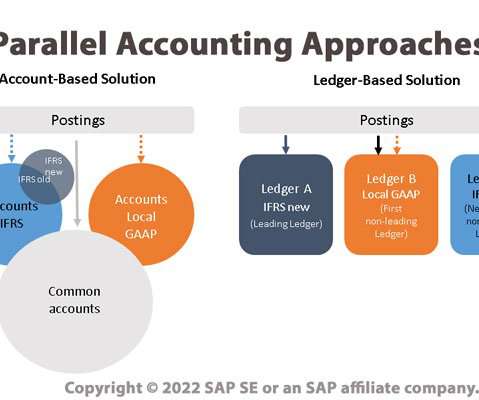

Parallel Accounting is a Key Tool for Global Companies with Multiple Reporting Requirements

Bramasol

JUNE 10, 2022

For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. Other key factors include where the company stands with regard to implementing new accounting standards (ASC 606, IFRS 15, ASC 842, IFRS, 16, etc.)

Let's personalize your content