Adoption insight can help CFOs maximize digital transformation investment

CFO Dive

FEBRUARY 10, 2022

Inefficient use of technology often takes root early. Knowing why employees avoid or under use new tools can help you leverage your spend.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

FEBRUARY 10, 2022

Inefficient use of technology often takes root early. Knowing why employees avoid or under use new tools can help you leverage your spend.

E78 Partners

DECEMBER 12, 2024

The coming together of private equity and technology is redefining how organizations operate, innovate, and compete. For private equity backed firms, adopting cutting-edge technological solutions is not just an advantageits a necessity for maximizing efficiency, driving growth, and maintaining a competitive edge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

E78 Partners

JANUARY 29, 2025

Effectively managing technology expenses is more important than ever. This is where technology expense management automation comes into play. By leveraging the power of AI and automation, businesses can take control of their tech spending, reduce inefficiencies, and realize substantial cost savings.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Global Finance

DECEMBER 9, 2024

The worlds biggest exporter of liquified natural gas leverages innovation to pursue diversified growth. The authorities have created blueprints and made strategic investments that aim to develop new industries, attract foreign investment and create a business-friendly environment beyond the gas sector.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment.

CFO Thought Leader

DECEMBER 1, 2024

In this episode of Planning Aces , Jack Sweeney and Brett Knowles share insights from CFOs Sandra Wallach (Amprius Technologies), David Morris (Guardian Pharmacy Services), and David Eckstein (Vanta). Brett Knowles: Identifies a “crawl, walk, run” approach to technology adoption and its impact on FP&A as a strategic partner.

Future CFO

JANUARY 22, 2025

At the FutureCFO Conference series, organised by Cxociety, finance leaders in Indonesia, Malaysia, Singapore, the Philippines and Thailand ranked automation and degitalisation (80%), investing in talent and employee development (58%) and continuous innovation (47%) as the top three strategies most important to sustainable growth in 2024.

Navigator SAP

JULY 28, 2023

They evolve faster and scale without heavy technology investment, they connect directly with other systems, they leverage data and automation, and soon they will use artificial intelligence for everything from insight to operational efficiency. Business operates differently now.

Global Finance

APRIL 5, 2025

trillion of investment-grade and $419.8 Investment-grade bond volume is down 14% thus far across the globe and global high-yield volume is 16% lower. billion leveraged loan for Lone Star Funds as part of its acquisition of Carrier Globals commercial and residential fire unit. Japan was the only major market to decline, by 3%.

Global Finance

APRIL 5, 2025

Throughout 2024, the infrastructure sector was highly active for investment bankers, with robust deal flow across renewable energy, digital transformation, and critical infrastructure projects. The infrastructure sector is fertile ground for dealmakers, as producers around the world seek to expand. million tons annually.

Global Finance

APRIL 5, 2025

Until more information becomes available, lets celebrate the investment banks that brightened up the M&A landscape in 2024. Absa Bank, a major M&A house with a presence in 10 markets, continues to facilitate most of the dealscutting across divestitures, cross-border transactions, take-privates, leveraged buyouts, and others.

E78 Partners

NOVEMBER 15, 2024

One key area of focus is the exploration of operational efficiency, which is crucial for maximizing the potential of private equity investments. This strategic emphasis allows us to make informed investment decisions and drive meaningful change for our client organizations.

Future CFO

DECEMBER 29, 2024

Financial transformation has emerged as a critical imperative for organisations in 2024, driven by the need to adapt to rapidly changing economic conditions, technological advancements, and evolving business landscapes. However, the increasing complexity of global markets and the pace of technological change have redefined this role.

Global Finance

APRIL 5, 2025

The top three sectors when it comes to dealmaking, according to McKinsey, are global energy and materials (GEM); telecom, media, and technology (TMT); and financial services. billion in 121 projects across six countries, nearly double the amount it invested in 2023. In Ukraine, the bank deployed $2.6 billion valuation.

Bramasol

NOVEMBER 11, 2024

Cloud ERPs offer modular architectures, allowing companies to scale their operations and add functionalities as needed without significant upfront investments. Leading cloud providers invest heavily in security measures and compliance protocols to protect sensitive information.

Future CFO

SEPTEMBER 5, 2024

Chief financial officers indeed play a pivotal role in the company’s digital transformation as they are in charge of aligning financial goals with technological advancements, but as the Finance function undergoes several shifts to keep up with the market, they also face tasks of fulfilling newer roles. One of which, of course, is ESG.

Global Finance

JUNE 11, 2024

Lori Schwartz : We are looking at ways to harness the power of such technology to simplify and make our internal processes more efficient. Overall, there is enormous potential with technology and how creatively we deploy efforts in a targeted manner. Has the investment ratio between keeping the lights on and innovation changed?

CFO Plans

MARCH 2, 2025

By leveraging agile financial planning, the company quickly reallocated resources and adjusted its business model. By implementing flexible financial management practices, they maintained liquidity and invested in innovation, positioning themselves ahead of competitors when the market rebounded.

CFO News Room

NOVEMBER 29, 2022

What’s unique about Anh, though, is how, as a solo advisor, she differentiates her firm by leveraging the combination of a high-touch concierge approach to client service with a unique investment management approach through the use of very carefully chosen structured notes to differentiate her portfolio design from other advisors.

CFO News Room

DECEMBER 1, 2022

Financial planning technology, in particular, has allowed advisors to automate time-intensive back-office tasks and delegate routine analyses to support staff, freeing up their time to engage more personally with clients.

Future CFO

FEBRUARY 14, 2025

As businesses navigate their way around various technological advancements, finance teams are faced with the task to integrate analytics and automation into their existing processes, determining at the same time which specific system to transform first for maximum operational impact.

Future CFO

SEPTEMBER 23, 2024

As the business world's thirst for mastering technological advancements properly intensifies, with the seemingly never-ending developments in artificial intelligence, automation, and machine learning, it is expected that organisations steer their priorities towards investments on the IT side.

Global Finance

OCTOBER 31, 2024

The GCC’s Shariah-compliant institutions are growing their assets and expanding their reach, thanks to new strategic partnerships and greater tech investment. The bank expects this will help it leverage artificial intelligence and other advanced technologies to identify and launch new Islamic banking solutions.

Nerd's Eye View

NOVEMBER 29, 2022

What's unique about Anh, though, is how, as a solo advisor, she differentiates her firm by leveraging the combination of a high-touch concierge approach to client service with a unique investment management approach through the use of very carefully chosen structured notes to differentiate her portfolio design from other advisors.

Barry Ritholtz

NOVEMBER 26, 2024

Full transcript below. ~~~ About this week’s guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. I’m Barry Ritholtz, and on today’s edition of At the Money , we’re going to discuss how retail investors can responsibly invest in crypto.

VCFO

NOVEMBER 27, 2023

Frequently referred to as leverage, debt has the potential to fuel growth, drive strategic initiatives, and propel businesses to new heights. Misconception: Debt is Only for Troubled Businesses Reality: Successful, thriving businesses strategically use debt to accelerate growth, invest in innovation, and gain a competitive edge.

Future CFO

MARCH 5, 2025

Winnie Law , CFO, Technology & Operations (T&O), Global Functionsand Fit for Growth, Standard Chartered , believes the war on talent continues to be a challenge as the role of Finance pivots from being mere number crunchers and financial journalists to strategy influencers.

Future CFO

MARCH 10, 2025

Current industry research suggests that AI technologies are gaining traction among finance professionals navigating a complex landscape marked by rapid change. However, the adoption rate varies significantly across the region, influenced by technological maturity and cultural attitudes towards innovation.

Future CFO

FEBRUARY 7, 2024

Delving into the key trends shaping the treasury landscape in 2024, the focus is on themes such as staffing challenges, macroeconomic risks, technology adoption, and strategic financial management. Staffing challenges and technology adoption Staffing emerges as a central theme for corporate treasurers.

PYMNTS

NOVEMBER 12, 2020

Safety-minded consumers the world over can now be seen tapping contactless cards, scanning QR codes or utilizing voice ordering technologies to make purchases without potentially putting themselves or others at risk of contracting the virus. Eighty-two percent of contactless users view the technology as cleaner than other options.

Future CFO

DECEMBER 22, 2024

Use Technology : CRM tools and data validation software can automate much of the cleanup process. Invest in Training : Educate employees on the benefits and workflows of e-invoicing to reduce resistance. Leverage Cloud-Based Solutions : Cloud platforms offer flexibility, scalability, and security, making integration smoother.

Global Finance

APRIL 4, 2025

Our investments in advanced digital banking solutions, automation, and cutting-edge analytics equip us to offer seamless, secure, and scalable financial services. Al Fulaij: In line with Kuwait Vision 2035, NBK identifies high growth potential in renewable energy, technology, digital transformation, health care, logistics, and contracting.

Centage

NOVEMBER 16, 2022

As a result, owners can see what the company owes and owns in assets and investments at a given point in time. This report should provide information on operations and investments that rely on cash. The post The Key to Modern Financial Reporting: Leveraging Data to Withstand Volatility appeared first on Centage.

CFO Thought Leader

FEBRUARY 26, 2025

His career illustrates how finance leaders can drive strategy by immersing themselves in operations, leveraging data insights, and aligning financial decisions with long-term business value. A companys GTM strategy, if effective and coupled with innovative technology, can make a significant impact.

CFO Plans

OCTOBER 29, 2024

A case in point is a mid-sized manufacturing company that saw its accounts receivable days drop by 30% after adopting automated invoicing and digital tracking tools, bolstering their liquidity and paving the way for strategic investments. Explore Cutting-Edge Financial Technologies to stay ahead of the competition.

CFO Plans

NOVEMBER 4, 2024

By employing advanced forecasting tools and real-time financial reporting, they maintained a healthy cash reserve, allowing them to invest in new markets and technologies confidently. Additionally, ROI analysis tools play a crucial role in evaluating the success of financial strategies and investments.

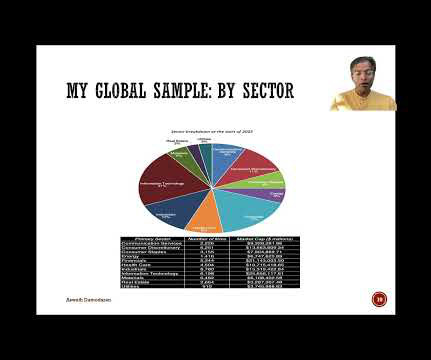

Musings on Markets

JANUARY 10, 2025

In corporate finance and investing, which are areas that I work in, I find myself doing double takes as I listen to politicians, market experts and economists making statements about company and market behavior that are fairy tales, and data is often my weapon for discerning the truth. Return on (invested) capital 2. Buybacks 2.

Global Finance

APRIL 4, 2025

Through strategic investments in technology and people, we have elevated the customer experience while delivering outstanding financial results and a solid balance sheet that provides a solid foundation for future growth. In 2025, we continue to focus on leveraging our regional presence to capture global trade and capital flows.

E78 Partners

MARCH 21, 2025

Understanding what PortCo in private equity is, how private equity firms manage these investments, and their role in the broader investment lifecycle is essential for anyone navigating the private equity landscape. What Is a PortCo?

Nerd's Eye View

SEPTEMBER 12, 2023

What's unique about Jason, though, is how he built Altruist as an "all-in-one" custodian platform for RIAs that includes the portfolio management and performance reporting software that most advisory firms have to purchase separately… as Jason found while he was building his own TAMP a decade ago, the limitations of current RIA custodians made (..)

E78 Partners

DECEMBER 5, 2024

Without careful planning, organizations may face trade-offs, reallocating funds from other critical IT initiatives to accommodate AI investments. Building Resilient IT Budgets Navigating these complexities requires a disciplined approach to cost management, enabling organizations to unlock the full value of their AI investments.

Global Finance

JANUARY 31, 2025

By entering the French market, the bank seeks to foster cross-border trade between Africa and Europe, leveraging technology to facilitate seamless financial transactions.

Global Finance

DECEMBER 6, 2024

Morgan US Private Bank, discusses navigating rising rates, global tensions, and technological transformation. The global economy is transitioning to an era marked by higher growth, increased capital investment, and elevated interest rates. Frame: Its prompting them to adopt more agile and diversified investment strategies.

Bramasol

JANUARY 28, 2025

SAP Joule was also identified by Bramasol as a prime example of leveraging embedded agentic AI in our post on Trends to Watch in 2025. Through the RISE with SAP program and complementary tools, businesses can leverage AI to enhance their digital transformation journeys and to streamline operations and drive efficiency.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content