Musings on Markets: Data Update 5 for 2022: The Bottom Line!

CFO News Room

JANUARY 18, 2023

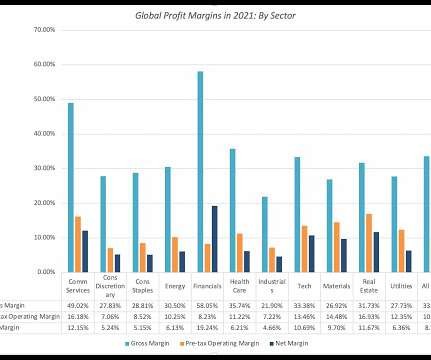

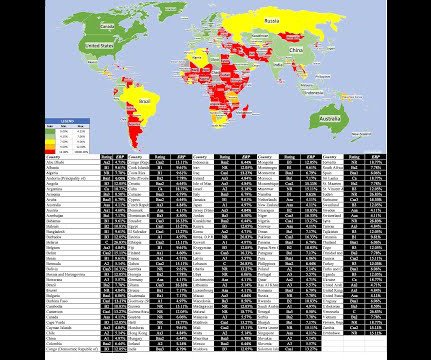

The question of whether a company is making or losing money should be a simple one to answer, especially in an age where accounting statements are governed by a myriad of rules, and a legion of number-crunchers follow these rules to report profits generated by a firm. The numbers yield interesting insights. .

Let's personalize your content