How AI is raising the bar for CFO budget planning

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

The Finance Weekly

JANUARY 19, 2025

Artificial intelligence (AI) is changing financial planning and how industries operate. According to NVIDIA, 91% of financial companies are already using or testing AI. AI automates tasks such as data entry and modeling, enabling finance teams to focus on analysis and strategy. What is AI in Financial Planning?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

The Finance Weekly

FEBRUARY 22, 2025

Did you know that 47% of businesses still rely on spreadsheets for financial planning, despite the risks of errors and inefficiencies? Workday Adaptive Planning aims to solve this problem by offering a cloud-based Financial Planning & Analysis (FP&A) solution with AI-powered forecasting, budgeting, and workforce planning tools.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Jedox Finance

JANUARY 12, 2022

The answer to these questions and more: a solid financial plan. What is the corporate financial planning process? What is the goal of corporate financial planning? The importance of financial planning for your company. Types of corporate financial planning. Table of Contents.

CFO Plans

NOVEMBER 25, 2024

No longer confined to traditional financial management, CFOs now play a pivotal role in safeguarding their organizations against increasingly sophisticated cyber threats. As stewards of financial data, CFOs must prioritize cybersecurity measures to ensure the security of sensitive information and maintain client trust.

CFO Plans

DECEMBER 2, 2024

These insights empower owners to make data-driven decisions that support long-term growth. Leverage Financial Insights in Hospitality In the hospitality industry, leveraging financial insights is essential to remain competitive. The post The Pivotal Role of the CFO in Hospitality Growth appeared first on CFO PLANS | Blog.

CFO Simplified

MARCH 27, 2022

This, however, does not necessarily mean that strategic planning is off the table. A proactive way for business owners to mitigate their risk is through contingency planning. So, what is contingency planning, and what is a CFO’s role in creating this strategy? What is Contingency Planning? What alternatives are available?

CFO Talks

MARCH 13, 2025

Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move. This is the power of Financial Information Systems (FIS). This shift allows businesses to move from reactive decision-making to proactive planning.

Centage

OCTOBER 17, 2022

As you start your financial planning for 2023 and beyond, follow these steps to solidify your three-year strategic plan and boost the odds of achieving your business’ goals. If you want to forecast your financial future, start by looking back at past performance. Financial planning comes with numerous challenges.

Future CFO

DECEMBER 29, 2024

Giselle Arellano-Geronimo For instance, integrating cloud-based systems allows for greater flexibility and accessibility of financial data, enabling finance teams to collaborate more effectively. This involves investing in technology that automates routine tasks and provides valuable insights that can drive competitive advantage.

Centage

SEPTEMBER 13, 2022

There is some risk to using past performance to inform your long-term plans, and this can be compounded during times of economic uncertainty. Your company needs to make plans for the future. What Is Financial Forecasting? Your budget is a roadmap of your business’s financial goals and how you plan to reach them.

Navigator SAP

MARCH 4, 2022

Implementing an enterprise resource planning (ERP) system has become a matter of survival for startups that want to scale fast or involve complex manufacturing operations, as the process efficiencies and data transparency ERP delivers can make or break such businesses.

CFO Plans

FEBRUARY 23, 2025

Discover how to transform your financial reports into investment magnets by aligning them with investor expectations. Clear, precise, and comprehensive financial reports that meet investor expectations are indispensable. Emphasizing robust financial performance and growth prospects is key.

Nerd's Eye View

NOVEMBER 29, 2023

The traditional way that most financial planning has been offered was for an advisor to create "The Plan": a comprehensive document outlining a client's financial strategy that was delivered either on a one-time basis or updated annually.

Centage

JANUARY 17, 2023

Between a volatile stock market, high interest rates, supply chain issues, inflation, and a possible recession, having a solid financial planning process in place is an important piece of sustaining your business through challenging times. Today’s business leaders are facing unprecedented uncertainty. Was it a salesmanship issue?

The Finance Weekly

OCTOBER 30, 2024

Here’s what modern cash management systems typically offer: Real-Time Bank Account Integration - The ability to link various bank accounts into a single platform allows businesses to view all their financial data in one place, reducing manual work and improving accuracy.

PYMNTS

JANUARY 14, 2021

The Saudi Arabian Monetary Authority (SAMA) is introducing an open banking policy to advance digital innovation in the financial services sector. Saudi Arabia’s central bank said the plan is for open banking to go live in the first half of 2022.

The Finance Weekly

FEBRUARY 23, 2025

Did you know that 35% of organizations identify data quality and timeliness as significant barriers to effective financial planning and analysis (FP&A)? Bad data, inaccessible information, and outdated processes make FP&A more difficult. Gain Approval - Present the plan to management with expected benefits.

Centage

DECEMBER 7, 2022

The Planning Maestro App for QuickBooks Online Advanced provides a two-way sync of financial data between QuickBooks Online Advanced and Planning Maestro, resulting in improved efficiency, fewer manual processes, and greater confidence in data quality and integrity. Seamless Integration. Automate Key Reports.

CFO Talks

FEBRUARY 5, 2025

How to Create Accurate Budgets for Business Units Budgeting is one of the most important things a business can do to stay financially healthy. A good budget helps a company plan its spending, control costs, and make smart decisions. Understanding Business Unit Budgets A business unit budget is like a financial roadmap.

Future CFO

FEBRUARY 14, 2025

This includes how data security is viewed as a top concern for 44% of Asian enterprises, exceeding the global average and how AI model accuracy is just 32% on average, with only 30% of data is structured, revealing messy data foundations.

Navigator SAP

AUGUST 19, 2022

One of the main success factors for modern enterprises is having access to real-time financial data. This can only be achieved through streamlining the process of collecting, managing, and sharing data in your organization.

Global Finance

DECEMBER 26, 2024

To present a consolidated view, this often requires the integration of data from multiple sources, such as ERP systems, forecast and planning processes, and even local-entity-level global finance team members. This interconnectedness ensures accurate, real-time financial insights. Connectivity goes beyond data aggregation.

The Finance Weekly

JANUARY 5, 2025

Assisting Financial Planning Finance AI chatbots are excellent tools for budgeting and financial planning. They analyze spending habits and recommend adjustments to help individuals or businesses achieve their financial goals. Free plan with basic features. Cons Advanced features may require premium plans.

CFO Talks

MARCH 5, 2025

To make sure everything aligns: Set up strong internal processes Have a clear system in place for collecting and verifying financial data. Some useful tools include: ERP (Enterprise Resource Planning) systems These systems (such as SAP, Oracle, or Sage) help track financial transactions and automate reporting.

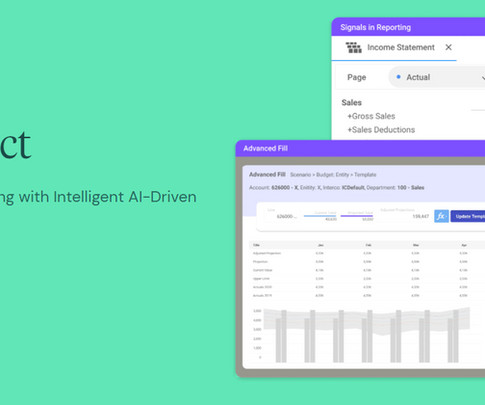

The Finance Weekly

JUNE 17, 2024

Financial planning and analysis (FP&A) is important in automating all of the manual tasks in the finance department and giving everyone greater insights into the data. Planful is one of these top FP&A software solutions , and this article will review their features, reviews, and customer feedback.

Lime Light

NOVEMBER 4, 2024

According to the 2024 Global Finance Trends Survey, 69% of finance leaders recognize the critical role of financial planning and profitability analysis in strategic decision-making. Interpreting financial data, especially complex datasets, can pose challenges, even for seasoned professionals.

E78 Partners

SEPTEMBER 9, 2024

Under these pressures, one aspect often underestimated is the power of strategic budget planning. It’s not just about managing numbers—it’s about aligning financial strategies with business goals to unlock value at every stage of the investment cycle. This is where scenario and sensitivity analyses come into play.

The Finance Weekly

MAY 29, 2024

Financial planning and analysis (FP&A) solutions provide a complete platform for organizational planning, which is important for all businesses. Understanding their financial status and performance is key for business growth. Two of these companies, Planful and Vena are popular for many reasons.

The Finance Weekly

FEBRUARY 26, 2025

Political shifts, rising inflation, and unpredictable market trends are forcing businesses to rethink their financial planning strategies. Prophix aims to address these challenges by offering advanced, cloud-native financial planning solutions. Investment Planning Evaluate potential investments through dynamic modeling.

Future CFO

SEPTEMBER 26, 2024

This is in the aim of producing timely financial data and other outputs, such as visualisations. Interpersonal skills are also important, as analysts and modelers can be tasked with communicating complex financial data to colleagues in other functions or locations, or with quickly educating senior leaders.

Navigator SAP

MARCH 27, 2023

Fortunately, new and innovative technologies provide businesses with cutting-edge tools designed to accelerate, track and support their research processes and provide them with accurate project and financial data that they can use to improve their daily operations.

CFO Talks

FEBRUARY 12, 2025

It allows businesses and organisations to predict future income, expenses, and cash flow, ensuring that they remain financially stable and prepared for challenges. However, forecasting is not just about guessing numbersit is a structured process that relies on analysing past data, considering present trends, and planning.

Collectiv

JANUARY 24, 2025

Did you know that 96% of finance teams still rely on spreadsheets for planning and 93% rely on them for reporting? If youre stuck in a vicious cycle of manual updates and outdated insights, its time to rethink your approach to planning and financial reporting. Centralize Financial Data Data silos are the enemy of efficiency.

E78 Partners

FEBRUARY 26, 2025

Yet, many PE-backed companies struggle with financial planning and analysis (FP&A), which creates barriers to achieving growth targets, cash flow clarity, and operational alignment. Executives rely on FP&A for backward-looking analysis rather than proactive scenario planning. Use operational KPIs (e.g.,

The Finance Weekly

AUGUST 27, 2023

Planful and Datarails are two of the leading FP&A solutions in 2023. Planful is an FP&A solution that was built for large companies and enterprises. Planful has a great AI feature called Planful Predict and it is a big selling point in 2023.

Spreadym

APRIL 27, 2023

Implementing automation systems for financial planning and analytics (or simply FP&A software) rarely brings direct benefits that could easily be demonstrated to a client. However, they exist, but don’t look so obvious as in case with CRM or Sales and operational planning systems (also we name them S&OP software).

CFO Plans

SEPTEMBER 24, 2024

This startling statistic underscores the critical importance of accurate financial forecasting. By predicting future financial outcomes based on historical data, market trends, and economic indicators, small businesses can navigate uncertainty, plan for growth, and ensure long-term sustainability.

Centage

SEPTEMBER 14, 2021

When it comes to business budgeting and planning, traditional spreadsheets are labor-intensive, prone to errors, and static, so it can be difficult to get a clear view on your current and future financial position. With the fast pace of business change, CFOs need accurate financial information to make informed decisions on the fly.

Cube Software

DECEMBER 3, 2023

Understanding Planful: strengths and limitations Planful is a provider of cloud-based financial planning software that allows FP&A teams to analyze their financial data and create more insightful forecasts and reports.

Navigator SAP

MARCH 11, 2022

Enterprise resource planning (ERP) solutions have been around for decades, so you likely have a sense of what they can do. Bookkeeping and financial tracking tend to get more complicated over time. The platform allows you to consolidate all of your financial data automatically and review it all on one dashboard.

Spreadym

NOVEMBER 16, 2023

The best Financial Planning and Analysis (FP&A) software typically offers a range of features designed to help organizations effectively manage their financial performance. Users can input data, make adjustments, and project future financial scenarios.

CFO Talks

JANUARY 8, 2025

Understand Your Teams Starting Point Before planning for growth, its essential to know where your team currently stands. This understanding helps you identify training needs and create tailored development plans. If someone struggles with presenting financial data, offer tips, resources, or even a mentor to help them improve.

Future CFO

MARCH 3, 2025

This is forcing finance leaders to integrate ESG considerations into their financial planning, reporting, and investment decisions. The ability to analyse data, identify insights, and communicate those insights effectively is highly valued.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content