FASB revisits GAAP cleanup

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

GAAP Related Topics

GAAP Related Topics

CFO Dive

OCTOBER 3, 2023

The board may remove some "non-authoritative" definitions from the codification — effectively the bible of generally accepted accounting standards.

CFO Dive

SEPTEMBER 19, 2024

The codification, effectively the bible for generally accepted accounting principles, was last updated in 2020.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

DECEMBER 20, 2023

With its anniversary year drawing to a close, there are signs FASB is stepping up the pace of its standards setting. Some finance executives are wary.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

JUNE 13, 2024

Like crypto rules FASB recently finalized, the environmental credit accounting standards would provide specific guidance where GAAP is currently silent.

CFO Dive

JUNE 5, 2024

Despite a unanimous vote, some board members expressed concern the proposed improvements to GAAP hedging guidance do not go far enough.

CFO Dive

OCTOBER 29, 2024

In June the FASB voted 7-0 for the more targeted update, even as some expressed concerns about not going far enough to modernize GAAP rules.

CFO Dive

MARCH 21, 2024

It's been decades since the Financial Accounting Standards Board has made any major changes to GAAP accounting rules for software.

CFO Dive

NOVEMBER 27, 2024

The new GAAP guidance stems from a request made by Big Four accounting firms and comes as the convertible bond market is regaining steam.

CFO Talks

NOVEMBER 20, 2024

For example, while South African companies follow International Financial Reporting Standards (IFRS), the US requires compliance with its Generally Accepted Accounting Principles (GAAP). IFRS is principles-based and allows for some judgment in financial reporting, while GAAP is more rigid, rules-based, and less forgiving.

CFO Dive

APRIL 5, 2024

Many businesses and financial report preparers already rely on the IAS government grant accounting rules because GAAP is silent on the subject.

CFO Dive

AUGUST 2, 2023

It reported its first-ever quarterly GAAP operating profit Tuesday. CFO Nelson Chai will depart from the ride-share company next year as Uber continues to focus on profitable growth.

CFO Dive

MARCH 1, 2023

Warren Buffett — CEO of Berkshire Hathaway and one of the world’s most renowned investors — didn’t disappoint fans of his folksy, acerbic writing in his latest shareholder letter.

CFO Dive

AUGUST 17, 2022

The accounting changes come as crypto-asset valuations have taken a beating and drawn increasing regulatory scrutiny.

CFO Dive

NOVEMBER 13, 2024

Intangible assets aren’t being captured in the merger review thresholds that federal antitrust agencies rely on, a paper shows.

PYMNTS

AUGUST 7, 2017

Nowadays, companies report for both generally accepted accounting principles (GAAP) and non-GAAP numbers, as mandated by the Securities and Exchange Commission. If GAAP is used, operating income came in at $430 million for the latest quarter, up 16 percent from a year ago. Not too shabby.

E78 Partners

MARCH 3, 2025

Non-GAAP Measures and Key Performance Indicators (KPIs) Non-GAAP financial measures and KPIs play a crucial role in shaping investor perceptions and demonstrating a companys value proposition. Common non-GAAP metrics include EBITDA, adjusted EBITDA, free cash flow, and revenue growth metrics.

CFA Institute

MARCH 5, 2021

You can find significant alpha in the mechanics that drive GAAP accounting.

E78 Partners

NOVEMBER 19, 2024

Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards. For companies with diverse revenue streams, ensuring that revenue recognition is compliant with GAAP is critical.

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place. For single and multiple family offices, governance is key to financial success and is an important element of your organizational structure.

E78 Partners

NOVEMBER 12, 2024

Staying compliant with the latest industry regulations—whether related to ASC 606, ASC 842, or other GAAP standards—is crucial for audit success. Ensuring Compliance with Evolving Standards and Regulations Private equity-backed companies often face heightened scrutiny due to rapid growth, acquisitions, or restructuring.

Global Finance

MARCH 2, 2025

Horton: If they have an IPO, theyll be big firms, and theyll follow International Financial Reporting Standards or US GAAP. GF: Why is so much fraud connected with IPOs? Because they dont do enough due diligence? Even if theyre private, they will still be doing so because theyre larger firms.

The Charity CFO

DECEMBER 30, 2021

It shows whether or not your accounting records are accurate per generally accepted accounting principles (GAAP), in the auditor’s professional judgment. In a Financial Review, an independent auditor reviews your financial statements to determine if they’re consistent with generally accepted accounting principles (GAAP). .

CFO Share

AUGUST 5, 2021

The difference between cost of goods sold and ordinary business expenses is well defined in Generally Accepted Accounting Principles (GAAP) but routinely ignored by small business bookkeeping services. Even worse, an IRS income tax return does not follow the same rules as GAAP. How do I maximize tax deductions under section 280E?

The Charity CFO

MAY 10, 2022

So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements.

The Charity CFO

MARCH 13, 2023

The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). For tax, this excess amount is reported as a contribution, and for GAAP, it can be reported as either a contribution or special event revenue. It will not be reported on Form 990.

Embark With Us

NOVEMBER 9, 2021

As you might already know, US GAAP doesn't have an awful lot to say about carve-outs or carve-out financial statements. And by awful lot , we mean nothing. Not a peep. So what should you do when there's a divestiture on the horizon and you need some guidance?

PYMNTS

DECEMBER 18, 2020

billion in revenue on an adjusted (non-GAAP) basis. The company said that those factors were offset, in part, by expenses to help with formidable demand and to grow services, pandemic-related costs and “variable compensation expense.”. For Q2 fiscal 2021, FedEx reported $4.83 in diluted earnings per share (EPS) on $20.6 in diluted EPS on $17.3

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. Southside Blooms had to invest in custom software development and incorporate AI to handle customer service and streamline operations. Blackwell is now focused on developing more sophisticated financial management skills.

Future CFO

DECEMBER 31, 2021

Their responsibilities already entail ensuring that the financial report is accurate, complete and verifiable, according to GAAP accounting standards and disclosures. CFOs are the logical candidate to lead the ESG initiative.

https://trustedcfosolutions.com/feed/

JUNE 2, 2022

GAAP, IFRS, and cash base side by side for better visibility. Ability to implement user-access controls. Use dimension values to capture your business transactions, operational measures, and budgets in General Ledger. Ability to view performance on U.S. Report on tax, country, or industry-specific bases with ease. Define your own workflows.

Bramasol

JULY 31, 2023

For leasing, this means International Accounting Standards Board’s (IASB’s) IFRS 16 and US GAAP Financial Accounting Standards Board’s (FASB’s) ASC 842. In addition, global companies need the flexibility to comply and report according to multiple accounting standards. For revenue recognition, they also must comply with ASC 606 and IFRS 15.

PYMNTS

MAY 7, 2020

non-GAAP EPS without credit reserves came in at $.83 66 non-GAAP EPS. According to PayPal, the deteriorating economic situation in March slashed the volumes and revenue generated from travel and events while simultaneously depressing credit income. Minus the credit reserve impact, PayPal noted, $0.83 billion.

CFA Institute

APRIL 5, 2021

GAAP sometimes misrepresents business reality. We can use that fact to generate some alpha.

PYMNTS

AUGUST 10, 2020

Alongside its comparable sales results, Foot Locker also reported that it expects non-GAAP Q2 earnings to come in between 66 cents and 70 cents per share when the firm formally reports numbers on Aug. The stock is up 75.68 percent since a March $60 intraday low. Foot Locker shares likewise rallied 7.8 percent Monday closing at $29.63

PYMNTS

AUGUST 20, 2020

As for its overall results, Alibaba reported non-GAAP net income of $5.6 billion (non-GAAP diluted earnings per ADS of $2.10) on revenue of $21.8 “Our strong profit growth and cash flow enable us to continue to strengthen our core business and invest for long-term growth.”. The results surpassed analyst estimates of $1.99

The Charity CFO

OCTOBER 9, 2024

individual and corporation connections), history, donor intent, or soft credits Accounting software tracks financial transactions with strict adherence to GAAP Integrating two systems with fundamentally different data priorities can risk data inconsistencies, inaccuracies, and loss of information.

The Charity CFO

APRIL 5, 2022

Cash accounting does not comply with Generally Accepted Accounting Principles (GAAP) for nonprofit organizations. Financial statement audit or review – if you are required to undergo a financial statement audit or assessment, using the accrual method to be in accordance with GAAP will make the process much smoother and less expensive.

PYMNTS

FEBRUARY 20, 2020

The company said its GAAP net income and GAAP diluted earnings were $1.7 The company also reported non-GAAP total operating revenues of $238.4 million, and EBITDA and non-GAAP diluted earnings per common share of $21.8 Non-GAAP values means those values not generally accepted in the U.S.,

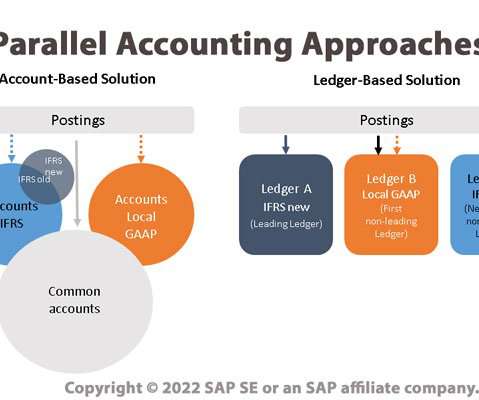

Bramasol

JUNE 10, 2022

For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. The account-based approach uses account logic identifiers to assign accounting principles, such as using unique prefixes to determine which accounts use IFRS vs GAAP principles.

PYMNTS

SEPTEMBER 7, 2017

According to reports in Nasdaq , Coupa’s non-GAAP losses of 10 cents per share were better than previous analysts’ estimates of 17 cents per share — and significantly better than the $1.83 Total GAAP operating loss stood at $14.4 million, with a non-GAAP loss at $5.7 million and non-GAAP losses of $9.6

The Charity CFO

JANUARY 21, 2022

Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit. And the more transparent your accounting system is, the more accountable you’ll be with the public and GAAP.

Proformative

SEPTEMBER 16, 2022

The company that I work for was just acquired by a private equity firm. The comp.

The Charity CFO

JANUARY 17, 2022

Accrual accounting is required by Generally Accepted Accounting Principles (GAAP), which means that you’ll need accrual-based reports to complete a nonprofit audit. Both GAAP and the IRS require nonprofits to report their expenses broken down into 3 categories: Program services expenses. Difference #3: Functional Expenses.

PYMNTS

AUGUST 5, 2020

Square’s net loss for the Q2 was $11 million on a GAAP basis. Adjusted earnings per share were 18 cents. Analysts at Refinitiv, the London-based global provider of financial market data, had predicted a 5 cent loss. The stock jumped 9 percent in after-hours trading to $149.43 Wednesday (Aug. 5), up from $136.83 at the close Tuesday (Aug.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content