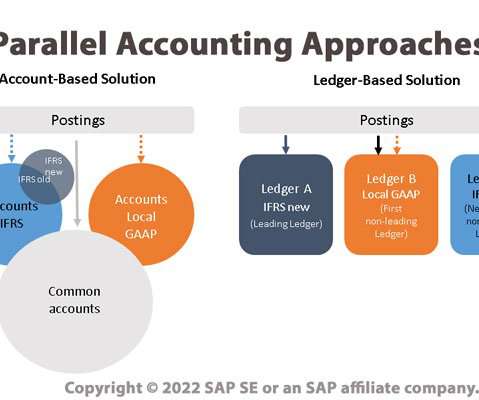

Parallel Accounting is a Key Tool for Global Companies with Multiple Reporting Requirements

Bramasol

JUNE 10, 2022

For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. The account-based approach uses account logic identifiers to assign accounting principles, such as using unique prefixes to determine which accounts use IFRS vs GAAP principles.

Let's personalize your content