Business lobby rips Biden’s stock buyback tax plan

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tax Planning Related Topics

Tax Planning Related Topics

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

CFO News Room

NOVEMBER 30, 2022

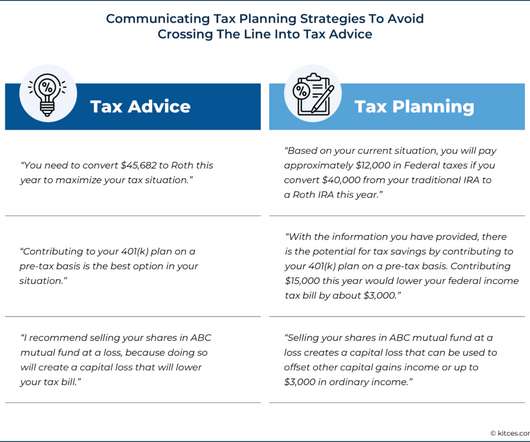

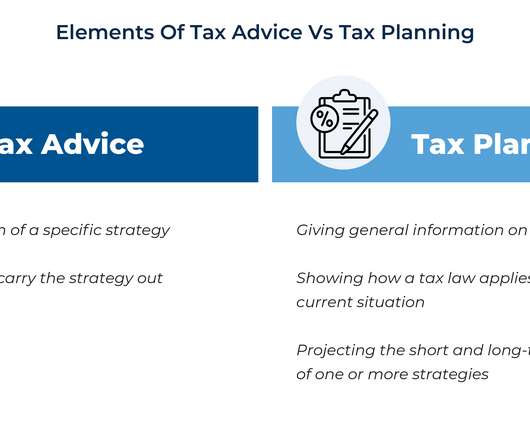

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

JUNE 27, 2022

Hungary’s eleventh hour opposition included concerns about the war in Ukraine and fears about being a first mover on the Pillar Two rules, according to a PwC report.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Selections

NOVEMBER 20, 2024

A CFO has a deep understanding of your business model and your banking relationships, works with your board of directors, prepares detailed financial and management reports, works with auditors, oversees tax planning, and sets policies around controls and payroll.

Nerd's Eye View

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

CFA Institute

JANUARY 13, 2023

While risk management may be the key component of wealth preservation, what often gets overlooked is how much smart tax planning can do to help clients retain more of their wealth. After a down year for financial markets, investors’ priorities have naturally shifted from growing their assets to preserving their wealth.

Nerd's Eye View

DECEMBER 30, 2024

We start with several articles on retirement planning: Why considering a client's retirement time horizon and spending flexibility could lead to more accurate (and often higher) safe withdrawal rates than the simpler "4% rule" Four unique risks retirees face when drawing down their assets, from sequence of returns risk to tax risk, and how financial (..)

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

CFO Plans

NOVEMBER 10, 2024

Optimize Your Hiring Strategy with CFO Plans Business Tax Planning as a Route to Savings In financial management, business tax planning is often an overlooked yet vital component. Meticulous planning can lead to substantial savings, freeing up resources for employee benefits.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility.

CFO Plans

SEPTEMBER 24, 2024

Discover expert tax planning and accounting services designed to help you thrive. Effective tax planning and accounting are not just about compliance; they are about unlocking opportunities for growth and stability. In conclusion, effective tax planning and accounting are vital for the success of small businesses.

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Navigator SAP

OCTOBER 28, 2022

Like tax planning, landed costs are a subtle but important business consideration for maximizing profit margins and ensuring profitability. It seemed like an efficient purchase order. A batch of camera equipment was ordered from a UK supplier for a warehouse in Thailand based on a good unit price.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

CFO Plans

JANUARY 20, 2025

This guide aims to equip you with essential tools and insights to simplify tax filing, ensuring you’re not only compliant but also maximizing potential savings. Strategic Tax Planning for Entrepreneurs The foundation of effective tax management begins with strategic planning.

PYMNTS

AUGUST 26, 2019

Thailand hopes to annually collect 3 billion to 4 billion baht ($98 million to $131 million) by introducing a tax on tech businesses, Reuters reported on Monday (Aug. If approved by Parliament, Thailand will institute a value-added-tax starting next year on electronic businesses, leveraging the eCommerce boom in the country.

CFO News

NOVEMBER 24, 2023

Dhankhar stressed that tax evasion and financial frauds endanger the financial stability and economic growth of the economy. “As As watchdogs, your capacity is potent enough to contain these,” he told the gathering of CAs.

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year rolls around, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you […].

Nerd's Eye View

SEPTEMBER 25, 2024

Because not only were very few households actually subject to the 1950s-era top tax rates (which were triggered at the equivalent of over $2 million of income in today's dollars), but the long decline in nominal tax rates has also come with the elimination of many loopholes and deductions that have resulted in more income being subject to tax.

PYMNTS

OCTOBER 19, 2020

However, the OECD cautioned about the potential of an international trade war brought by different nations rolling out digital services taxes on their own to assist in their economic rebounds from COVID-19 in the event nations don’t all agree on the new tax regulations. France Will Proceed With Controversial Digital Services Tax Plan.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

Nerd's Eye View

OCTOBER 5, 2022

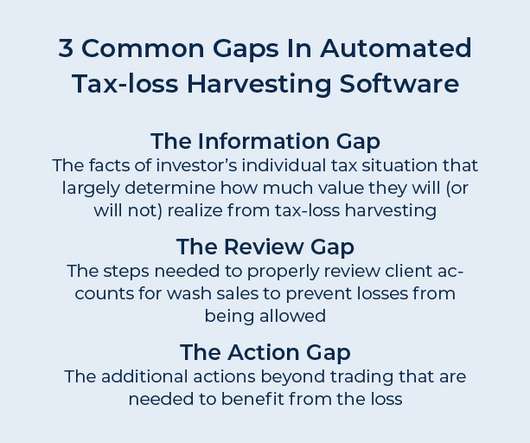

And when factoring in the fees charged by those technology platforms, the value of such ‘tactical’ tax-loss harvesting might exceed the value the investor would have realized by relying on a technology solution to do it automatically! Read More.

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year begins, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you get […].

Nerd's Eye View

JANUARY 8, 2024

improves on the previous iterations of planning by involving a more thorough technical analysis of a client's unique situation than it did before and drilling deeper to reveal more planning opportunities to present to clients. Specifically, Financial Advice 3.0

CFO Network

NOVEMBER 10, 2021

With outsourced business accounting services , you can get access to professional tax planning advice from a CPA or a CFO. They will be able to advise you on what tax planning strategies to put in place to legally minimize your tax burden each year. You Get Valuable Advice for Your Small Business.

E78 Partners

MARCH 3, 2025

Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations. Implement Internal Controls and SOX Compliance: Establish governance frameworks to support transparency and regulatory compliance.

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

FEBRUARY 24, 2023

Also in industry news this week: Why the behavior of some TAMPs and investment advisers might have led the SEC to propose its new (and potentially burdensome) ‘outsourcing rule’ Why independent broker-dealers could become major players in RIA M&A in the coming year From there, we have several articles on advisor marketing: How to craft (..)

Nerd's Eye View

OCTOBER 27, 2023

Also in industry news this week: A survey indicates that while financial advisors remain the most trusted source of financial advice, they might increasingly encounter client questions and ideas that originated from social media Following the transition of advisors and clients from TD Ameritrade and amid competition from competing RIA custodians, Charles (..)

Nerd's Eye View

OCTOBER 14, 2022

While this will help seniors keep pace with rising prices, it also creates tax planning opportunities for advisors and raises the possibility that the Social Security Trust Fund could be depleted sooner than expected. for 2023, the largest COLA since 1981.

PYMNTS

NOVEMBER 25, 2020

The potential amendment to bring in the tax plan is intended to take effect in October of next year, but the legislative body is aiming to have the taxation timeframe begin in the first month of 2022.

Nerd's Eye View

AUGUST 9, 2024

Also in industry news this week: With a potential SEC regulation requiring RIAs to engage in enhanced "know your customer" practices under consideration, the Investment Adviser Association is arguing for a more tailored approach to identifying risky clients and a longer implementation period to relieve the potential burden on RIAs The SEC is investigating (..)

Nerd's Eye View

JULY 7, 2023

Also in industry news this week: A recent survey indicates that a strong majority of financial advisory clients have maintained their trust in their advisors despite the investment market setbacks experienced last year A report from the SEC shows that a majority RIAs have mandatory arbitration clauses in their client agreements, a practice that has (..)

Nerd's Eye View

NOVEMBER 18, 2022

A potential compromise during the lame-duck Congressional session could see a boost to the child tax credit and extended tax breaks for businesses. From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions.

Nerd's Eye View

SEPTEMBER 6, 2024

Also in industry news this week: A probe by the Government Accountability Office found that the conflict-of-interest disclosures offered by many firms offering financial advice are often inadequate or confusing, making it hard for consumers to understand whether and when a financial professional is operating in their best interest A recent study has (..)

Nerd's Eye View

JUNE 21, 2024

Also in industry news this week: A recent survey indicates that financial advisors continue to move towards ETFs and away from mutual funds when it comes to client portfolio recommendations, though a majority of advisors continue to see a role for active management in the investment management process A former employee has filed a lawsuit alleging (..)

Nerd's Eye View

SEPTEMBER 20, 2024

Also in industry news this week: A coalition of organizations representing financial advisors is pressing Congress to include tax breaks for financial advisory fees amidst expected negotiations to address the pending expiration of several provisions of the Tax Cuts and Jobs Act A recent survey indicates that client referrals remain the chief source (..)

CFO News Room

NOVEMBER 28, 2022

Tax Planning. In addition to managing investments, tax planning is another area where advisors can demonstrate their value in dollar terms. This often starts with reviewing the client’s tax return to ensure they received the credits and deductions for which they were eligible.

CFO Talks

NOVEMBER 11, 2024

By staying informed on tax types, emerging trends, and compliance strategies, CFOs can manage tax obligations effectively, ensuring their companies remain compliant while taking advantage of available tax efficiencies. The post Understanding Taxation in South Africa and Beyond appeared first on CFO Club Africa.

CFO Plans

OCTOBER 9, 2024

Learn How CFO Plans Can Boost Your Financial Health Corporate Tax Planning for Proactive Financial Management Corporate tax planning is a fundamental aspect of successful tax compliance. As a result, they were able to invest more in innovation, fueling further growth.

Nerd's Eye View

MAY 12, 2023

Also in industry news this week: Why industry groups representing investment advisers and others have blasted an SEC proposal that would significantly expand its Custody Rule A new study suggests that organic client growth and profit margins are the key factors driving RIA valuations, with the firm’s affiliation model having little to no impact (..)

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content