Toast CFO leans into tactical investments for market share

CFO Dive

FEBRUARY 25, 2022

“As CFO it’s my role to make sure I take the strategy and paint the picture with numbers,” Elena Gomez said.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

FEBRUARY 25, 2022

“As CFO it’s my role to make sure I take the strategy and paint the picture with numbers,” Elena Gomez said.

CFO Dive

AUGUST 24, 2022

Companies may continue to fill roles that require specialized skills while investing in automation and reducing headcounts in other areas.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Growth Architect: How Financial Leaders are Unlocking Potential

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

From Start to Scale: Driving Growth Through Seamless Payments Implementation

Barry Ritholtz

NOVEMBER 15, 2023

Markets screamed higher yesterday after a benign CPI report showed a 0.0% It was a classic fear-driven error, a combination of bad market timing and poor impulse control. It was a classic fear-driven error, a combination of bad market timing and poor impulse control. Last, recognize that markets go up and down.

Barry Ritholtz

MARCH 18, 2024

The 2017 Barron’s cover (above) showing Apple’s extravagant new headquarters and suggesting that the company’s market value would reach $1 trillion in 2018 generated some chatter from the usual suspects. Because separating reality from silliness is the key to making better-informed and more intelligent investment decisions.

Barry Ritholtz

MAY 1, 2023

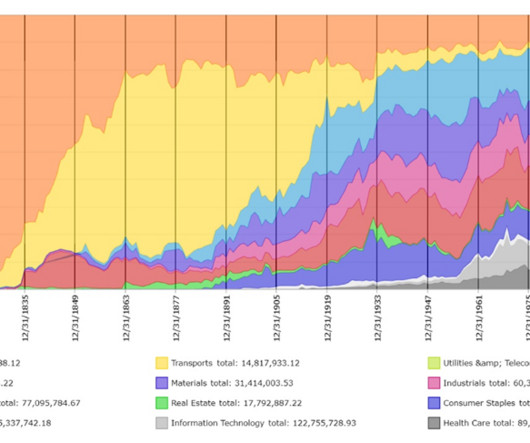

Towards that end, check out Catherwood’s latest project: The Ages Of Finance: A Timeline Of Markets. You can sort the long history of finance on a timeline, either by specific topics — Equities, Milestones & Innovations, Commodities, Debt, and Manias & Crashes — or by “All Market History.”

Barry Ritholtz

JUNE 17, 2024

They are based on historical data that looks at 200 Years of Market Concentration. As the chart above shows, there are long periods of market concentration. Increased concentration is a sign of a bull market and bear markets reduce concentration.” You might be surprised at the findings.

Barry Ritholtz

OCTOBER 20, 2023

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes. It does that splendidly.”

Barry Ritholtz

OCTOBER 2, 2023

Along those lines, here are in chronological order, the thinkers who have helped shape how I view the world view, including how I philosophically think about the economy, markets, and investing. 10 Quotes That Shaped My Investment Philosophy 1. Hence, whatever your views are about the economy, markets, your portfolio, etc.,

Barry Ritholtz

NOVEMBER 27, 2023

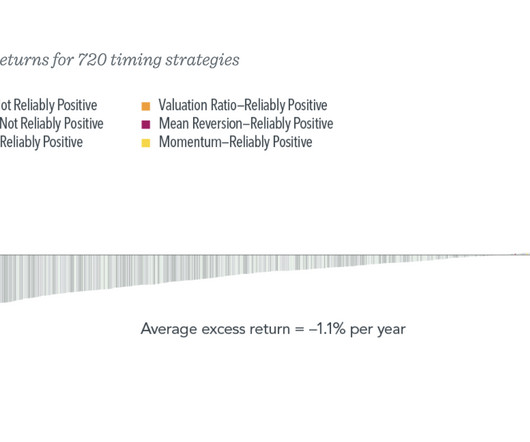

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Low Stakes : The most successful market timers are often those people who do not have actual assets at risk.

CFO Dive

AUGUST 6, 2024

Companies that invest in the pricey technology may need to wait two to three years on average to see a return on investment, market analyst Ash Sharma said.

Barry Ritholtz

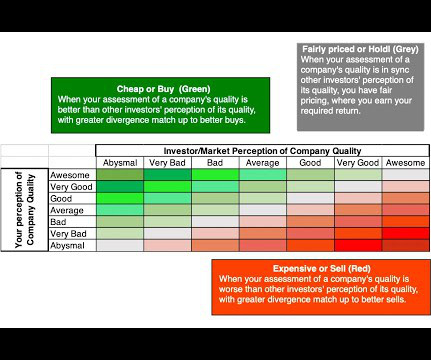

FEBRUARY 7, 2024

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. Should value investing be part of that strategy? TRANSCRIPT: Jeremy Schwartz Value Investing Barry Ritholtz : How much you pay for your stocks has a giant impact on how well they perform. What Is value investing?

Global Finance

AUGUST 1, 2024

In a prepared statement on X.com, Ackman posted: “While we have received enormous investor interest in PSUS, one principal question has remained: Would investors be better served waiting to invest in the aftermarket than in the IPO? I don’t think the global IPO statistics reflect the health of the US IPO market,” he adds. Lineage Inc.,

Global Finance

DECEMBER 11, 2024

Global Finance spoke with Hossam Heiba, CEO of the General Authority for Investment and Free Zones in Egypt, during the 2024 World Investment Conference organized by Saudi Invest and the World Association of International Promotion Agencies (WAIPA), in Riyadh, Saudi Arabia.

Global Finance

JULY 2, 2024

The Qatar Stock Exchange (QSE) carried out its first domestic securities lending and borrowing (SLB) transaction in May as part of its strategy to raise market liquidity. The move marked an important development for the QSE, as it looks to increase market and product sophistication, depth, and securities lending.

Global Finance

OCTOBER 30, 2024

The QIA (Qatar Investment Authority) is the wealth manager of the State of Qatar. QIA invests across nine sectors: retail and consumer; technology, media and telecoms (TMT); liquid securities; infrastructure; financials; funds; healthcare; industrials; and real estate. Key investments aiding the energy transition: QIA invested €2.4

Barry Ritholtz

OCTOBER 4, 2023

Source: Visual Capitalist Batnick also takes a swing at this: What’s the Stock Market Worth? The post $109 Trillion Global Stock Market appeared first on The Big Picture.

Global Finance

AUGUST 6, 2024

Daniel Labovitz, the former NYSE head of regulatory policy, is swapping the traditional stock market blues for a greener pasture. As the CEO of the Green Impact Exchange (GIX), he aims to introduce the first US stock market exclusively focused on the $50 trillion-plus global green economy. CEOs and CFOs also like our trading model.

Barry Ritholtz

FEBRUARY 14, 2024

At the Money: Is War Good for Markets? February 14, 2024) What does history tell us about how war impacts the stock market? Can these patterns inform us of future bull market behavior? To help us unpack all of this and what it means for your investments, let’s bring in Jeff Hirsch. Jeff Hirsch : Yeah. As vicious.

Global Finance

JULY 25, 2024

BYD, the Chinese manufacturer of batteries and electric vehicles, is rapidly becoming the dominant force in the global EV space, despite the US and Europe railing against its disruptive effect on their domestic markets. The post China’s BYD Races Ahead With New Plants In Emerging Markets appeared first on Global Finance Magazine.

Global Finance

JULY 26, 2024

In July, US global investment company and hedge fund, Citadel LLC, and Japanese energy startup, Energy Grid, announced their intent to enter a strategic partnership. Details of the deal were undisclosed, though it represents the first major step into Japan’s wholesale energy market by the Miami-based firm.

Musings on Markets

FEBRUARY 8, 2024

I was planning to finish my last two data updates for 2024, but decided to take a break and look at the seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) which carried the market in 2023. In terms of dollar value added, Microsoft and Apple each added a trillion dollars to their market capitalizations, during the year.

Global Finance

OCTOBER 16, 2024

The US IPO market is seeing renewed momentum as the 2024 presidential election approaches, with investors and analysts eyeing potential opportunities ahead. This resurgence follows a prolonged period of stagnation, sparking confidence that the market is turning a corner. “In Valuations today are more grounded in reality,” said Ritter.

Musings on Markets

AUGUST 19, 2024

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. Tech companies age in dog years, and the consequences for how we manage, value and invest in them are profound.

Global Finance

JUNE 17, 2024

A 10-year veteran at DBS Bank, Karoonyavanich recently expanded his role to cover all Equity Capital Markets business for the bank globally when the firm merged its equities, fixed income and brokerage businesses to form a new Investment Banking unit. Its Hong Kong market share surged from a mere 0.2% in the same period.

Global Finance

JUNE 18, 2024

The Hyundai India IPO that was announced earlier this year has become a bellwether for the health of Indian stock markets and particularly its IPO market, now that the South Korean carmaker has reportedly filed a draft red herring prospectus with the Securities and Exchange Board of India (SEBI) on June 15.

CFO Dive

MAY 18, 2023

The former CFO is charged with investing the funds without permission into his own crypto venture before losing them during the market’s crash, according to a federal indictment.

Musings on Markets

SEPTEMBER 5, 2024

Last Wednesday (August 28), the market waited with bated breath for Nvidia’s earning call, scheduled for after the market closed. This dance between companies and investors, playing out in expected and actual earnings, is a feature of every earnings season, especially so in the United States, and it has always fascinated me.

CFO Dive

JULY 25, 2023

The funds will be invested toward product development, growing the company’s team and accelerating its “go-to-market strategy,” according to Bunker CEO Shivom Sinha.

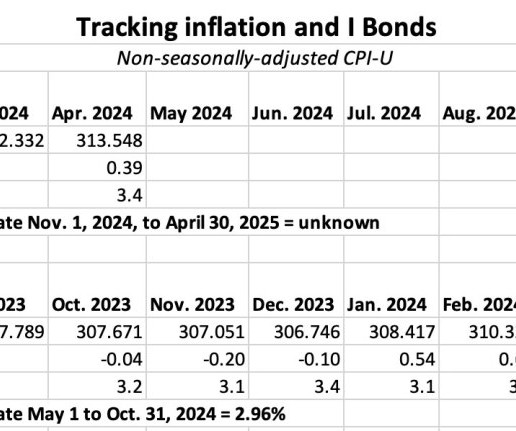

Tips Watch

MAY 15, 2024

prices in April increased on target, setting off a euphoric mood in the stock and bond markets. By David Enna, Tipswatch.com After three months of higher-than-expected inflation, U.S. The … Continue reading →

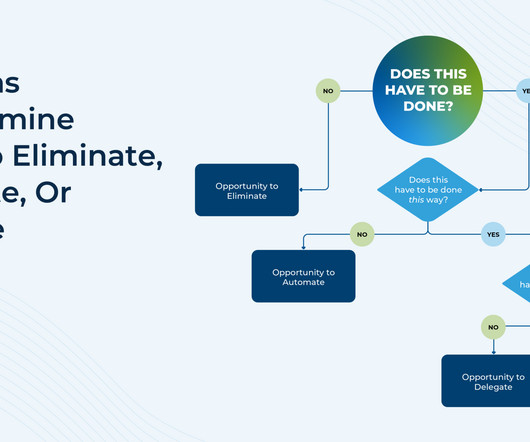

CFO Talks

NOVEMBER 13, 2024

Achieving the Right Balance of Risk and Return in Corporate Investments When handling corporate investments, CFOs often face the balancing act between risk and return. Know Your Comfort Zone for Risk Before diving into investments, have a clear discussion with your board or executive team about your company’s tolerance for risk.

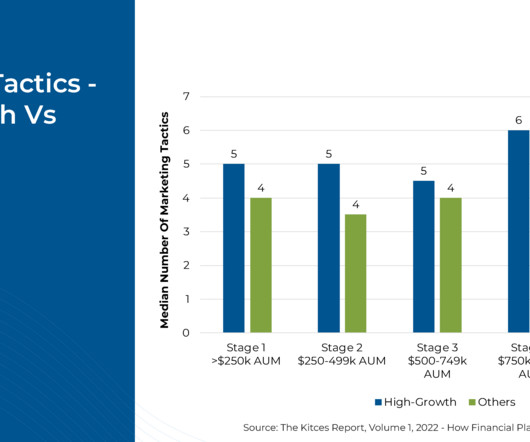

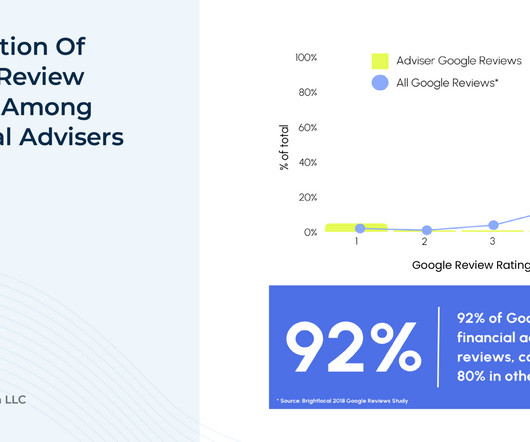

Nerd's Eye View

APRIL 15, 2024

But with limited resources to invest in elaborate marketing campaigns, how can newer advisors leverage a multi-tactic approach to attract new clients and grow their firms? This approach allows advisors to get their name and brand spread across more areas, increasing the breadth of their marketing with just 1 piece of content.

Nerd's Eye View

JUNE 17, 2024

Nonetheless, fewer than 10% of SEC-registered investment advisers report using them, even though the SEC’s updated investment adviser marketing rule allows financial advisors to proactively encourage testimonials (from clients), use endorsements (from non-clients), and highlight their own ratings on various third-party review sites.

Nerd's Eye View

MAY 27, 2024

This is because the tactics generally used tend to be time-based marketing tactics, and as the firm's client base and revenue grows, the advisor's time becomes increasingly valuable and in short supply. Ultimately, the key point is that marketing, when limited by an advisor's own time and energy, can only take a firm so far.

Nerd's Eye View

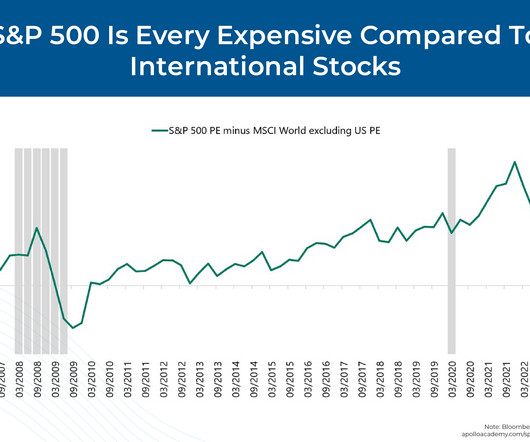

APRIL 3, 2024

The equity market is experiencing its own bifurcation, with a wide dispersion in (extremely elevated) valuations across the "Magnificent 7" and the rest of the market, which is much closer to historical averages.

CFO News

DECEMBER 3, 2024

BlackRock plans to acquire HPS Investment Partners for about $12 billion in an all-stock deal to expand its presence in the burgeoning private credit market. The acquisition is set to close in mid-2025 and aligns with BlackRock's strategy to grow within alternatives, leveraging HPS's substantial $148 billion assets under management.

Barry Ritholtz

OCTOBER 2, 2024

At The Money: Finding Overlooked Private Investments , with Soraya Darabi, TMV (October 02, 2024) The Efficient Market Hypothesis informs us that stock markets reflect all of the information known about any company. Inefficient markets can lead to unexpectedly better returns. How does this affect VC investing?

Navigator SAP

SEPTEMBER 9, 2022

This is taking place in an environment where these companies face pressures to cut costs and accelerate time-to-market as they aim to meet the challenges of the pandemic and deal with resource and capital constraints—all while needing to comply with regulations.

Barry Ritholtz

FEBRUARY 22, 2024

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Going back to 1954, markets are always higher one year later – the only exception was 2007. This is the 15th time markets have made ATH highs after 12 months. Check out the table above, via Warren Pies.

Barry Ritholtz

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I’m Barry Ritholtz, and on today’s edition of At the Money , we’re going to discuss how retail investors can responsibly invest in crypto.

Navigator SAP

AUGUST 5, 2022

The pharmaceutical industry has been transformed in recent years by pressure from intensely competitive markets and the need to comply with new regulations that mandate the highest quality standards across all processes. The industry is a complex one and highly regulated as well, as it deals with the safety of people’s lives.

Navigator SAP

DECEMBER 3, 2021

Getting to market involves investment, risk-taking, and strategic planning — all at a rapid pace. Life sciences and biotech companies often make miracles happen, but the road from a spark of genius to a regulator-approved product isn’t easy.

Barry Ritholtz

MAY 9, 2024

TikTokInvestors: “Apart from his misleading arrogance and the inaccurate market statistics mentioned, a 401K is possibly the best investment vehicle for the average American. I doubt he’s run the real numbers of being invested in the stock market tax deferred with an additional company match. The dumbest idea ever!

Barry Ritholtz

APRIL 11, 2024

There were no disclosure rules, insider trading was rampant, and market manipulation the norm. Deregulating the brokerage industry, SEC allowed trading fees to be set by market competition for the first time in more than 180 years. Few noticed what was to become a revolution in investing. A new bull market broke out in 1982.

Global Finance

DECEMBER 3, 2024

Global Finance spoke with Laziz Kudratov, Uzbekistan’s Minister of Investment, Industry and Trade. We have unified the exchange rate and liberalized the forex market, making it easier for international partners to do business here, including through public-private partnerships and outsourcing. We have recently secured a $13.1

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content