Key lease accounting trends: Then and now

CFO Dive

SEPTEMBER 16, 2024

Are you a lease accountant navigating 2024? We dive into the trends that have shaped the year, from interest rate volatility to ESG disclosures & the accountant shortage.

CFO Dive

SEPTEMBER 16, 2024

Are you a lease accountant navigating 2024? We dive into the trends that have shaped the year, from interest rate volatility to ESG disclosures & the accountant shortage.

Nerd's Eye View

SEPTEMBER 16, 2024

The business model of many financial advisory firms revolves around serving clients who are able to pay a certain minimum in annual advisory fees, which reflects not only the value that the advisor can provide for the client, but also the amount that the advisor must charge in order to provide the level of deep planning and investment management that higher-net-worth clients expect (while also earning enough profit to make the venture worthwhile).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Barry Ritholtz

SEPTEMBER 18, 2024

At the Money: Can You Have Too Much Money? Brian Portnoy, Shaping Wealth (September 18, 2024) Can money buy you happiness? How much money is too much? Does wealth offer diminishing returns? In this edition of At the Money, I sit down with Brian Portnoy to explore these questions. Full transcript below. ~~~ About this week’s guest: Brian Portnoy is founder and CEO of Shaping Wealth , which helps advisors and their clients to achieve “funded contentment,” and operates as an outsourced Chief Beha

CFO Talks

SEPTEMBER 18, 2024

Cost-Effective Strategies for Maximizing Capital Employed As a CFO, one of the critical tasks is to ensure that capital employed in your business is used efficiently to generate the highest possible returns. Maximizing capital employed doesn’t always require hefty investments; instead, you can use cost-effective strategies to ensure that every rand works hard for the company.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

The Finance Weekly

SEPTEMBER 16, 2024

Sixty-four percent of tech companies pivot towards Artificial Intelligence (AI) to streamline operations. Tech giants like Apple, IBM, Cisco, Dell, and Intel were among the 48 companies that announced a whopping 26,024 job cuts. Over 400 tech companies have made similar announcements, affecting more than 130,000 workers, with January having the highest count of job cuts at 34,107.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO News

SEPTEMBER 15, 2024

Deloitte reported a $67.2 billion global revenue for FY2024, marking a 3.1% increase. With notable growth in Tax & Legal and a strategic FY2025 restructure, the firm targets enhanced integrated solutions and tech-driven transformation.

The Charity CFO

SEPTEMBER 19, 2024

With a focus on the concept of collaborative funding, Tosha is joined today by the Executive Director of Young Futures , Katya Hancock. Young Futures is a 501c(3) organization with a mission to make it easier to grow up in the digital world. The organization focuses on young persons aged 10 -19, where they believe young people should still feel hopeful and optimistic about their futures.

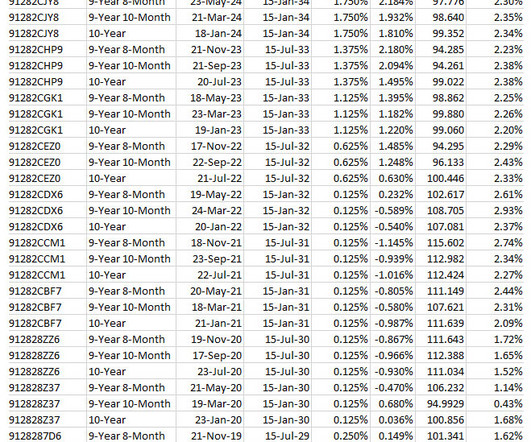

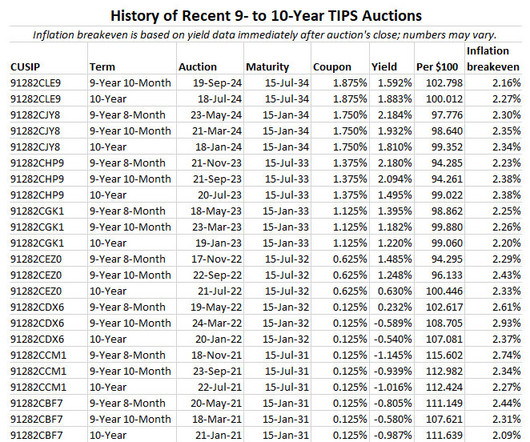

Tips Watch

SEPTEMBER 15, 2024

By David Enna, Tipswatch.com First off, let’s point out that the Federal Reserve has not yet lowered interest rates by a single basis point and, in fact, the federal funds rate has been stable since July 2023.

Global Finance

SEPTEMBER 18, 2024

The valuation of the largest companies in the world fluctuates day to day, even minute by minute, but true success is a marathon, not a sprint. You heard the news: propelled by the AI frenzy, the chipmaker Nvidia passed the $3 trillion market cap and became the most valuable company in the world by market capitalization—for a few days last June, that is.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

CFO Dive

SEPTEMBER 19, 2024

Finance chiefs are “uniquely positioned” to take point on AI’s adoption ahead of its coming strategic impact, Thomson Reuters’ interim head of data and analytics said.

Navigator SAP

SEPTEMBER 20, 2024

The idea is a simple one: an end-to-end backend software solution that is simple enough for startups and fast-growing businesses to roll out quickly and affordably but is modular and flexible enough that the software will continue supporting the business as it grows The less simple part is how to buy SAP S/4HANA Cloud Public Edition.

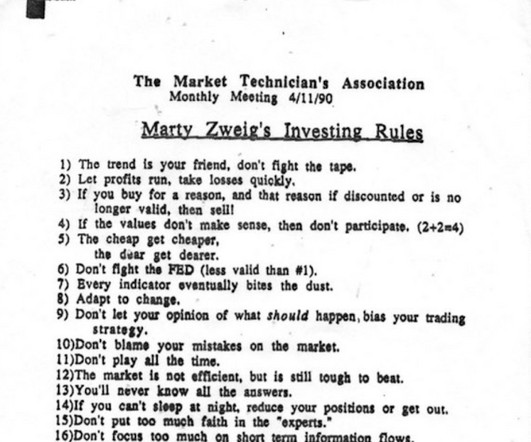

Barry Ritholtz

SEPTEMBER 19, 2024

Marty’s Zweig’s Trading rules 1) The trend is your friend; don’t fight the tape hard return; 2) Let profits run take losses quickly; 3) If you buy for a reason and that reason if discounted or is no longer valid then sell 4) if the values don’t make sense then don’t participate (2 + 2 = 4) 5) The cheap get cheaper the deer get deer; 6) Don’t fight the Fed (less valid than #1); 7) Every indicator eventually bites the dust; 8) Adapt to change; 9) Don’t let your

Musings on Markets

SEPTEMBER 20, 2024

The big story on Wednesday, September 18, was that the Federal Reserve’s open market committee finally got around to “cutting rates”, and doing so by more than expected. This action, much debated and discussed during all of 2024, was greeted as "big" news, and market prognosticators argued that it was a harbinger of market moves, both in interest rates and stock prices.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

CFO Dive

SEPTEMBER 20, 2024

There is a “widening gap” between how executives and employees think about their workplace environments that needs to be taken into account, the report warned.

Tips Watch

SEPTEMBER 19, 2024

By David Enna, Tipswatch.com Too often, the bond market tricks you. It happened again Thursday in the wake of Wednesday’s “sort-of surprise” action by the Federal Reserve to cut short-term interest rates by 50 basis points.

Future CFO

SEPTEMBER 16, 2024

Global full-cycle verification provider Sumsub received full regulatory compliance approval for its non-doc identity verification solution following a regulatory-led audit conducted by FINTRAIL, a global-consultancy specialising in financial crime risk management and regulatory compliance. The company is set to expand its Non-Doc Verification solution into 10 additional markets, including Australia, Canada, Hong Kong, and the UAE.

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets declined slightly in 2023 (perhaps due to many firms seeing their AUM hit the $100 million mark amidst strong market performance and organic grow

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CFO Dive

SEPTEMBER 18, 2024

Heightened pressure to deliver strategy could push CFOs to adopt GenAI faster than previous technologies, Billtrust CEO Sunil Rajasekar said.

CFO Share

SEPTEMBER 18, 2024

The federal reserve will lower interest rates , ending a three-year strategy to stamp out inflation. During that time, I’ve seen startups turn to zombies as they failed to raise VC funding, growth stumble as digital marketing turned upside-down, and small businesses struggle to pass price increases onto customers. I’ve also seen dozens of our clients seize the opportunity a high-interest environment creates to differentiate their products, focus on their core, and deepen their competitive

Barry Ritholtz

SEPTEMBER 19, 2024

Now THAT’S a financial conference! If you are reading this on the 19th, I may be still asleep. I am writing this on my flight home, scheduled to land at midnight Wednesday; I was alcohol-free all week (ok, one Mexican lager Tuesday afternoon at my RWM-crew pool swim after the Animal Spirits Live !), and while I feel pretty good, its been a long week.

Nerd's Eye View

SEPTEMBER 18, 2024

In the nearly 2 years since the launch of ChatGPT, there has been an explosion of new technology solutions incorporating Artificial Intelligence (AI). Today, AI is now almost ubiquitous across many of the tools that we use, from smartphone cameras to search engines to office productivity software. For financial advisors, too, a ballooning number of new advisor-focused AI tools has appeared over the last 24 months, purporting to save advisors' time and staffing needs by automatically performing p

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CFO Dive

SEPTEMBER 16, 2024

The accounting associations are seeking public comment on an alternative route to getting a CPA license that doesn’t require a fifth year of college.

CFO News

SEPTEMBER 18, 2024

BVR Subrahmanyam, CEO of NITI Aayog, envisions a transformative economic future for India, projecting a doubling of the economy by 2030 and highlighting its potential as a global powerhouse.

Barry Ritholtz

SEPTEMBER 20, 2024

This week, we speak with Victor Khosla, Founder and CIO of Strategic Value Partners. Before establishing SVP in 2001, Victor served as President of Cerberus Capital. In the 1990s, he built and managed the distressed credit desk at both Citi and Merrill Lynch, establishing two of the top proprietary trading businesses. SVP has grown 5x in size over the past 10 years, now manages over $18B in AUM with 200 employees.

Nerd's Eye View

SEPTEMBER 17, 2024

Welcome everyone! Welcome to the 403rd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Eric Stein. Eric is a partner at East Bay Investment Solutions, a firm that provides fractional Chief Investment Officer services based in Charleston, South Carolina, that supports over $6 billion in assets under advisement across 26 advisory firms they serve.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content