Nonprofit Accounting Basics for Founders, Board Members & Executives

The Charity CFO

JANUARY 17, 2022

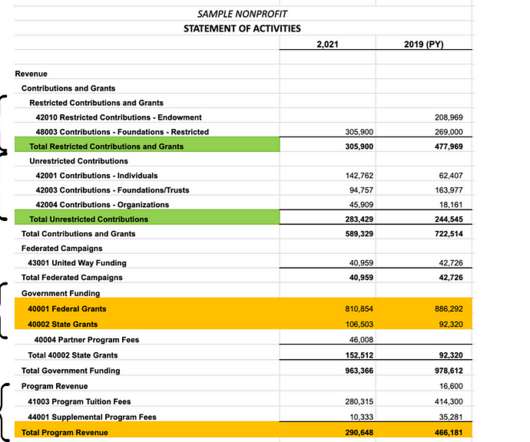

If you’re like most nonprofit leaders, you’re not researching nonprofit accounting basics to satisfy your curiosity. with this overview of nonprofit accounting basics. . What is nonprofit accounting? The basic accounting principles for nonprofit organizations are the same as accounting for for-profit companies. .

Let's personalize your content