M&A slump raises bar for seller CFOs

CFO Dive

AUGUST 3, 2023

The mergers and acquisitions boom is long over. The best CFOs are cleaning up their books and arming their CEOs with key data to win offers anyway.

CFO Dive

AUGUST 3, 2023

The mergers and acquisitions boom is long over. The best CFOs are cleaning up their books and arming their CEOs with key data to win offers anyway.

Driven Insights

AUGUST 4, 2023

If you receive accurate, insightful financial and operating reports each month -- without taking time away from where you need to be adding value -- and that information fuels the decisions that drive your business month after month, then there’s no need to read on. However, if you’re like most small business owners (or advisors/investors thereof), real game-changing information is as fleeting as time in the day.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

JULY 30, 2023

To become a value-adding CFO, one needs to adopt integrative thinking, said ACCA recently. CFOs need to change their mode of operation to successfully navigate complex multi-dimensional problems, according to the accountancy body’s latest research. According to ACCA, CFOs have an immense responsibility and career-defining challenge in helping their organisations navigate complex multi-dimensional problems.

CFO Selections

AUGUST 2, 2023

If you’re wondering whether your company needs to switch to a rolling forecast, it’s important to look at why you’re asking. The simple act of questioning whether your current budgeting process is sufficient likely indicates that you have identified a shortcoming in your current budgeting process that provides an opportunity for improvement. Moving to a rolling forecast may offer benefits over your existing methodology, but it’s important to understand the pros and cons associated with using a r

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CFO Dive

JULY 31, 2023

Well-publicized cases of bad behavior have fueled certain biases against private equity. But family-owned businesses shouldn’t ignore the financial lifeline that PE can offer, Bob Goldsmith argues.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Future CFO

AUGUST 1, 2023

The demand for mobile wallets, online banking services, and the increasing adoption of digital technologies has led to the expansion of the financial applications market in Asia/Pacific. The rise in digital transformation (DX) initiatives and the adoption of mobile technologies have also contributed to the demand for cloud-based financial applications in Asia/Pacific.

CFO Dive

JULY 31, 2023

To tackle outdated or redundant tech driving up IT spending costs, CFOs need to work with CIOs to create a “common plan,” LeanIX’s Christian Richter said.

The Finance Weekly

JULY 31, 2023

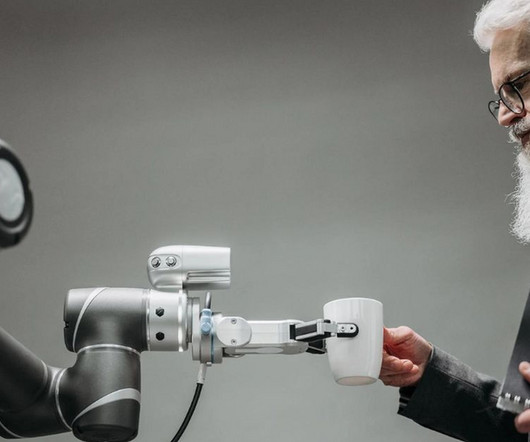

Artificial Intelligence (AI) is gradually revolutionizing various industries, including the field of accounting and finance. With the emergence of , AI tools and Large Language Models (LLMs) like ChatGPT, Google Bard, and BERT, professionals in these fields can benefit from enhanced capabilities and streamlined processes. In a recent webinar sponsored by Datarails , the FP&A solution for Excel users, three distinguished finance leaders came together to discuss the impact of AI on corporate f

CFO News

JULY 31, 2023

After years of logging losses and write-offs, Lendingkart, Indifi, Fibe and a few others are in the black and hoping to stabilise their businesses over the next two years.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Navigator SAP

AUGUST 4, 2023

Cloud-based enterprise resource planning systems (ERP) are becoming the norm among businesses as backend processes are fully moved to the cloud as part of an organization’s digital transformation strategy. Cloud ERP does have its downsides, however, as with all technology. Chief among the disadvantages of cloud-based ERP is limited customization. With cloud-based ERP, as with all cloud services, standard processes replace the customization that often comes with on-premise software.

CFO Dive

AUGUST 4, 2023

As of June 30, approval rates for shareholder proposals focused on environmental and social issues fell compared to all of 2022, Diligent Market Intelligence said.

Accountancy Today

AUGUST 4, 2023

The retail sector accounted for 16% of administrations in the first six months of 2023 – the highest industry in the UK, according to analysis by full-service law firm Shakespeare Martineau. A total of 759 businesses, 118 of which came from the retail sector, filed for administration between 1 January and 30 June 2023, marking a 22% increase compared with 2022.

Barry Ritholtz

AUGUST 3, 2023

Source: Madison Trust The post Who Are the World’s Largest Land Owners? appeared first on The Big Picture.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

CFO News

AUGUST 3, 2023

The order came after NFRA received information from the Ministry of Corporate Affairs regarding irregularities observed by the Financial Reporting Review Board (FRRB) of Indian Institute of Chartered Accountants of India (ICAI).

CFO Dive

AUGUST 4, 2023

The parent of the credit rating giant Moody’s Investors Service tapped its chief accounting officer to step in as interim CFO as it hunts for a permanent finance chief.

Nerd's Eye View

AUGUST 4, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that credit ratings agency Fitch on Tuesday downgraded its assessment of the U.S. government's creditworthiness from an AAA rating to AA+. While the downgrade has made headlines and might be startling to advisory clients (particularly those with significant portfolio allocations to U.S.

Tips Watch

AUGUST 2, 2023

By David Enna, Tipswatch.com We got a surprise announcement yesterday that should surprise no one: Fitch Ratings downgraded the Issuer Default Rating on U.S. debt to ‘AA+’ from ‘AAA,’ with a stable outlook.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CFO News

AUGUST 4, 2023

The Digital Personal Data Protection (DPDP) Bill 2023 has introduced a concept of deemed consent, explicit consent and a right to the data subject to withdraw consent.

CFO Dive

AUGUST 3, 2023

Many accounting firms lacking qualified staff have had to turn away work, according to alliantTalent.

Nerd's Eye View

AUGUST 2, 2023

Adoption, the social and legal process in which an adult is formally made the parent of another individual (typically a child), helps fill a critical need in society: to unite children who need loving families with those who want to raise children. At the same time, adoption can be expensive, with costs that can add up to $70,000 or more. Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the pr

Barry Ritholtz

AUGUST 1, 2023

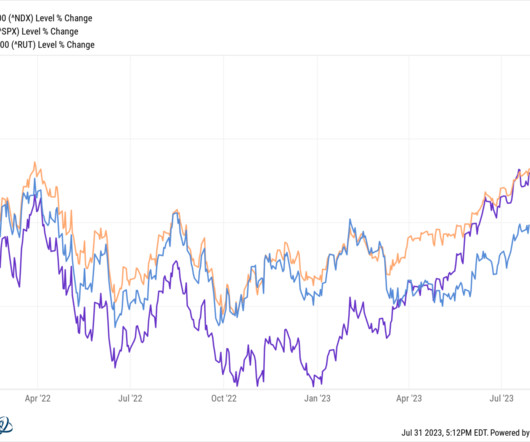

After a monstrous 68% recovery from the March 2020 pandemic low, and another nearly 30% gain in 2021, markets decided to have one of their all-too-regular spasms. Blame whatever you want – Too far, too fast? End of ZIRP? Too rapid rate increases? – but the giveback off the highs was substantial: S&P 500 was down ~23%, Russell 2000 was off 27%, and the Nasdaq 100 came down 32%.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CFO News

AUGUST 3, 2023

Interest rates in the US are at a 22-year high, while the banking sector still remains shaky emerging out of a crisis recently.

CFO Dive

AUGUST 4, 2023

CFOs facing the generative AI learning curve should take a two-pronged approach to its deployment, EY’s Mike Kelly advises.

Future CFO

AUGUST 1, 2023

Editor’s note: Have you ever had any regrets from unrealised dreams? Clodagh Farrell (pictured), Vice President and Chief Financial Officer, Asia Pacific, Middle East and Africa, DXC Technology , once dreamt to become a dress designer, but financial constraints back then drove her to choose business and finance, which eventually opened up a huge world filled with exciting opportunities.

Nerd's Eye View

JULY 31, 2023

Many financial advisors who launch solo advisory firms do so with the intention of adding more employees once the firm becomes big enough to support them. And while conceptually it makes sense that the firm will be ready to hire its first employee at some point, in practice, there often isn't a lot of clarity about the right time to actually make an initial hire.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content