Workday Adaptive Planning Reviews

The Finance Weekly

FEBRUARY 22, 2025

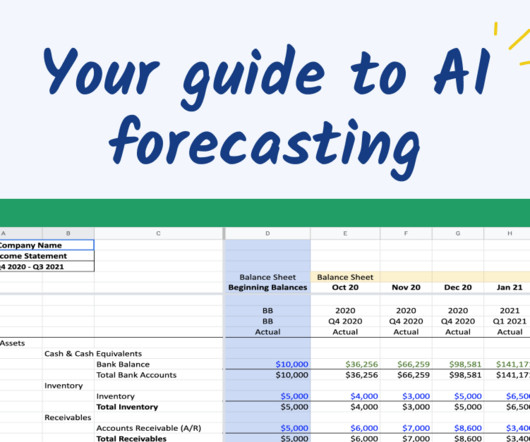

Did you know that 47% of businesses still rely on spreadsheets for financial planning, despite the risks of errors and inefficiencies? Workday Adaptive Planning aims to solve this problem by offering a cloud-based Financial Planning & Analysis (FP&A) solution with AI-powered forecasting, budgeting, and workforce planning tools.

Let's personalize your content