Business lobby rips Biden’s stock buyback tax plan

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

FEBRUARY 10, 2023

The push to raise taxes on corporate stock buybacks could hurt America’s retirement savers, as well as entrepreneurs, according to the U.S. Chamber of Commerce.

CFO Dive

JUNE 27, 2022

Hungary’s eleventh hour opposition included concerns about the war in Ukraine and fears about being a first mover on the Pillar Two rules, according to a PwC report.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Nerd's Eye View

NOVEMBER 30, 2022

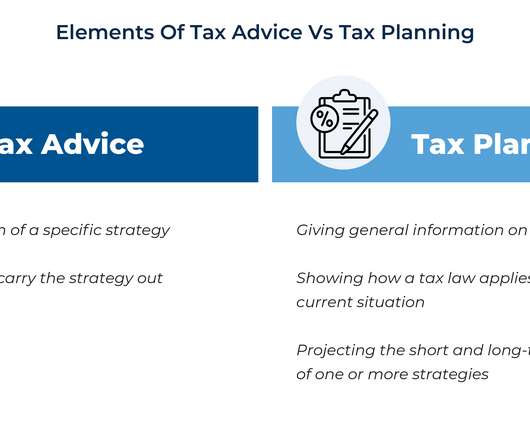

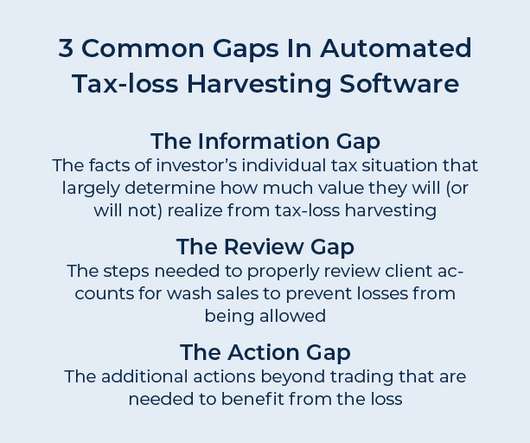

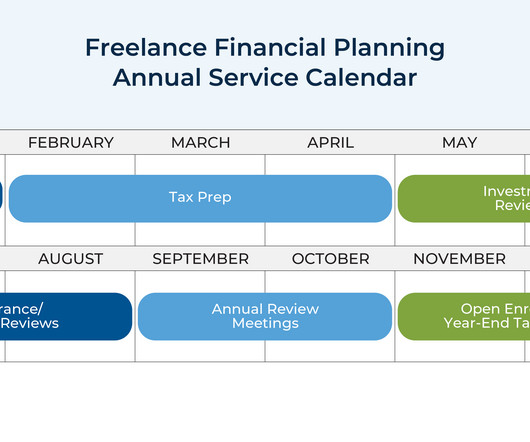

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Selections

NOVEMBER 20, 2024

A CFO has a deep understanding of your business model and your banking relationships, works with your board of directors, prepares detailed financial and management reports, works with auditors, oversees tax planning, and sets policies around controls and payroll.

CFA Institute

JANUARY 13, 2023

While risk management may be the key component of wealth preservation, what often gets overlooked is how much smart tax planning can do to help clients retain more of their wealth. After a down year for financial markets, investors’ priorities have naturally shifted from growing their assets to preserving their wealth.

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. Welcome everyone! Welcome to the 432nd episode of the Financial Advisor Success Podcast!

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Pricing the impact of financial planning can be challenging, because many of its benefits – like peace of mind – are intangible, compelling in value but difficult to match with an exact price.

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

CFO Plans

NOVEMBER 10, 2024

For businesses poised for expansion, understanding and strategically planning for these costs isn’t just advantageous—it’s essential for success. Optimize Your Hiring Strategy with CFO Plans Business Tax Planning as a Route to Savings In financial management, business tax planning is often an overlooked yet vital component.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

CFO Plans

SEPTEMBER 24, 2024

Discover expert tax planning and accounting services designed to help you thrive. Effective tax planning and accounting are not just about compliance; they are about unlocking opportunities for growth and stability. In conclusion, effective tax planning and accounting are vital for the success of small businesses.

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year rolls around, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you […].

Navigator SAP

OCTOBER 28, 2022

Like tax planning, landed costs are a subtle but important business consideration for maximizing profit margins and ensuring profitability. It seemed like an efficient purchase order. A batch of camera equipment was ordered from a UK supplier for a warehouse in Thailand based on a good unit price.

CFO Plans

JANUARY 20, 2025

Get expert guidance from CFO Plans today to ensure you’re compliant and maximizing potential savings. This guide aims to equip you with essential tools and insights to simplify tax filing, ensuring you’re not only compliant but also maximizing potential savings. However, you dont have to face it alone.

Anaplan

FEBRUARY 12, 2021

The planning disconnect Every time a new year begins, many of us take it as an opportunity to reorder our lives. Reorganize closets or refrigerators, create an emergency go-bag, get ahead of tax planning so that the weekend before the filing deadline you’re not frantically pawing through a year’s worth of receipts – you get […].

Nerd's Eye View

APRIL 5, 2023

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Nerd's Eye View

JULY 20, 2022

A sabbatical refers to a period of time in which someone takes an extended, planned break from work prior to retirement, often as an opportunity to focus on their wellbeing and/or to gain valuable perspectives of life outside of work.

PYMNTS

AUGUST 26, 2019

The company has also introduced a taxi-hailing and meal delivery service in Bangkok and three surrounding provinces, with plans to expand into other major cities such as Pattaya, Phuket and Chiang Mai by next year.

CFO News Room

NOVEMBER 23, 2022

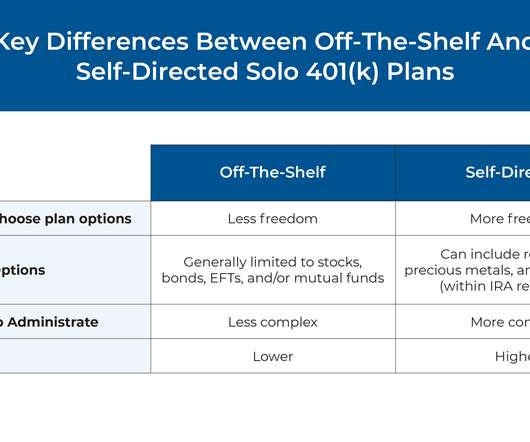

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings. Self-directed plans, meanwhile, offer more ability to tailor a plan’s features to an individual’s needs.

PYMNTS

NOVEMBER 6, 2017

The GOP unveiled its plans for tax reform late last week in an effort to streamline the tax code, a move that aims to cut the tax rates for corporates. In a statement released late last week, the NFIB said it is “unable to support the House tax reform plan in its current form.”.

CFO News

NOVEMBER 24, 2023

Dhankhar stressed that tax evasion and financial frauds endanger the financial stability and economic growth of the economy. “As As watchdogs, your capacity is potent enough to contain these,” he told the gathering of CAs.

Nerd's Eye View

MAY 31, 2023

Ultimately, for a subset of taxpayers – namely high-income owners of pass-through businesses in high-tax states, who preferably only do business in 1 or a small number of states to reduce the overall complexity – PTETs can provide an opportunity for significant Federal tax savings.

Nerd's Eye View

SEPTEMBER 25, 2024

tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon. However, with the national debt expanding rapidly, observers of U.S.

PYMNTS

OCTOBER 19, 2020

However, the OECD cautioned about the potential of an international trade war brought by different nations rolling out digital services taxes on their own to assist in their economic rebounds from COVID-19 in the event nations don’t all agree on the new tax regulations. France Will Proceed With Controversial Digital Services Tax Plan.

Nerd's Eye View

JANUARY 8, 2024

These changes all have the potential to change the industry by shifting the current focus on selling financial products (including financial plans themselves) to providing a more in-depth and personalized experience that helps anticipate future issues in a client's life and better help them identify the goals that will help them thrive.

CFO News

MARCH 15, 2023

The Indian government is unlikely to make changes to its budget proposal of taxing the total returns on high-value life insurance policies, two government officials said on Wednesday, amid demands by insurance companies to reconsider the move.

CFO Plans

OCTOBER 29, 2024

Strategic Budget Planning as a Success Blueprint The journey to financial stability begins with strategic budget planning. Leveraging CFO Financial Insights for Strategic Growth CFO financial insights play a pivotal role in shaping business growth planning.

CFO Plans

NOVEMBER 4, 2024

In today’s dynamic financial landscape, Discover Strategic Financial Planning Solutions that are more than a necessity; they’re the backbone of sustainable business growth. By understanding the return on investment, companies can ensure that their financial planning aligns with their growth objectives.

E78 Partners

MARCH 3, 2025

Develop Comprehensive Tax Strategies: Optimize tax planning, transfer pricing, and international tax considerations. Refine Financial Planning and Analysis (FP&A): Develop robust forecasting models and scenario planning tools.

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

SEPTEMBER 16, 2024

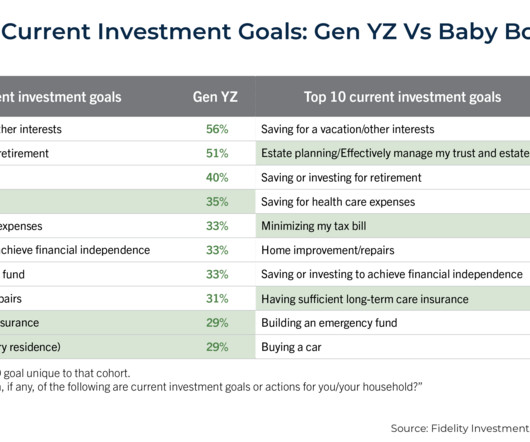

For example, most Millennial and Gen Z clients can open their own investing account and buy index funds online with only minimal guidance from their advisor, so full-service investing might not offer enough value to a next-generation client to justify an ongoing planning fee.

Nerd's Eye View

SEPTEMBER 30, 2024

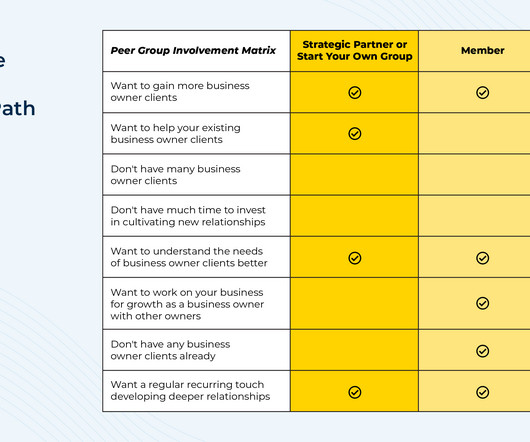

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies. Ultimately, the key point is that for advisors who work with (or would like to work with!)

Nerd's Eye View

OCTOBER 5, 2022

And when factoring in the fees charged by those technology platforms, the value of such ‘tactical’ tax-loss harvesting might exceed the value the investor would have realized by relying on a technology solution to do it automatically! Read More.

Nerd's Eye View

OCTOBER 7, 2024

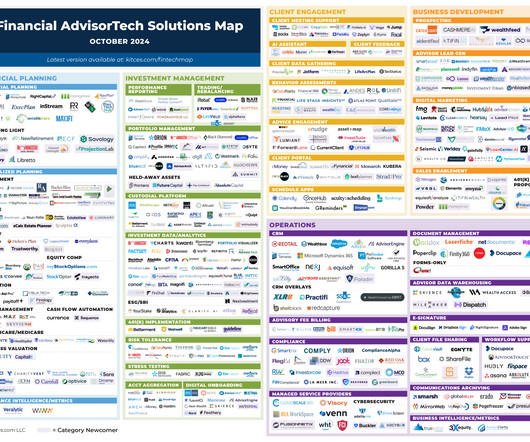

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Global Finance

DECEMBER 6, 2024

This approach delivers coordinated services, including private banking, wealth planning, trust and estate planning, insurance, and investment management. This is mainly due to the banks strong financial performance, bolstered by its best-in-class integration of wealth planning, personal banking, and bespoke financial services.

Spreadym

NOVEMBER 3, 2023

Financial planning is the process of assessing your current financial situation, setting financial goals, and creating a strategy to achieve those goals. It involves evaluating your income, expenses, assets, and liabilities to develop a comprehensive plan for managing your finances effectively.

Nerd's Eye View

SEPTEMBER 6, 2023

While asset protection is a popular planning topic for High-Net-Worth (HNW) and ultra-high-net-worth clients, those who are not HNW are susceptible to the same threats to wealth. For instance, qualified plan assets (e.g.,

Nerd's Eye View

MAY 8, 2023

In this post, Kitces.com Senior Financial Planning Nerd Ben Henry-Moreland writes about how he went from being hesitant to offer tax preparation at his solo RIA (given how common it is for tax preparers to work long hours throughout tax season) to embracing it as a core part of the business’ service offering.

Nerd's Eye View

SEPTEMBER 6, 2024

Notably, while the rule will create an additional compliance burden, the due diligence advisers offering comprehensive planning services (as well as their investment custodians) are likely already conducting on their clients to create an effective financial plan could be a 'defense mechanism' for these firms against criminals looking to take advantage (..)

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Nerd's Eye View

OCTOBER 27, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that the shift in financial advice from pure investment management to comprehensive financial planning continues, with more individuals becoming CFP professionals than CFAs in the past few years as consumers increasing the diversity (..)

Nerd's Eye View

NOVEMBER 18, 2022

A potential compromise during the lame-duck Congressional session could see a boost to the child tax credit and extended tax breaks for businesses. From there, we have several articles on tax planning: How advisors can add value for their clients by managing their exposure to mutual fund capital gains distributions.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content