When to use FP&A software for nonprofits

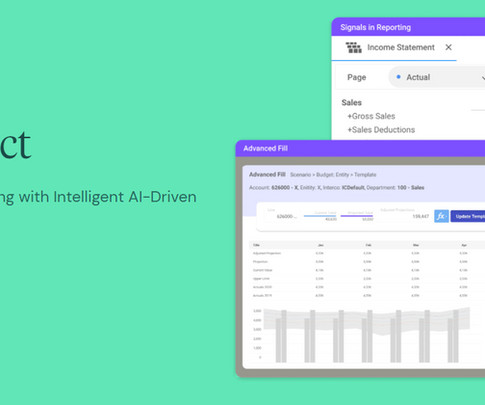

Centage

NOVEMBER 8, 2023

Building and maintaining an effective budget is daunting no matter what industry you’re in — but financial planning for nonprofits is especially tough. The specific circumstances of how nonprofits operate and get funded adds a layer of complexity to their FP&A processes. No programming. No formulas.

Let's personalize your content