FASB studies AI use in financial data analysis

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

E78 Partners

DECEMBER 12, 2024

The coming together of private equity and technology is redefining how organizations operate, innovate, and compete. For private equity backed firms, adopting cutting-edge technological solutions is not just an advantageits a necessity for maximizing efficiency, driving growth, and maintaining a competitive edge.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

Simply Treasury

AUGUST 26, 2021

We all agree on the existence of a problem and a need, we all would like to implement it and "digitize" even more and automate, without knowing how or with which technology. You must start from the business needs and not from the technology. Technology is only a means to an end. This is where the problem lies.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

CFO Dive

MARCH 26, 2024

AI analytics technology is turbocharging anti-fraud measures through its ability to process oceans of financial data.

CFO News Room

DECEMBER 2, 2022

When Frances Lawrence was first brought in as Financial Director at software company FISCAL Technologies in 2019, the business was in real need of working capital to accelerate the growth curve. . Frances’ beginnings at FISCAL Technologies. The post Frances Lawrence, CFO, FISCAL Technologies appeared first on GENCFO.

Future CFO

DECEMBER 29, 2024

Financial transformation has emerged as a critical imperative for organisations in 2024, driven by the need to adapt to rapidly changing economic conditions, technological advancements, and evolving business landscapes. Evolving role Historically, CFOs were the stewards of financial reporting and compliance.

Global Finance

MARCH 1, 2025

ICBC uses DeepSeek for wealth management tasks and financial data analysis. Bank of Beijing uses the app for data analysis through a partnership with Chinese IT conglomerate Huawei. In addition, DeepSeek helps the bank sort and respond to thousands of emails received daily.

Future CFO

JANUARY 22, 2025

Source: Data collected during the FutureCFO Conference series in 2024, Cxociety Research Coming into 2025, as finance leaders face mounting pressure to do more with less while driving growth and maintaining compliance, they are turning to digital solutions and holistic approaches to reshape and modernise financial processes.

CFO Plans

NOVEMBER 25, 2024

No longer confined to traditional financial management, CFOs now play a pivotal role in safeguarding their organizations against increasingly sophisticated cyber threats. As stewards of financial data, CFOs must prioritize cybersecurity measures to ensure the security of sensitive information and maintain client trust.

PYMNTS

JULY 26, 2020

The announcement by the Consumer Financial Protection Bureau ( CFPB ) comes on the heels of a symposium it held in February which included experts from consumer groups, financial technology (FinTech) companies, trade groups, banks and data aggregators.

Global Finance

DECEMBER 16, 2024

As AI is piloted and adopted across all aspects of the personal and business banking landscape, Global Finance held a Digital Banking and AI Innovation panel in London with global financial industry leaders to explore the impact of new technologies and how to incorporate them in a way that creates a win-win for all stakeholders.

Bramasol

SEPTEMBER 29, 2023

This blog post provides an overview of these major waves of change based Bramasol's more than 27 years of working closely with CFOs and their stakeholders across many industry segments and technology innovation cycles. They are expected to provide financial leadership and insight into the organization's strategic direction.

Future CFO

FEBRUARY 14, 2025

As businesses navigate their way around various technological advancements, finance teams are faced with the task to integrate analytics and automation into their existing processes, determining at the same time which specific system to transform first for maximum operational impact.

The Finance Weekly

JANUARY 19, 2025

Traditionally, financial teams had to analyze large amounts of data to evaluate performance, predict trends, and plan for success. AI in financial planning uses important technologies like: Machine Learning (ML) - AI learns from data and makes better predictions over time. This isnt the future; its happening now.

Global Finance

JUNE 6, 2024

Africa And Middle East MNT-Halan MNT-Halan developed innovative technology that provides a digital solution for unbanked populations. Moody’s Research Assistant is an add-on to CreditView that combines genAI with Moody’s proprietary data. The resulting products have driven digital engagement, customer retention and market share.

CFO Talks

MARCH 13, 2025

Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move. This is the power of Financial Information Systems (FIS). Often, finance teams work separately from sales, operations, and HR, leading to inconsistent financial data.

CFO Plans

AUGUST 2, 2024

In today’s rapidly evolving business landscape, the integration of technology into accounting practices has shifted from a luxury to a necessity. With the demands of modern businesses continuously growing, leveraging technology to streamline accounting processes is crucial for maintaining accuracy, efficiency, and competitiveness.

The Charity CFO

MAY 31, 2024

Luckily, modern accounting software and other bookkeeping technologies can help you keep up with day-to-day bookkeeping, reporting, and accounting tasks more efficiently. Efficient bookkeeping isn’t just about keeping records–it’s about building a solid foundation for your organization’s financial integrity and operational success.

CFO Talks

MARCH 5, 2025

To make sure everything aligns: Set up strong internal processes Have a clear system in place for collecting and verifying financial data. Use Technology to Make Reporting Easier Financial reporting can be time-consuming, especially if youre relying on spreadsheets or manual calculations.

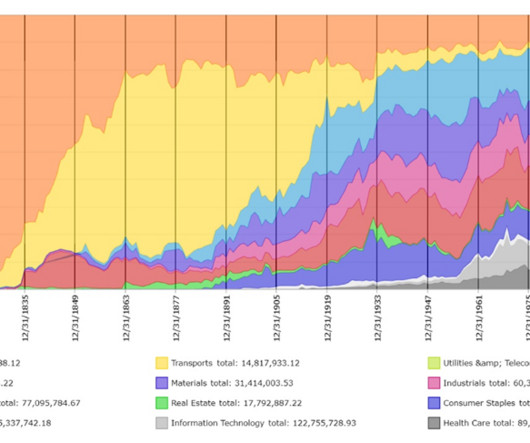

Barry Ritholtz

JUNE 17, 2024

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam points to some amazing charts from Global Financial Data. They are based on historical data that looks at 200 Years of Market Concentration. You might be surprised at the findings.

PYMNTS

JANUARY 26, 2021

The financial institution (FI) revealed last week that it is working with Volante Technologies to accelerate its ISO 20022 adoption, leaving Citi to become Volante’s first banking customer to take a unified approach to its global migration to the messaging standard. HashCash Brings Blockchain Tech To Unnamed Bank.

E78 Partners

DECEMBER 12, 2024

The coming together of private equity and technology is redefining how organizations operate, innovate, and compete. For private equity backed firms, adopting cutting-edge technological solutions is not just an advantageits a necessity for maximizing efficiency, driving growth, and maintaining a competitive edge.

E78 Partners

DECEMBER 12, 2024

The coming together of private equity and technology is redefining how organizations operate, innovate, and compete. For private equity backed firms, adopting cutting-edge technological solutions is not just an advantageits a necessity for maximizing efficiency, driving growth, and maintaining a competitive edge.

Navigator SAP

MARCH 27, 2023

Fortunately, new and innovative technologies provide businesses with cutting-edge tools designed to accelerate, track and support their research processes and provide them with accurate project and financial data that they can use to improve their daily operations.

Future CFO

DECEMBER 4, 2024

Developing specialised expertise expertise—whether in fundraising, M&A, technological transformation, or another key area—can set you apart as a leader.” A great finance leader sees the bigger picture, understanding how financial data aligns with organisational goals and drives growth.

Future CFO

MARCH 3, 2025

Technological advancements, evolving market demands, and a heightened focus on sustainability are converging to reshape the finance landscape. The rapid pace of technological change and the growing importance of ESG have created a demand for new skills that are often in short supply. The finance function is undergoing a seismic shift.

CFO Talks

FEBRUARY 20, 2025

The real value lies not in reporting the past but in questioning, interpreting, and challenging financial data to drive better decisions for the future. Financial reports are produced the same way they have always been. However, technology should be seen as a tool, not a replacement for human judgment.

The Finance Weekly

FEBRUARY 23, 2025

Strong FP&A practices help finance teams improve data accuracy , use technology effectively, and make well-informed financial decisions. This leads to better budgeting, more reliable forecasting, and stronger financial stability. Present financial data with clear charts for faster decision-making.

CFO Talks

APRIL 17, 2025

Critically, CFOs must move beyond siloed financial data and begin synthesising a broader spectrum of intelligence. Technology as an Enabler, Not the Destination Digital finance transformation remains a boardroom prioritybut its not about technology for its own sake.

The Finance Weekly

JANUARY 5, 2025

At their core, finance AI chatbots are virtual assistants designed to automate financial tasks and provide customers with personalized, real-time support. What started as simple, rule-based programs has evolved into smart conversational agents powered by advanced technologies. Automated dashboards and custom reports.

PYMNTS

DECEMBER 29, 2020

Consumer Bank Chief Digital Officer Mike Naggar said the FI aims to provide customers "a choice, convenience and control of their financial data. WEX Talks Bank Partnerships To Advance B2B Payments. Radius Bank Ramps Up SMB Services With Narmi.

Global Finance

OCTOBER 22, 2024

However, due to existing privacy laws and regulations, banks remain hesitant to share financial data. If data is shared, it is done via lateral agreements. From a technology perspective, relying on lateral agreements doesn’t scale well, and participation is entirely voluntary.

The Finance Weekly

DECEMBER 30, 2021

For businesses, this might spell out the adoption of a new strategy, scheduling approach, or technology implementation. Technology implementation has been a popular course of action in recent years for many organizations. Moreover, how do you ensure data quality, security, and privacy as cybersecurity breaches stubbornly persist?

CFO Talks

JANUARY 8, 2025

If someone struggles with presenting financial data, offer tips, resources, or even a mentor to help them improve. Adopt Technology and Innovation Technology is reshaping the finance world, and your team needs to stay ahead of the curve. However, adopting technology isnt just about implementation; its about training.

CFO Talks

NOVEMBER 27, 2024

Review existing data: Look at your company’s historical trends, current financial data, and market research. Even if the data isn’t perfect, it can give you a starting point. Use visuals, like charts or dashboards, to explain financial data. Ask questions: What information do you have now?

Future CFO

JUNE 1, 2022

Rigid data silos have been replaced with more fluid methods of working as technology-enabled collaboration provides a comprehensive, company-wide, real-time overview for agility when plans change. Provide continuing education programs to build resilience and prevent resistance toward new technologies.

Global Finance

DECEMBER 26, 2024

In a 2023 Treasury & Risk survey, over 70% of CFOs emphasized the importance of flexible technology in keeping their treasury operations efficient amid increasing volatility. Treasury functions are no longer isolated; they require seamless communication between ERP systems, banks, and financial data providers.

CFO Talks

FEBRUARY 12, 2025

Use Technology and Automation Modern technology has made financial forecasting easier and more accurate. Many software tools can analyse financial data and provide useful insights. Benefits of using technology: Automates data collection and analysis, saving time and effort.

https://trustedcfosolutions.com/feed/

MARCH 22, 2023

The Tech Stack for Your Accounts Payable Technology has revolutionized how we do business, and accounting is no exception. You can track invoices, payments, and expenses in real time and securely access your financial data from anywhere. Optical Character Recognition (OCR) Technology. Electronic Payment Systems.

Simply Treasury

JUNE 3, 2021

It also aims at identifying challenges corporate treasurers of MNC’s are facing and technological innovations they intend to implement. Top three treasury priorities in the coming months: Technological innovations. The answers show a certain lucidity on the part of treasurers who seem realistic in their use of new technologies.

PYMNTS

MARCH 4, 2020

Enterprise cloud migrations have opened up the ability for smaller businesses to adopt ERP technology once reserved for the largest corporates. At the same time, a surge in third-party financial platforms has disrupted the flow of data into the ERP, disbursing information throughout the back office. Modernizing the ERP.

Future CFO

FEBRUARY 2, 2025

In navigating the current world that is ever-changing, evolving constantly with various technological advancements that almost always force their way in to day-to-day routines of organisations, it is a no-brainer that the Finance function has shifted its focus on artificial intelligence for some time now.

Global Finance

FEBRUARY 12, 2025

They value transparency, ease of use, and personalization, putting pressure on asset managers to adopt new technologies and pivot from traditional relationship models. Real-time data access Millennials and gen Z clients have high expectations for immediacy in financial information.

CFO Thought Leader

OCTOBER 2, 2024

LaPeer instinctively stepped in, simplifying the explanation of complex details and demonstrating her ability to distill intricate financial data while effectively reading the room. The head of finance for the acquired firm struggled to present the information clearly, while the new owners shifted uneasily in their seats.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content