Jobless claims dip below forecasts in glimmer of hope for labor market

CFO Dive

AUGUST 8, 2024

The report on initial jobless claims helped fuel a rebound in equity markets following news last week of job market weakness.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

AUGUST 8, 2024

The report on initial jobless claims helped fuel a rebound in equity markets following news last week of job market weakness.

CFO Dive

APRIL 1, 2024

Investor enthusiasm for artificial intelligence may spur companies to go public in coming months, EY said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

CFO Dive

APRIL 10, 2024

Futures traders cut from 56% to 17% the odds that the Fed will conclude 2024 having trimmed the main rate by more than a half percentage point.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

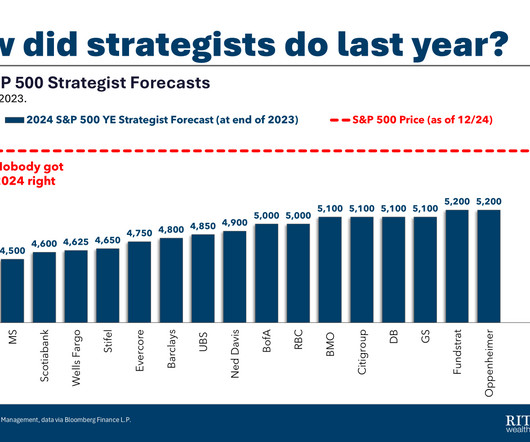

Barry Ritholtz

JANUARY 2, 2025

This is true about equity and bond markets, specific company stocks, and economic data series. It is especially true for strategists and forecasters at large brokers and banks. Similarly, there are numerous problems with forecasting. Even the most well-ordered, thoughtful forecasts turn to mush when randomness strikes.

Speaker: Genevieve Hancock, CPA

Go beyond traditional forecasting models, identifying key leverage points within your organization for liquidity, even in the most challenging environments. Understanding that cash flow management fuels every decision, every opportunity, and every growth phase is critical.

CFO Dive

JANUARY 17, 2024

Robust retail sales defy predictions that trends such as declining savings and a cooling labor market will inhibit consumer spending.

Nerd's Eye View

DECEMBER 11, 2024

These assumptions are rooted in Capital Market Assumptions (CMAs), which project how different assets might perform in the future. Beyond market variables, clients bring their own behaviors and preferences into play. However, for many advisors, using these assumptions isn't always comfortable.

Focus CFO

NOVEMBER 22, 2024

Heading into 2025, accurate sales forecasting is more critical than ever. Here are five key ways to align your sales forecasting and budgeting processes for success in the year ahead. Here are five key ways to align your sales forecasting and budgeting processes for success in the year ahead.

CFO Talks

FEBRUARY 12, 2025

Optimising Budgets: Strategies for Effective Financial Forecasting Financial forecasting plays a crucial role in managing budgets effectively. However, forecasting is not just about guessing numbersit is a structured process that relies on analysing past data, considering present trends, and planning. Allocate resources wisely.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty.

Barry Ritholtz

DECEMBER 1, 2023

The chart above shows that 84% of CEOs are forecasting a recession over the next 12 months, 69% of Consumers saying the same thing, with the yield curve predicting a 61% chance of a contraction. The problem is those sets of forecasts is already 2 months old, dated October 3, 2023. Previously : Slowing U.S.

Fpanda Club

JANUARY 23, 2025

FP&A is an evolving function that falls into the intersection of finance, operations and strategy aimed at driving better decision-making trough insightful analysis, forecasting and goal setting. In this blog post I wont focus on the activities that fall into FP&As scope by default, such as budgeting, forecasting and regular analysis.

Future CFO

MARCH 14, 2025

People should understand and prepare for the consequences of a potential debt crisis, and CFOs face the need to deregulate the finance system as it will be the key to unlocking growth for businesses and generate more healthy competition in the market.

E78 Partners

MARCH 3, 2025

Yet many middle-market companies continue to explore opportunities to go public. After a challenging IPO market from 2022 to 2023, conditions have certainly improved. However, while market sentiment is improving, IPO readiness requires more rigorous preparation than ever before.

CFO Dive

FEBRUARY 26, 2024

Data on the job market, and consumer and producer prices, suggest the Fed may need to keep the main interest rate at a 40-year high longer than markets anticipated.

Barry Ritholtz

AUGUST 19, 2022

The link was to James Mackintosh’s column “ Five Not-Quite-Impossible Things the Market Believes.” But rational people can reasonably disagree on anything market-related — after all, someone has to be on the other side of your trade. As to what the market “knows:” Stop Anthropomorphizing Mr. Market.

Barry Ritholtz

JANUARY 31, 2024

At the Money: Forecasting Recessions with Claudia Sahm (January 31, 2024 ) Investors don’t like recessions. In this episode, we discuss how to use labor data to forecast recessions. Claudia Sahm : Recessions aren’t supposed to be forecastable. But how can they tell if one’s coming? Claudia Sahm : Absolutely.

Fpanda Club

MARCH 19, 2025

Working a lot with uncertainty, be it planning, forecasting or analysis of the business initiative to pursue, curious FP&A team members are able to ask the right questions, identify new trends and patterns, and uncover insights and opportunities that can drive the business forward.

Cube Software

FEBRUARY 14, 2025

What is demand forecasting? Demand forecasting predicts future customer demand using historical data, market trends, and analytics. Without demand forecasting, youre essentially guessing how much inventory youll need, how many staff members to hire, or whether a new product launch will hit its revenue targets.

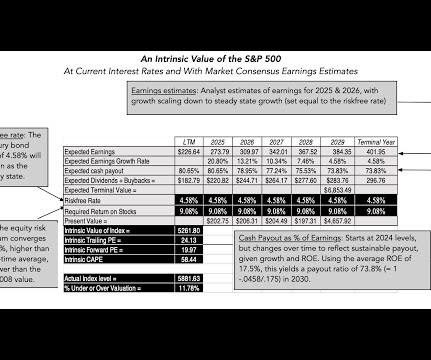

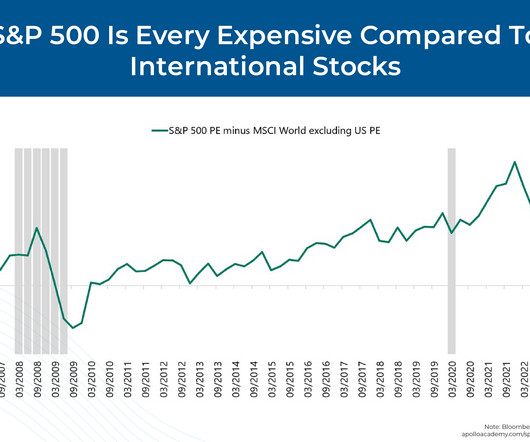

Musings on Markets

JANUARY 17, 2025

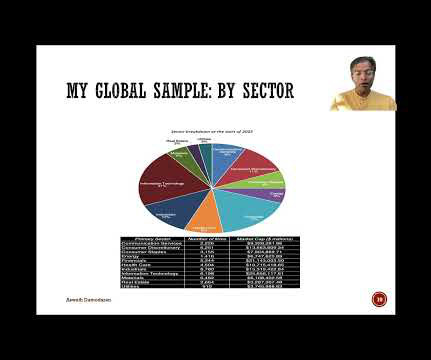

In my last post , I noted that the US has extended its dominance of global equities in recent years, increasing its share of market capitalization from 42% in at the start of 2023 to 44% at the start of 2024 to 49% at the start of 2025.

CFO Dive

AUGUST 8, 2023

Many economists have recently scuttled recession forecasts even as most small businesses still complain about persistent inflation and a tight labor market.

Barry Ritholtz

MAY 19, 2023

Only 5 stocks driving markets?! Equal-weighted Nasdaq100 up 17% since the June lows for the market because “it’s only 5 stocks”? How bad at math do you need to be to think that it’s only 5 stocks driving this market? But people have been forecasting an imminent recession for 18 months — and we still have yet to have one.

Global Finance

DECEMBER 26, 2024

Policymakers are leaning on banks of all stripesfrom city commercial banks to state-owned giants such as ICBC and China Everbright Bankto stimulate a market hard-hit by falling home prices and property developer losses since the Covid-19 pandemic. In some cities, banks have cut rates for first-time homeowners.

Musings on Markets

SEPTEMBER 5, 2024

Last Wednesday (August 28), the market waited with bated breath for Nvidia’s earning call, scheduled for after the market closed. This dance between companies and investors, playing out in expected and actual earnings, is a feature of every earnings season, especially so in the United States, and it has always fascinated me.

Global Finance

OCTOBER 31, 2024

China continues to search for antidotes to an ailing economy and the deterioration of its real estate market, and the banking sector continues to expand. in 2023, up from 3% in 2022, but it is now forecast by the International Monetary Fund (IMF) to fall to 4.8% GDP growth rose to 5.2% in 2024 and further, to 4.5%, the following year.

Barry Ritholtz

MARCH 18, 2025

This is as true for professionals as it is for amateurs; it’s also true in music, film, sports, television, and economic and market forecasting. Market Mayhem : As investors, we often rely on rules of thumb that fail us. The vast majority of market gains come from ~1% of all stocks. We prefer narratives over data.

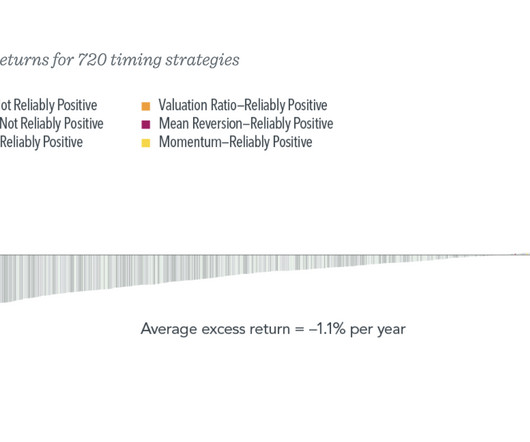

Barry Ritholtz

NOVEMBER 27, 2023

This weekend Jeff Sommer discussed a DFA research paper on market timing; both are well worth your time to read. The broad strokes are: Market timing is extremely difficult, very few people (if any) do it consistently well. Low Stakes : The most successful market timers are often those people who do not have actual assets at risk.

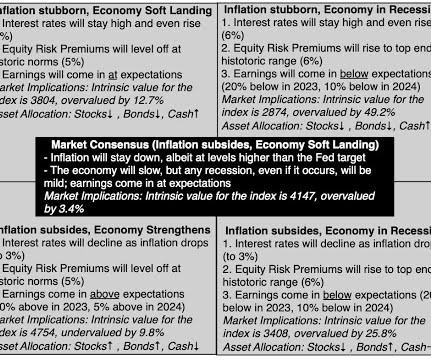

Musings on Markets

OCTOBER 4, 2023

That recovery notwithstanding, uncertainties about inflation and the economy remained unresolved, and those uncertainties became part of the market story in the third quarter of 2023. The Markets in the Third Quarter Coming off a year of rising rates in 2022, interest rates have continued to command center stage in 2023.

Barry Ritholtz

NOVEMBER 27, 2024

I think about that calm pond this time of year when the annual Wall Street forecasts for markets and the economy get released. I think about this when I see the torrent of forecasts this time of year: Price targets for the S&P, inflation forecasts, and most LOL of all, NRF Black Friday retail predictions.

Nerd's Eye View

JANUARY 3, 2024

The sentiment is especially poignant when it comes to economic forecasting, as it's nearly impossible to get an accurate picture of the current state of the economy at any given moment. The labor market, while still remarkably resilient, has also started to show signs of stress.

Musings on Markets

JANUARY 10, 2025

In corporate finance and investing, which are areas that I work in, I find myself doing double takes as I listen to politicians, market experts and economists making statements about company and market behavior that are fairy tales, and data is often my weapon for discerning the truth. Lease Effect 2. Dividend yield & payout 3.

Future CFO

MARCH 6, 2025

Amid the hype brought about by the advent of artificial intelligence in the Finance function, challenges concerning the technological advancement in sales and receivables forecasting remain. Business-Specific Internal Factors : Sales pipeline strength, marketing efforts, operational bottlenecks, and product pricing.

The Finance Weekly

FEBRUARY 23, 2025

This issue hampers forecasting accuracy, risk management, and resource allocation. Without accurate insights, businesses struggle with forecasting, risk management, and resource allocation. This leads to better budgeting, more reliable forecasting, and stronger financial stability. Use past data to predict future performance.

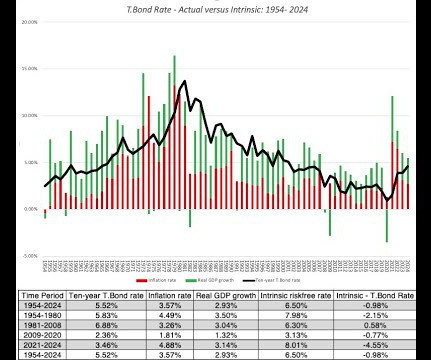

Musings on Markets

JANUARY 28, 2025

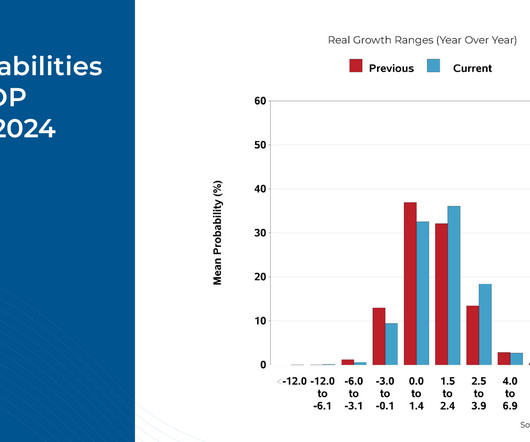

It was an interesting year for interest rates in the United States, one in which we got more evidence on the limited power that central banks have to alter the trajectory of market interest rates. We started 2024 with the consensus wisdom that rates would drop during the year, driven by expectations of rate cuts from the Fed.

Navigator SAP

OCTOBER 7, 2022

Market changes occur much more quickly in the modern era, making it nearly impossible to forecast supply and demand through historic data alone. And trying to keep up with the dizzying pace of the market can lead to low-quality batches of products—which can damage a company’s once-sterling reputation.

Nerd's Eye View

APRIL 3, 2024

The equity market is experiencing its own bifurcation, with a wide dispersion in (extremely elevated) valuations across the "Magnificent 7" and the rest of the market, which is much closer to historical averages. Given that corporate profits have historically tracked GDP growth, this inconsistency creates an interesting enigma.

Barry Ritholtz

OCTOBER 24, 2024

At least if you do forecasts for market returns over the next decade (lol), you may see incredible similarities. In other words, if you were forecasting 10-year returns of 3% annually, you are also forecasting an economic shitstorm of rare and historic proportions. If you are a strategist at Goldman Sachs , then a lot.

Future CFO

NOVEMBER 6, 2024

CFOs and the Finance team rode on the waves of these shifts in the market, putting talent management—re-skilling and up-skilling—on the priorities list to help finance professionals through transformation and change. The post Gearing up for 2025: How finance leaders will take the reign appeared first on FutureCFO.

Lime Light

MARCH 4, 2025

Picture this: You kick off a cross-departmental meeting to build a yearly financial forecast. The sales team projects a 30% increase in new customer acquisition based on a recent marketing campaign. But the marketing team raises concerns about rising customer churnespecially among smaller businessesdue to a recent price hike.

The Finance Weekly

OCTOBER 29, 2024

Financial models are essential for organizations, helping forecast financial performance using historical data and future projections. This practice allows businesses, investors, and finance professionals to evaluate investment opportunities, assess risks, forecast future scenarios, and support strategic decision-making.

Global Finance

JANUARY 2, 2025

So dont wait until a crisis is at its peak and you incur losses, lose market share, lose customers. Every quarter it either met or exceeded analysts revenue forecasts. Its the alleged technology used by the target to penetrate a new type of market. Thats a bad time to buy. Look ahead!

Future CFO

DECEMBER 29, 2024

However, the increasing complexity of global markets and the pace of technological change have redefined this role. This includes real-time data analysis, which allows finance leaders to respond swiftly to market changes and identify growth opportunities.

Future CFO

FEBRUARY 16, 2025

With market volatility, digital disruption, and regulatory uncertainty appearing to be the norm rather than the exception in 2025, finance leaders will be hard-pressed to accelerate transformation initiatives and get them up and running quickly. Moreover, the importance of storytelling in data intelligence cannot be overstated.

Global Finance

MARCH 4, 2025

These are not new phenomena, and over time companies have responded by implementing a variety of strategies, such as rationalizing production lines, finding new markets, or near shoring sources of supply to name but a few. In the past its usually been like taking a scalpel to the tariffsmarket by market, she said.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content