FASB at 50: Under the gun to modernize GAAP

CFO Dive

DECEMBER 20, 2023

Some finance executives are wary. With its anniversary year drawing to a close, there are signs FASB is stepping up the pace of its standards setting.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 20, 2023

Some finance executives are wary. With its anniversary year drawing to a close, there are signs FASB is stepping up the pace of its standards setting.

Future CFO

DECEMBER 31, 2021

What does this mean to the finance and accounting team of 2022? According to Gartner , finance leaders anticipate a greater percentage of their time will be spent in improving flexibility of budgeting & forecasting (58%), closely followed by developing digital skills (56%) and redefining employee value proposition in hybrid environments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

https://trustedcfosolutions.com/feed/

JUNE 2, 2022

Suppose your company finances are complicated and include multiple entities or locations. GAAP, IFRS, and cash base side by side for better visibility. The post How Complex Are Your Business Finances? No two businesses are exactly alike. Every business has unique financial needs. Ability to implement user-access controls.

Book of Secrets on the Month-End Close

How To Break Digital Transformation Barriers And Accelerate AI Adoption

Forecasting Failures Are Costly: Heres How To Fix Them

Operational Strength Starts with People: The New Rules of Finance Leadership

What Your Financial Statements Are Telling You—And How to Listen!

E78 Partners

MARCH 3, 2025

Ensure their finance team has public company reporting expertise. Non-GAAP Measures and Key Performance Indicators (KPIs) Non-GAAP financial measures and KPIs play a crucial role in shaping investor perceptions and demonstrating a companys value proposition. Produce comprehensive board-ready financial reports.

E78 Partners

NOVEMBER 19, 2024

Here are four of the most common audit preparation obstacles and practical ways to overcome them, based on client experience supporting finance teams through efficient and streamlined audits. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

Global Finance

MARCH 2, 2025

Global Finance: Can you briefly describe what your model does? Horton: If they have an IPO, theyll be big firms, and theyll follow International Financial Reporting Standards or US GAAP. The post Forecasting Future Fraud: Q&A With Joanne Horton Of Warwick Business School appeared first on Global Finance Magazine.

E78 Partners

NOVEMBER 12, 2024

Enhancing Cross-Departmental Collaboration for Accurate Insights Audits impact more than just the finance team; for an accurate, holistic view, the audit process should engage departments like HR, legal, and financial planning and analysis (FP&A).

https://trustedcfosolutions.com/feed/

FEBRUARY 18, 2022

Financial governance allows your organization to meet compliance requirements, such as IFRS and GAAP updates, by having the right financial controls in place. Software like Sage Intacct automates many of the manual accounting and finance functions and allows your team to focus on higher-value tasks.

Centage

APRIL 28, 2022

Fortunately, finance teams have flocked to Planning Maestro. For more information on how to modernize your office of finance with intelligent planning , view our product demonstration video , or call 800-366-5111. The post Centage Planning Maestro: Innovating the Future of Finance appeared first on Centage.

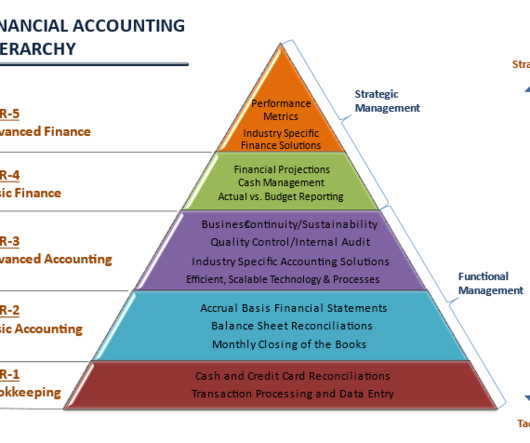

Future CFO

SEPTEMBER 15, 2021

There are 10 most sough-after shared services skills in the finance and accounting function in the past year, said Gartner recently. Looking for the top finance shared services skills in the same place as everyone else is costly,” said Jessica Kranish, senior principal, research, Gartner. Knowledge of GAAP.

CFO Leadership

OCTOBER 10, 2023

AI coupled with The Digitization of the Finance Function create powerful levers for today’s CFO. AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals.

VCFO

NOVEMBER 1, 2023

Assessing Accounting For entities preparing GAAP compliant financial statements, adoption of Revenue Recognition Standard (ASC 606) and Lease Accounting Standard (ASC 842) is now mandatory. The post Strategic Finance Focus at Year-End appeared first on vcfo. Reviewing the asset register and eliminating assets that have been scrapped.

The Charity CFO

JANUARY 22, 2025

Financial Management Moving from basic bookkeeping to GAAP-compliant accounting became necessary as the organization grew. Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances. Get the free guide!

The Charity CFO

MAY 10, 2022

So now is the perfect time to make sure you report in kind gift donations in compliance with GAAP standards in 2022. The changes to in kind donation reporting are specifically for organizations that follow generally accepted accounting principles (GAAP) in preparing their financial statements. Why is FASB making this change?

The Charity CFO

MARCH 13, 2023

The way revenue and expenses are recorded can differ for GAAP purposes and tax purposes ( Form 990 ). For tax, this excess amount is reported as a contribution, and for GAAP, it can be reported as either a contribution or special event revenue. It will not be reported on Form 990. Get the free guide!

Future CFO

APRIL 18, 2022

Finance organizations regularly face the challenges of meeting strict deadlines and satisfying data quality requirements for closing the books and delivering accurate financial statements. It enables finance teams to automate and accelerate the financial close with minimal IT support. DOWNLOAD NOW.

Centage

NOVEMBER 22, 2021

For those dedicated finance professionals working in the nonprofit sector, the myriad of unique industry challenges from managing multiple stakeholders and funding sources, to understanding compliance standards and creating financial processes, add another layer of complexity to the process. It’s all automated and GAAP compliant.

The Charity CFO

JANUARY 21, 2022

Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit. In many cases, though, you’re going to want to have more funds in order to optimize accuracy and transparency in your finances.

The Charity CFO

APRIL 5, 2022

Though both systems use the same numbers, looking at those numbers differently can give you a very different perspective on the state of your finances. Cash accounting does not comply with Generally Accepted Accounting Principles (GAAP) for nonprofit organizations. Is Accrual Accounting a Requirement For You?

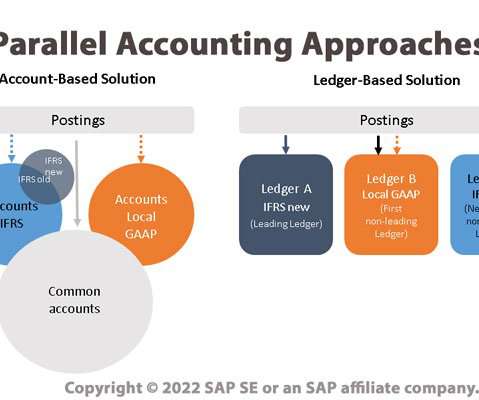

Bramasol

JUNE 10, 2022

For example, a company with branches doing business in the United States and the European Union will need to comply with both GAAP and IFRS accounting principles. The account-based approach uses account logic identifiers to assign accounting principles, such as using unique prefixes to determine which accounts use IFRS vs GAAP principles.

PYMNTS

FEBRUARY 20, 2020

The company said its GAAP net income and GAAP diluted earnings were $1.7 The company also reported non-GAAP total operating revenues of $238.4 million, and EBITDA and non-GAAP diluted earnings per common share of $21.8 Non-GAAP values means those values not generally accepted in the U.S.,

The Charity CFO

JANUARY 17, 2022

You need to get a better grasp of your organization’s finances now. Accrual accounting is required by Generally Accepted Accounting Principles (GAAP), which means that you’ll need accrual-based reports to complete a nonprofit audit. It’s a necessity. Well, you’ve come to the right place! Difference #3: Functional Expenses.

Centage

JANUARY 31, 2022

The cash flow statement is an important tool that shows how your business decisions impact cash and cash equivalents – and breaks the analysis down to operating, investing, and financing activities. The one thing finance executives can count on for 2022 is that the business environment will continue to be dynamic.

PYMNTS

OCTOBER 25, 2019

Top accountancy firms are asking the Financial Accounting Standards Board (FASB) to clarify how corporates should report on supplier finance programs that are in place, according to Compliance Week reports on Friday (Oct. As the letter notes, U.S. “Trade payables classification tends to be treated more favorably than borrowings (i.e.,

CFO Selections

AUGUST 28, 2024

Business executives rely on their Finance Teams to be in front of changes, especially when the impact is big. By proactively preparing for GAAP changes, CFOs can position their business for success. In fact, this is a primary requirement for your accounting and finance personnel. Executive Summary: Changes happen.

Strategic Treasurer

MARCH 6, 2023

Episode 243 Becoming a Treasurer Series, Part 24: Languages of Finance: FP&A As we jump back into the Becoming a Treasurer series, we are launching a new sub-series where we will look at the “language of finance.” What are some of the different ways we look at it in finance, accounting as a view of it?

CFO Talks

SEPTEMBER 5, 2024

It’s essential to engage with various stakeholders—including finance teams, auditors, and even IT professionals—to identify the specific needs that your system must address. A user-friendly interface can significantly reduce the learning curve and increase the system’s adoption rate among your finance team.

The Finance Weekly

MARCH 25, 2024

Anthony Noto Anthony Noto, a famous finance executive and former NFL exec, now wears the CEO and CFO hats at a fintech company named SoFi. Safra Ada Catz Safra Ada Catz, the business leader overseeing ,, Oracle Corporation , a major tech company, handles key aspects like sales, marketing, finance, and legal matters. Ianniello Joseph R.

PYMNTS

SEPTEMBER 7, 2017

According to reports in Nasdaq , Coupa’s non-GAAP losses of 10 cents per share were better than previous analysts’ estimates of 17 cents per share — and significantly better than the $1.83 Total GAAP operating loss stood at $14.4 million, with a non-GAAP loss at $5.7 million and non-GAAP losses of $9.6

The Charity CFO

OCTOBER 9, 2024

individual and corporation connections), history, donor intent, or soft credits Accounting software tracks financial transactions with strict adherence to GAAP Integrating two systems with fundamentally different data priorities can risk data inconsistencies, inaccuracies, and loss of information. Get the free guide!

Bramasol

JULY 26, 2024

Using CLM, global companies are better able to manage lease classification such as sales type leases and operating leases, as well as to meet lessor accounting requirements of US GAAP and other country GAAP requirements, or IFRS mandates. Multiple Regulatory Compliance Mandates: Meeting regulatory requirements (e.g.,

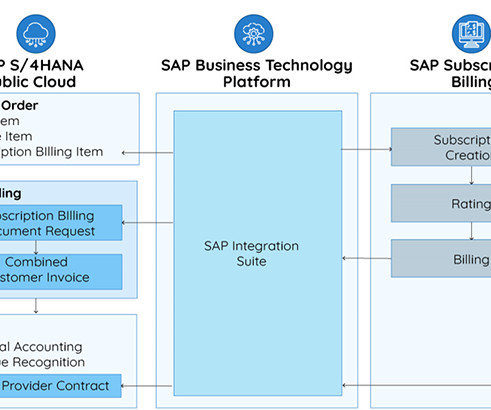

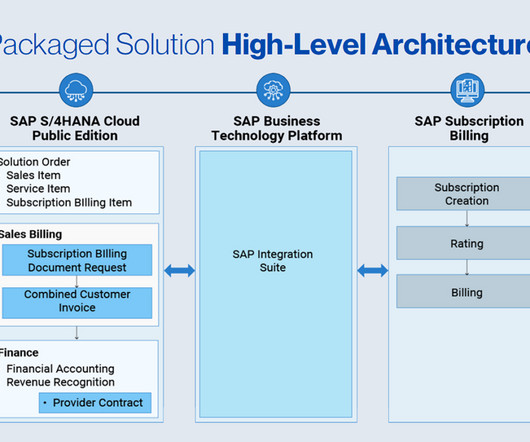

Bramasol

AUGUST 21, 2024

By focusing on only those business processes needed to quickly launch a robust, scalable subscription business, the package includes key end-to-end processes in the areas of Sales, Finance and Procurement, including Invoice-to-Cash, Order-to-Fulfill, Record-to-Report and Procure-to-Receipt.

Centage

AUGUST 15, 2022

Similarly, having too much data can prevent finance and accounting departments from knowing where to focus their energies. GAAP compliant and easy to use, our system eliminates the need for messy spreadsheets, so you don’t have to worry about errors from linking complex formulas and macros.

CFO Leadership

OCTOBER 18, 2023

AI coupled with The Digitization of the Finance Function create powerful levers for today’s CFO. AI in the “Real World” While these powerful tools seem to have a near mastery of natural language communication, they are not necessarily designed to possess many of the skills required by finance and accounting professionals.

The Charity CFO

JANUARY 11, 2023

All these sources must be carefully managed to ensure compliance with Generally Accepted Accounting Principles (GAAP) and guidelines. Understanding how and when to recognize different revenue is perhaps one of the most important but difficult aspects of managing a nonprofit’s finances. Receive grants. Employ paid staff.

Centage

JUNE 12, 2023

As change continues to add uncertainty to businesses across industries, finance leaders are tasked with effectively analyzing, monitoring and predicting the financial performance of their organizations with a new level of granularity. Today, it’s a fast-paced business world. Our winery budgets are quite extensive.

E78 Partners

NOVEMBER 19, 2024

Here are four of the most common audit preparation obstacles and practical ways to overcome them, based on client experience supporting finance teams through efficient and streamlined audits. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

E78 Partners

NOVEMBER 19, 2024

Here are four of the most common audit preparation obstacles and practical ways to overcome them, based on client experience supporting finance teams through efficient and streamlined audits. Ensure that impairment analyses are completed according to audit priorities, with asset groupings and forecast data that align with GAAP standards.

PYMNTS

DECEMBER 16, 2016

In a survey conducted by the Institute of Management Accountants (IMA), and sponsored by Blackline, titled “Process Automation in Accounting and Finance,” examining the attitudes and concerns of 750 financial professionals surrounding accounting and month-end closing processes, manual activities remain prevalent — at the cost of time and money.

Centage

DECEMBER 7, 2022

It’s during times like this where it’s important for finance teams to evaluate their budgeting, planning, and forecasting processes, evolve priorities and implement best practices to ensure they have insight and confidence needed to navigate the year ahead and beyond. Key Priorities & Requirements for Finance in 2023.

VCFO

APRIL 27, 2023

Buckley is a highly accomplished CFO, overseeing finance, operations, IT, and HR in areas such as domestic and international manufacturing and distribution, SaaS, retail, healthcare, nonprofit, and service companies worth from $2M to $25B. Starting in 2008, he went to work in private equity and consulting.

The Charity CFO

JANUARY 19, 2023

In the United States, these Generally Accepted Accounting Principles (or GAAP) are set by the Financial Accounting Standards Board (FASB). First, nonprofits must follow GAAP, the Generally Accepted Accounting Principles. NPOs must adhere to these accounting policies to remain compliant with the law and maintain their tax-exempt status.

Boston Startup CFO

APRIL 3, 2023

However, don't undervalue the significance of comprehending finance for your startup's survival. Familiarity with Generally Accepted Accounting Principles (GAAP) is essential. Additionally, you open yourself up to compliance and audit issues, and you’ll potentially decrease your chances of securing funding and financing.

CFO Thought Leader

MARCH 25, 2025

By offering that openness, he reinforced his belief that finance isnt just about numbers, but about building trust and forging a clear path forward. Robbins embeds dedicated finance professionals alongside revenue-focused teams, helping to fine-tune territory splits, refine pricing, and calibrate product positioning based on real-time data.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content