FASB studies AI use in financial data analysis

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Financial Data Related Topics

Financial Data Related Topics

CFO Dive

MARCH 3, 2023

The surge in use of conversational artificial intelligence has prompted scrutiny of the technology’s role in financial decisions.

Jedox Finance

JANUARY 23, 2025

Real-time financial data is your key to turning the tide and unlocking faster, smarter forecasting and budgeting. This article explores how real-time financial data enables CFOs to lead with agility, precision, [.]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Simply Treasury

AUGUST 26, 2021

Like salmons in rivers, we need to swim upstream to find the best way to optimize this incredible but too often untapped asset.

Maximizing Profit and Productivity: The New Era of AI-Powered Accounting

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Here's How To Fix Them

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Global Finance

MARCH 1, 2025

ICBC uses DeepSeek for wealth management tasks and financial data analysis. Bank of Beijing uses the app for data analysis through a partnership with Chinese IT conglomerate Huawei. In addition, DeepSeek helps the bank sort and respond to thousands of emails received daily.

CFO Dive

DECEMBER 12, 2023

AI can analyze vast amounts of financial data to predict trends, model budget scenarios, and deliver insights, writes Falconi’s Bernardo Miranda.

CFO Dive

MARCH 26, 2024

AI analytics technology is turbocharging anti-fraud measures through its ability to process oceans of financial data.

CFO Dive

MARCH 7, 2023

The majority of leaders at financial institutions say interest rates will drive business model guidance this year but few are leveraging financial data to support these changes.

CFO Dive

FEBRUARY 21, 2023

Nearly half of execs expect cyber attacks on financial data to increase in 2023, but the majority of finance leaders don't have consistent communication with their CIO to mitigate this risk.

Cube Software

MAY 20, 2024

Why spring cleaning is essential to finance Spring cleaning your financial data is more than a routine check—it's a critical practice that ensures healthy, efficient finance operations.

CFO Plans

NOVEMBER 25, 2024

No longer confined to traditional financial management, CFOs now play a pivotal role in safeguarding their organizations against increasingly sophisticated cyber threats. As stewards of financial data, CFOs must prioritize cybersecurity measures to ensure the security of sensitive information and maintain client trust.

Future CFO

DECEMBER 29, 2024

Giselle Arellano-Geronimo For instance, integrating cloud-based systems allows for greater flexibility and accessibility of financial data, enabling finance teams to collaborate more effectively. This involves investing in technology that automates routine tasks and provides valuable insights that can drive competitive advantage.

CFO Talks

MARCH 13, 2025

Now, picture the opposite: instant access to real-time financial insights, automated compliance checks, and AI-driven forecasts guiding your next move. This is the power of Financial Information Systems (FIS). Often, finance teams work separately from sales, operations, and HR, leading to inconsistent financial data.

CFO Plans

DECEMBER 2, 2024

These insights empower owners to make data-driven decisions that support long-term growth. Leverage Financial Insights in Hospitality In the hospitality industry, leveraging financial insights is essential to remain competitive. For those seeking expert guidance, Explore Strategic CFO Services tailored to the hospitality sector.

CFO Talks

DECEMBER 5, 2024

Connect Financial Data to Human Behavior Numbers tell a story, but it’s curiosity that brings the story to life. Takeaway: Partner with HR, marketing, and operations teams to gain insights into the human side of your financial data. For instance: Test a new financial tool for expense tracking.

CFO Plans

FEBRUARY 23, 2025

Discover how to transform your financial reports into investment magnets by aligning them with investor expectations. Clear, precise, and comprehensive financial reports that meet investor expectations are indispensable. Emphasizing robust financial performance and growth prospects is key.

The Finance Weekly

JANUARY 19, 2025

Predictive Analytics - AI uses past data to predict future events, helping businesses prepare effectively. These technologies allow AI to quickly analyze large amounts of financial data, spot patterns, and trends, and provide helpful insights. This ensures that client investments remain aligned with their financial objectives.

CFO News

MARCH 16, 2025

MSMEs face challenges accessing credit due to traditional assessments, lack of formal financial data, and high operational costs. Experts suggest leveraging alternative data, digital processes, and government incentives to improve credit accessibility and support fintech partnerships for better risk assessment and scalability.

Navigator SAP

MARCH 4, 2022

Some businesses only need operational support that streamlines financial data and processes. Most ERP systems can integrate all your operating and tax information to automate business processes, but you should ensure the solution aligns properly with the legal structure of your business.

CFO Talks

MARCH 5, 2025

To make sure everything aligns: Set up strong internal processes Have a clear system in place for collecting and verifying financial data. Some useful tools include: ERP (Enterprise Resource Planning) systems These systems (such as SAP, Oracle, or Sage) help track financial transactions and automate reporting.

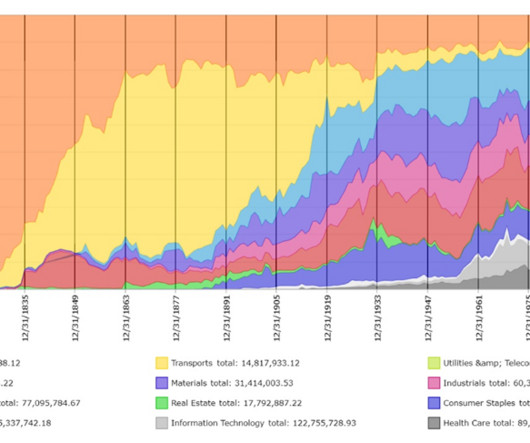

Barry Ritholtz

JUNE 17, 2024

A quick break from book authorship to share a fascinating set of data and charts, via Sam Ro. In his weekly missive, Sam points to some amazing charts from Global Financial Data. They are based on historical data that looks at 200 Years of Market Concentration. You might be surprised at the findings.

CFO Talks

NOVEMBER 7, 2024

In a role filled with financial data, strategic meetings, and high-stakes decisions, active listening can drive better outcomes and turn tough conversations into collaborative wins. But here’s the twist—real negotiation power often lies in something much quieter: listening. Listening is more than a soft skill; it’s a secret weapon.

Future CFO

JANUARY 22, 2025

For CFOs, this means managing financial data and utilising technology to provide insights that drive strategic decision-making. The document outlines the importance of understanding and implementing technological solutions to address these challenges.

Navigator SAP

AUGUST 19, 2022

One of the main success factors for modern enterprises is having access to real-time financial data. This can only be achieved through streamlining the process of collecting, managing, and sharing data in your organization.

CFO Talks

FEBRUARY 20, 2025

The real value lies not in reporting the past but in questioning, interpreting, and challenging financial data to drive better decisions for the future. Financial reports are produced the same way they have always been. Yet, in many organisations, the status quo remains unchallenged.

Future CFO

FEBRUARY 14, 2025

"Ensuring data integrity requires robust governance frameworks, automated validation processes, and continuous monitoring for inconsistencies." He says AI-driven anomaly detection can help identify discrepancies in financial data, while real-time reconciliation tools can ensure accuracy in reporting.

The Finance Weekly

OCTOBER 30, 2024

Here’s what modern cash management systems typically offer: Real-Time Bank Account Integration - The ability to link various bank accounts into a single platform allows businesses to view all their financial data in one place, reducing manual work and improving accuracy.

CFO Talks

FEBRUARY 5, 2025

This isnt always easy, but looking at past financial data and market trends can help create more accurate estimates. Steps to Creating a Budget That Works Creating an accurate budget starts with looking at past financial records. Collaboration is key to creating a budget that is both realistic and useful.

The Finance Weekly

JANUARY 5, 2025

With over 200 integrations (think ERP and CRM systems), its built to streamline financial data management, budgeting, forecasting, and more. Data Privacy Concerns : Handling sensitive financial data requires robust security protocols. Key Features Generative AI chatbot (FP&A Genius) for real-time insights.

Navigator SAP

MARCH 27, 2023

Fortunately, new and innovative technologies provide businesses with cutting-edge tools designed to accelerate, track and support their research processes and provide them with accurate project and financial data that they can use to improve their daily operations.

PYMNTS

DECEMBER 29, 2020

Consumer Bank Chief Digital Officer Mike Naggar said the FI aims to provide customers "a choice, convenience and control of their financial data. WEX Talks Bank Partnerships To Advance B2B Payments. The company is focusing on users that may be underbanked, lacking traditional bank accounts.

PYMNTS

JANUARY 26, 2021

In what the companies described is a first for South Africa’s banking sector, small business accounting platform Xero is working with Nedbank to unlock financial data of joint small business customers.

The Finance Weekly

FEBRUARY 23, 2025

Budget approval ensures financial stability, prevents unnecessary expenses, and keeps projects on schedule. Present financial data with clear charts for faster decision-making. Provide business context to support data-driven discussions.

CFO Share

JUNE 18, 2024

Implement Sign-Offs and Quality Assurance from Other Departments Asking your bookkeeper to validate all financial data is unrealistic and sets them up for failure. Instead, create a system where department heads are responsible for confirming the accuracy of some data. Operations – validates inventory records.

Navigator SAP

MARCH 11, 2022

Bookkeeping and financial tracking tend to get more complicated over time. The platform allows you to consolidate all of your financial data automatically and review it all on one dashboard. This is where an ERP solution truly shines.

The Finance Weekly

FEBRUARY 26, 2025

Charting and Graphing Tools Create interactive financial visuals to support decision-making. Self-service Reporting Empower stakeholders with easy access to real-time financial data. Automated Report Generation Streamline financial reporting processes with pre-built templates.

CFO Talks

NOVEMBER 27, 2024

Review existing data: Look at your company’s historical trends, current financial data, and market research. Even if the data isn’t perfect, it can give you a starting point. Use visuals, like charts or dashboards, to explain financial data. Ask questions: What information do you have now?

Global Finance

DECEMBER 26, 2024

Treasury functions are no longer isolated; they require seamless communication between ERP systems, banks, and financial data providers. This interconnectedness ensures accurate, real-time financial insights. Connectivity goes beyond data aggregation.

PYMNTS

JUNE 24, 2020

Specifically, payments giants are buying up data aggregators, which let consumers share data with thousands of apps — and in the process are taking on the roles of trusted intermediaries as information flows across the financial services landscape. Visa bought Plaid earlier this year. the payments giant said in an announcement.

Future CFO

NOVEMBER 17, 2022

With external pressures that are hard to predict, real-time visibility over financial data, processes and working capital will be key to survival, leading to greater pressure on CFOs and those who report into them, according to the research.

Centage

SEPTEMBER 14, 2021

Compounded over many rows, even a simple mistake can lead to faulty financial data. Large or small business that use spreadsheets are taking a risk: Boeing leaked employees’ personal data in a hidden spreadsheet column. Siloed financial data can lead to false assumptions because insight isn’t based on a complete picture.

FISPAN

APRIL 13, 2022

Financial data is one of the most valuable commodities in the world, and consumers have the right to control who gets access to it. Through customer-permissioned data sharing, central interfaces and the emergence of the consumer data right, consumers are the main beneficiaries of Open Banking.

Future CFO

DECEMBER 4, 2024

Wong says the ability to connect financial insights to the broader business landscape is crucial. “A A great finance leader sees the bigger picture, understanding how financial data aligns with organisational goals and drives growth. “I believe impactful leaders empower others to grow, creating strong, capable teams.”

CFO Thought Leader

JANUARY 29, 2025

Whether leading acquisitions or guiding cross-functional teams, Collis uses financial narratives to clarify priorities and inspire action. Someone has to be the storyteller, Collis tells us, emphasizing how framing financial data in relatable terms helps drive organizational alignment and decision-making.

PYMNTS

NOVEMBER 23, 2020

There’s no shortage of consulting advice and press clippings that will state the importance of actionable data for companies as a selling, operational and marketing strategy. Big data, it used to be called. Last week, the Department of Justice gave the green light to Mastercard’s $825 million acquisition of data aggregator Finicity.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content