Family Office Financial Management

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

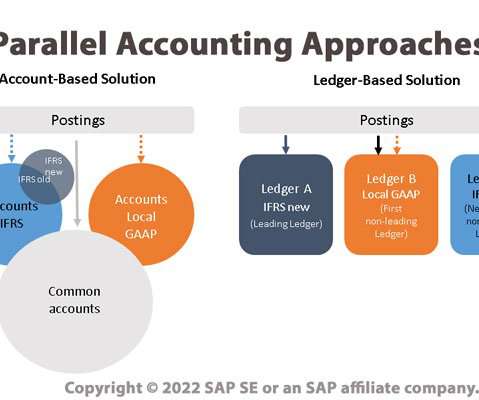

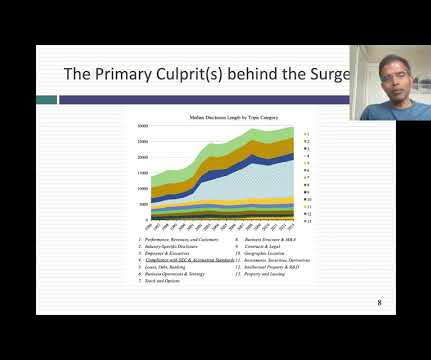

For single and multiple family offices, governance is key to financial success and is an important element of your organizational structure. Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place.

Let's personalize your content