How Advisors Can Offer Tax Planning And Stay In Compliance

CFO News Room

NOVEMBER 30, 2022

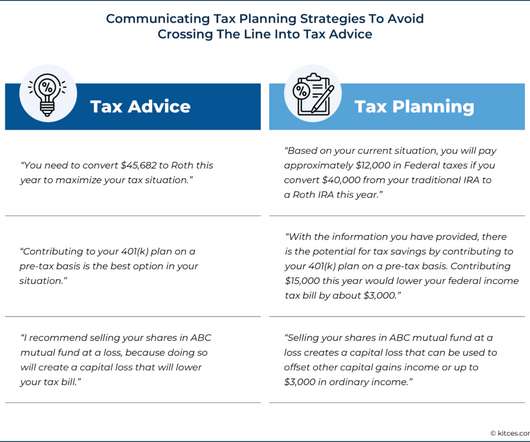

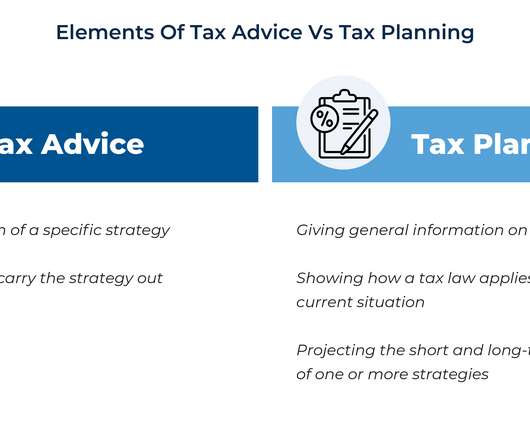

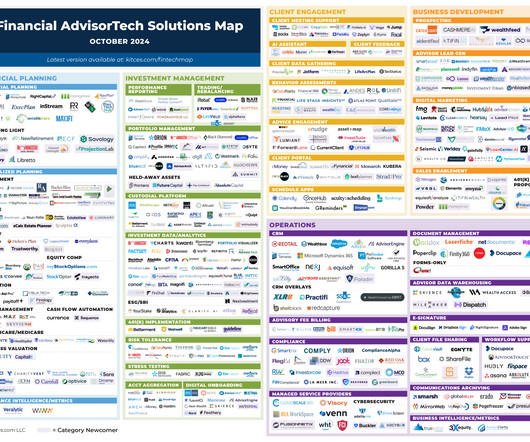

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden. Team Kitces.

Let's personalize your content