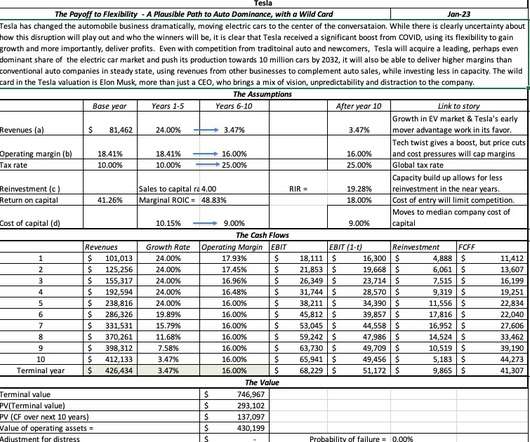

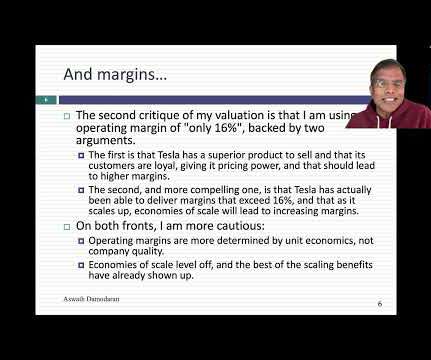

I wrote about my most recent valuation of Tesla just over a week ago , and as has always been the case when I value this company, I have heard from both sides of the Tesla divide. Based at least on the reactions, I have realized that some may be misreading my story and valuation, ore reacting just to a picture in a tweet.

CFO Dive

NOVEMBER 7, 2022

With the recent decision by US regulators to abandon plans to scrap mandatory goodwill impairment valuations, goodwill assessments are here to stay.

Musings on Markets

JANUARY 31, 2025

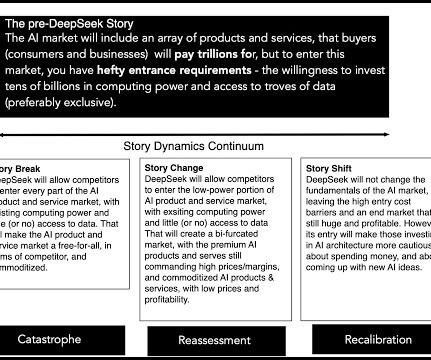

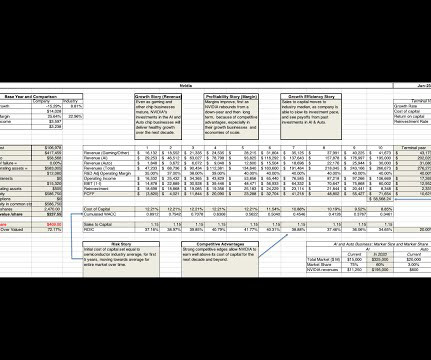

Nvidia market share: In my valuation, I assumed that Nvidia's lead in the AI chip business would give the company a head start, as the business grew, and to the extent that demand is sticky (i.e., The AI Story, after DeepSeek I teach valuation, and have done so for close to forty years.

CFO Dive

NOVEMBER 7, 2023

Some investors seek broader company disclosures with the aim of promoting social change rather than clarifying stock valuations, SEC Commissioner Mark Uyeda said.

CFO News Room

JANUARY 15, 2023

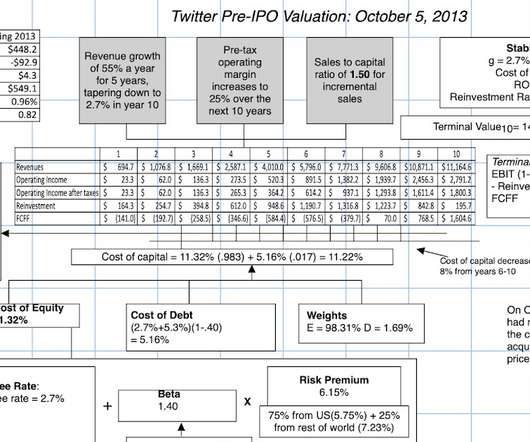

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. . billion, well below the $9.6

CFO News

MARCH 17, 2025

Additionally, he emphasizes valuation concerns in capex stocks despite government initiatives. He notes the benefits for discretionary spending and consumption stocks due to income tax savings and potential growth in government salaries.

Musings on Markets

AUGUST 19, 2024

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. In 2022, I decided that I had hit critical mass, in terms of corporate life cycle content, and that the material could be organized as a book.

CFO Dive

OCTOBER 12, 2022

The FASB’s tentative decision Wednesday is an important step toward providing an answer to the crypto valuation question companies and other stakeholders have been clamoring for.

Musings on Markets

DECEMBER 10, 2023

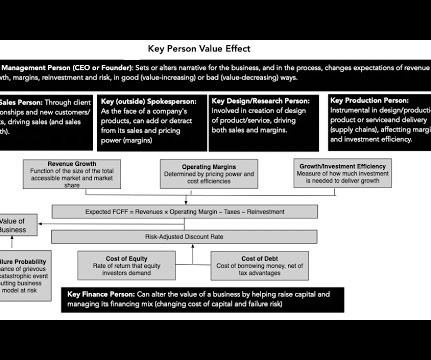

Of course, and with small businesses, especially those built around personal services (a doctor or plumber’s practice), it is part of the valuation process, where the key person is valued or at least priced and incorporated into valuation. To estimate key person value, there are three general approaches: 1.

CFO Dive

MAY 12, 2022

The board is getting serious about improving accounting standards for digital assets even as a crypto market slump is hammering valuations.

CFO Dive

OCTOBER 25, 2022

The suit comes as CFOs are likely to face more disputes around appraisals as the slowing economy impacts real estate valuations.

Musings on Markets

JANUARY 10, 2025

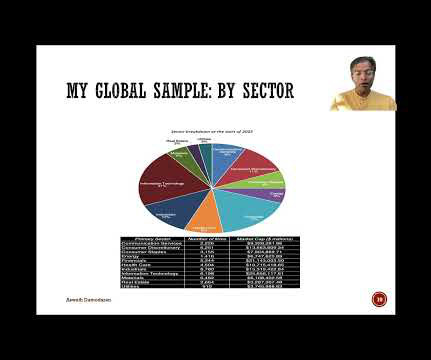

I know that this classification is at odds with the industry classifications based upon SIC or NAICS codes, but it works well enough for me, at least in the context of corporate finance and valuation. Since I teach corporate finance and valuation, I find it useful to break down the data that I report based upon these groupings.

CFO Dive

JANUARY 19, 2023

The sector has been hit by declining sales for PCs and software, plummeting valuations and high inflation. nCino and Microsoft are the latest tech firms to announce layoffs.

Musings on Markets

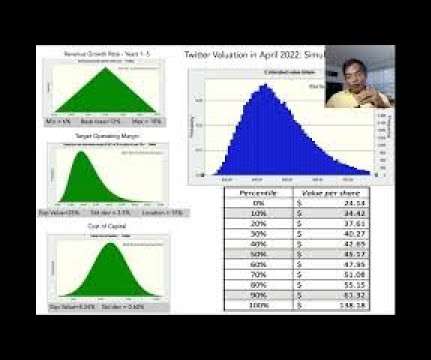

APRIL 21, 2022

billion I estimated in 2021 (year 8 in my IPO valuation) as revenues in my IPO valuation of the company in November 2013, and its operating margin, even with generous assumptions on R&D, was 19.02% in 2021, still below my estimate of 19.76% in that year. billion, well below the $9.6

CFO Dive

MARCH 29, 2023

The Chinese ecommerce giant will be splitting into six separate groups in a move that follows declining tech valuations and a regulatory crackdown on the country’s tech sector.

Musings on Markets

FEBRUARY 2, 2023

I wrote about my most recent valuation of Tesla just over a week ago , and as has always been the case when I value this company, I have heard from both sides of the Tesla divide. Based at least on the reactions, I have realized that some may be misreading my story and valuation, ore reacting just to a picture in a tweet.

CFO Dive

APRIL 12, 2022

Making money based on the customer's savings or revenue generated from the product or service is gaining steam but valuation and accounting challenges are still being sorted out.

CFO News

MAY 26, 2023

The finance veterans highlighted that the funding winter for Indian startups will last at least for six to nine months more, and the investment crisis has normalised the valuation of startups.

CFO News

AUGUST 25, 2023

Zepto funding alert: The 2-year-old company has raised funds at a valuation of USD 1.4 billion making it the first unicorn of 2023 in India.

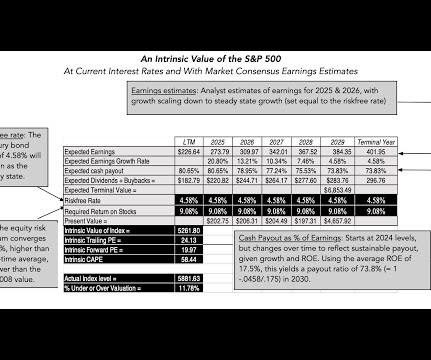

Musings on Markets

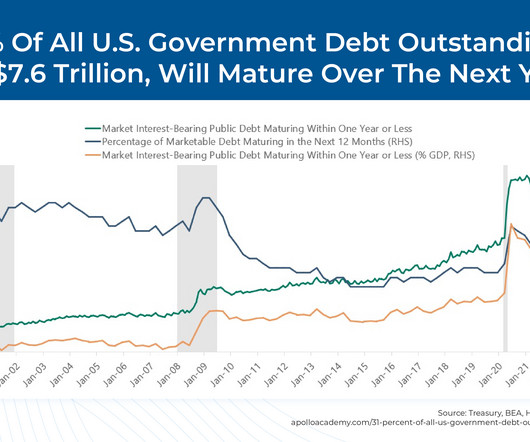

JANUARY 17, 2025

I will follow up by trying to judge where markets stand at the start of 2025, starting with PE ratios, moving on to earnings yields and ending with a valuation of the index. My advice is that you download the valuation spreadsheet , change the inputs to reflect your views of the world, and value the index yourself.

VCFO

SEPTEMBER 21, 2023

Owner’s opinions of their business value can be influenced by inherent biases, flawed valuation methodologies, and factors lurking beyond their control. Owners often seek valuations from CPAs or similar entities for purposes such as insurance, estate planning, or internal events.

Nerd's Eye View

MARCH 6, 2024

The Shilller Cyclically Adjusted Price-to-Earnings (CAPE 10) Ratio is one example that takes into account current market valuations versus company earnings, generally predicting that the higher the valuation at the beginning of a period the lower the expected return for that period.

CFO Dive

APRIL 22, 2022

Cash flow, cost of capital and other factors remain central when it comes time to determine what a business or its credit is worth to investors.

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

Navigator SAP

MARCH 25, 2022

A unicorn startup, a company with a valuation over $1 billion, is a rare beast. According to a September 2021 report by CB Insights, there are only around 800 in the wild. Any startup needs a killer idea; but to truly achieve unicorn status, a company needs the ability to scale up quickly.

CFO News

DECEMBER 19, 2022

SEBI has not proceeded to get the veracity of revenue models, and valuations checked even after post listing debacle in case of various issues, says the former President at ICAI.

Navigator SAP

FEBRUARY 2, 2024

Others move fast and chase the unicorn status of a $1 billion valuation like sustainable shoe manufacturer, Rothy’s. Some startups grow over time. For slow-growth businesses, there are many options for backend IT systems. But for fast-growing companies that are growth-focused, there really is only one path: cloud-based ERP.

VCFO

NOVEMBER 7, 2023

How Quality of Earnings Reports Impact Valuation Securing a Quality of Earnings (QoE) report is often a routine step in the due diligence process for acquisitions. The post Quality of Earnings Reports Impact Valuation appeared first on vcfo. EBITDA is not a complete indication of financial performance for a business.

CFO Dive

AUGUST 8, 2022

The slump in global technology stocks, rising inflation and a weaker yen led Japanese bank SoftBank to report a record $23 billion loss.

CFO News

JULY 19, 2024

Further, how does it impact investment decisions, market valuations, ease of doing business, and foreign investment? How is the Angel Tax affecting India's startup ecosystem?

Musings on Markets

FEBRUARY 8, 2025

I spend most of my time in the far less rarefied air of corporate finance and valuation, where businesses try to decide what projects to invest in, and investors attempt to estimate business value.

Musings on Markets

JUNE 23, 2023

and with my own students asking ChatGPT questions about valuation that they would have asked me directly, the potential for AI to upend life and work is visible, though it is difficult to separate hype from reality. As I watched my wife, who teaches fifth grade, grapple with students using ChatGPT to do homework assignments.

CFO Dive

MARCH 9, 2022

Setting a price is formula-based, but there are levers finance leaders can pull to manage the variance between preferred and common stock, Chad Wilbur of Carta says.

Nerd's Eye View

MAY 16, 2023

What's unique about Jim, though, is how he has scaled his retainer-based boutique firm to more than $7 million in revenue, a $31 million enterprise valuation, and is growing organically at a 40% growth rate, by providing a high-touch comprehensive advice offering for his business owner niche clientele.

Nerd's Eye View

OCTOBER 4, 2023

The expectations for the future economic outlook also appear in the valuations of equities, which tend to reflect how markets anticipate that corporate earnings will grow in the future.

Fox Corporate Finance

DECEMBER 17, 2024

FCF Fox Corporate Finance GmbH is delighted to publish the new FCF Valuation Monitor Q4 2024. The FCF Valuation Monitor is a comprehensive valuation analysis for the German small / midcap market segment and. Read more The post FCF Valuation Monitor – Q4 2024 published appeared first on FCF Fox Corporate Finance GmbH.

Nerd's Eye View

FEBRUARY 11, 2025

David is the President of Succession Resource Group, an advisory consulting and valuation business based in Portland, Oregon that serves independent financial advisors with RIAs and broker-dealers. Welcome to the 424th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is David Grau, Jr.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content