FASB updates convertible debt rules

CFO Dive

NOVEMBER 27, 2024

The new GAAP guidance stems from a request made by Big Four accounting firms and comes as the convertible bond market is regaining steam.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

NOVEMBER 27, 2024

The new GAAP guidance stems from a request made by Big Four accounting firms and comes as the convertible bond market is regaining steam.

CFO Talks

NOVEMBER 20, 2024

The next logical step might be to take your company to international markets by listing on a foreign stock exchange. IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving. These aren’t just different rulebooks—they reflect different philosophies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

What Your Financial Statements Are Telling You—And How to Listen!

E78 Partners

MARCH 3, 2025

Yet many middle-market companies continue to explore opportunities to go public. After a challenging IPO market from 2022 to 2023, conditions have certainly improved. However, while market sentiment is improving, IPO readiness requires more rigorous preparation than ever before.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

What Your Financial Statements Are Telling You—And How to Listen!

CFO News Room

JANUARY 18, 2023

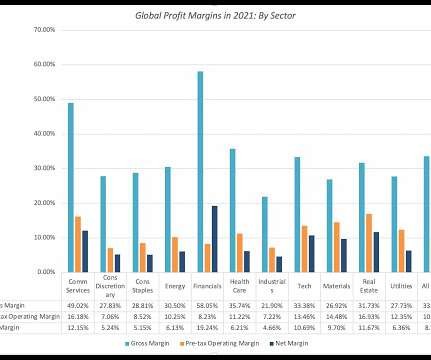

That said, about 31% of the net profits of all publicly traded firms listed globally in 2021 were generated by financial service firms; that percent is lower in the US and higher in emerging markets. IFRS and GAAP now treat as leases as debt, but that is still not the case in many other markets that are not covered by either standard).

The Charity CFO

MAY 10, 2022

So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements.

The Charity CFO

MARCH 13, 2023

The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). For tax, this excess amount is reported as a contribution, and for GAAP, it can be reported as either a contribution or special event revenue. It will not be reported on Form 990.

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. Other distribution expenses, such as rent.

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. Translate Your Impact into Business Terms When seeking funding, especially from business-oriented donors, be prepared to discuss your work in terms of business plans, financial statements, and market potential.

CFO Thought Leader

MARCH 25, 2025

Above all, he prioritizes strong relationships across every organizational function, from sales and marketing to product and engineering. This is why go-to-market execution, he explains, has become the centerpiece of his strategic leadership. Over the last fiscal year, we grew 31% with strong non-GAAP (gross) margins.

https://trustedcfosolutions.com/feed/

JUNE 2, 2022

The ability to receive those quick business insights also helps you respond to rapidly changing market conditions, so you remain highly competitive in a very demanding business environment. GAAP, IFRS, and cash base side by side for better visibility. The benefits don’t end there. . Ability to implement user-access controls.

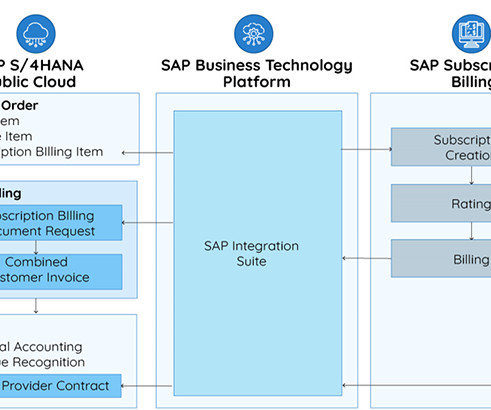

Bramasol

JULY 31, 2023

According to Allied Market Research, "The global medical equipment rental market was valued at $56.0 For leasing, this means International Accounting Standards Board’s (IASB’s) IFRS 16 and US GAAP Financial Accounting Standards Board’s (FASB’s) ASC 842. billion in 2022, and is projected to reach $94.5 billion by 2032."

The Charity CFO

JANUARY 13, 2022

Prepare financial statements per Generally Accepted Accounting Principles (GAAP). For the purposes of GAAP, donations of goods and services are valid revenue. Step #1: Establish Fair Market Value . How to calculate fair market value for in-kind goods: . Submit to an annual audit. File IRS Form 990 ( in-kind goods only )

PYMNTS

MAY 7, 2020

non-GAAP EPS without credit reserves came in at $.83 66 non-GAAP EPS. According to PayPal, the deteriorating economic situation in March slashed the volumes and revenue generated from travel and events while simultaneously depressing credit income. Minus the credit reserve impact, PayPal noted, $0.83

PYMNTS

AUGUST 10, 2020

Alongside its comparable sales results, Foot Locker also reported that it expects non-GAAP Q2 earnings to come in between 66 cents and 70 cents per share when the firm formally reports numbers on Aug. The stock is up 75.68 percent since a March $60 intraday low. Foot Locker shares likewise rallied 7.8 percent Monday closing at $29.63

PYMNTS

AUGUST 5, 2020

Analysts at Refinitiv, the London-based global provider of financial market data, had predicted a 5 cent loss. Square’s net loss for the Q2 was $11 million on a GAAP basis. CNBC reported the company had $1.92 billion in net revenue for the second quarter (Q2) — that’s a 64 percent increase compared to the same period one year ago.

PYMNTS

OCTOBER 29, 2020

Johnson indicated that the growth is supported by ongoing improvements to its mobile app and increased messaging throughout its marketing channels to fuel further awareness. As for its overall results, Starbucks reported non-GAAP earnings per share (EPS) of 51 cents on consolidated net revenues of $6.2 rose to 19.3 billion.

Bramasol

JULY 26, 2024

As shown below, the three acceptable methods for estimating SSP are 1) Adjusted Market Approach, 2) Expected Cost Plus Margin Approach, and 3) Residual Approach. GAAP, IFRS) for various countries and ensuring accuracy in financial reporting can add significant complexity and time to the close process.

The Charity CFO

JANUARY 17, 2022

Accrual accounting is required by Generally Accepted Accounting Principles (GAAP), which means that you’ll need accrual-based reports to complete a nonprofit audit. Both GAAP and the IRS require nonprofits to report their expenses broken down into 3 categories: Program services expenses. Examples of nonprofit expenses: Rent.

PYMNTS

JULY 1, 2020

Executive Vice President, Chief Marketing and Communications Officer Brie Carere said in the call, “We are focused on driving growth through increased penetration in healthcare, specifically in med device, pharmaceutical and testing equipment segments. All in, FedEx reported adjusted non-GAAP revenue of $17.4

Centage

AUGUST 15, 2022

Recognizing that details are everything in the current market, many of today’s top businesses are looking for tools to help them stay organized. GAAP compliant and easy to use, our system eliminates the need for messy spreadsheets, so you don’t have to worry about errors from linking complex formulas and macros.

Future CFO

JUNE 14, 2021

Only 52% of survey respondents believe that IFRS 17 earnings / equity will be slightly or much more helpful than current GAAP earnings / equity, and 54% believe that the need for non-GAAP reporting will either slightly or significantly increase.

Centage

JANUARY 31, 2022

Is your business set up to handle these dynamic market conditions? Or perhaps your integrated cash flow reports are based on GAAP accounting rules, not formulas, but aren’t supported in your current planning and forecasting software application. Do you have the resources to adapt?

PYMNTS

OCTOBER 28, 2020

content marketing.). As for its overall results, Fiverr reported non-GAAP net income of $4.7 The company is also debuting features that would let buyers make recurring purchases, which Kaufman noted are particularly relevant when it comes to continuing digital investments (i.e. million in Q3.

PYMNTS

AUGUST 12, 2020

Analysts at Refinitiv, the London-based global provider of financial market data, had predicted a 5-cent loss. Square’s net loss for Q2 was $11 million on a GAAP basis. Cash App, which competes head-to-head with PayPal’s Venmo, was the key factor that drove Square’s profitability in Q2.

CFO Talks

SEPTEMBER 5, 2024

The South African market offers a range of solutions, from cloud-based platforms that offer flexibility and scalability to on-premises systems that provide greater control and customization. Choosing the Right Software and Technology Selecting the appropriate financial software is a critical decision.

PYMNTS

NOVEMBER 4, 2020

In terms of product offerings, the firm recently announced the rollout of Project Catalog, which Brown said is “an easy way to quickly purchase some of the most popular services freelancers offer — from website development and graphic design to videos and digital marketing.”. million.

PYMNTS

DECEMBER 10, 2016

The consumer credit market has huge potential — trillions and trillions of dollars — and I wanted to ride that winner. This is a probably a very fine example of how these emerging companies don’t have the compliance and control environments necessary to operate in these markets.”. So what’s next?

Centage

APRIL 28, 2022

Back in 2019, Centage made waves when it announced the availability of Planning Maestro , the first-ever FP&A platform designed specifically for the mid-size market. Up until the release of Planning Maestro, only enterprise-sized companies could afford the expense of automated and intelligent cloud-based FP&A technologies.

PYMNTS

JUNE 10, 2019

Reports in The Block Crypto late last week said a group of California CPAs has sent a letter to the Financial Accounting Standards Board, a federal board that sets Generally Accepted Accounting Principles (GAAP), requesting that it consider establishing a task force to address a lack of clarity in cryptocurrency accounting standards.

PYMNTS

AUGUST 6, 2019

billion, roughly flat year on year (under GAAP), but added that organic revenue growth was 5 percent. A detail of the pro-forma 2018 revenue contribution by segment shows 49 percent derived from banking, 32 percent from merchants and the remainder from capital markets. Adjusted earnings per share were $1.78.

PYMNTS

APRIL 12, 2018

Goodman brings to Fiserv more than 25 years of experience in the payments market, software and business innovation, and consulting. Overall revenues (measured on a GAAP basis) were up 7 percent year over year to $1.54 That GAAP number topped the Street at $10 million. billion, while internal revenues grew by 6 percent to $1.42

VCFO

APRIL 27, 2023

A few career highlights include: uncovering $8M incorrectly capitalized expenses per GAAP SaaS regulations that resulted in restated financial statements; managing SaaS contracts in excess of $10M annually; directing the implementation of SaaS GAAP Standards when the company’s business model pivoted to SaaS outsourced services.

PYMNTS

SEPTEMBER 8, 2020

Kohl’s has rolled out its new Kohl’s Rewards loyalty program throughout the country after a successful pilot in multiple markets, according to a Tuesday (Sept. Kohl’s said it has been testing Kohl’s Rewards in 13 markets and the initiative has garnered a “strong customer response.” 8) announcement. billion.

Jedox Finance

OCTOBER 6, 2022

If there are, for example, high marketing expenses, it may be necessary to explore ways to reduce those costs. It’s easy to forget to include all of the expenses associated with running an organization, such as marketing, repairs, or travel costs. Identifying areas of improvement. Omitting expenses. Inaccurate revenue.

PYMNTS

APRIL 9, 2020

The strong revenues coupled with what he called disciplined expense management led to 28 percent year-over-year growth in non-GAAP earnings per share to $3.10. In 2019, PayPal entered the China market with its purchase of Guofubao Information Technology Co., GoPay) for an undisclosed amount.

Centage

DECEMBER 7, 2022

the maker of QuickBooks Online Advanced, to bring automated budgeting, forecasting, reporting and analytics capabilities to QuickBooks Online Advanced customers and mid-market organizations looking for more robust and streamlined budgeting capabilities. The Planning Maestro & QuickBooks Online Advanced Difference.

PYMNTS

FEBRUARY 6, 2020

As measured on a GAAP basis, revenues in the United States and Canada were up 41 percent, to $2.5 Management has said that Uber still is targeting the top positions in each of the markets it targets for the Eats business. Data provided by the company show that trips for the full year were up 32 percent, to 6.9

PYMNTS

JULY 30, 2020

GAAP diluted earnings per share in Q3 fell by $0.21, compared to a profit of $0.59 As a result, Sally achieved rent abatements and reduced its marketing and back-office costs. . As a result of COVID-19, same-store sales dropped by 26.6 percent for Q3. percent as operations restarted. in the prior year. “We

PYMNTS

FEBRUARY 26, 2020

Wainwright added that the company “will continue to invest in growth through expanding our retail footprint, making appropriate investments in marketing and growing our sales team.”. Non-GAAP basic and diluted net loss per share was 17 cents. Consignment and service revenue was $80.7 million, which represented a 46 percent YOY rise.

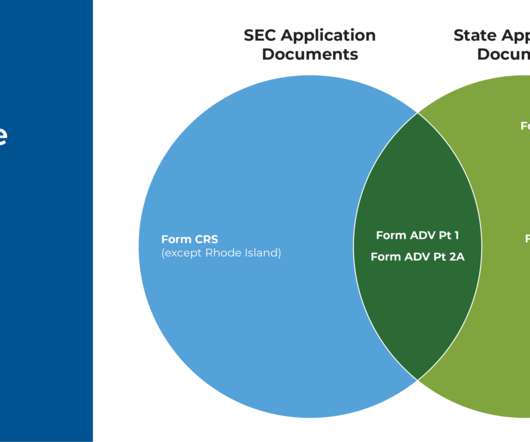

CFO News Room

NOVEMBER 2, 2022

Along with renewing their registration annually (for both SEC- and state-registered firms), firms face a variety of requirements related to their internal finances, fees, marketing activities, and advisor agreements depending on whether they are SEC- or state-registered. RIA Marketing Activities (Including Testimonials).

PYMNTS

MARCH 13, 2020

However, the technology company reported a less-than-expected billings outlook on Thursday (March 12) after the markets had closed. Despite the decline in the markets and its less-than-forecasted billing outlook, Slack reported total revenue of $181.9 But analysts had forecast an average estimate of $1.02 billion for billings.

PYMNTS

MARCH 3, 2020

As its marketing plan over the holidays powered customer engagement and a double-digit increase in new customer acquisition, Kohl’s CEO Michelle Gass said the retailer enjoyed increased traffic over the period that was propelled, in part, by its Amazon Returns program. billion and non-GAAP diluted earnings per share of $1.99.

PYMNTS

NOVEMBER 3, 2017

The company also noted a GAAP net income of $27.5 Competition and Markets Authority to maintain its ownership of the U.K. This resulted in a GAAP net loss for the third quarter of 2017, totaling $175.6 million, or $0.60 per diluted share, as well as adjusted EBITDA of $99.9 million, up 15 percent from $86.6 million ($193.5

Cube Software

MAY 11, 2023

The answers—based on different sources of data like market research or historical sales information—guide internal decision-making to promote regular, sustainable growth as well as create contingency plans for worst-case or best-case scenarios. While GAAP statements are required for public companies, pro forma financials are not.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content