3 Keys to Accelerating Growth with High-Quality Revenue

CFO Alliance

MARCH 28, 2023

The post 3 Keys to Accelerating Growth with High-Quality Revenue appeared first on CFO Alliance.

CFO Alliance

MARCH 28, 2023

The post 3 Keys to Accelerating Growth with High-Quality Revenue appeared first on CFO Alliance.

Barry Ritholtz

MARCH 28, 2023

Just back from California and Arizona, and still digging out. In the meanwhile, check out Nick today : The post All You Need to Know to Build Generational Wealth appeared first on The Big Picture.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

MARCH 29, 2023

CFOs were planning to reduce expenditures before turmoil in the banking system threatened to provoke a credit tightening.

Navigator SAP

MARCH 29, 2023

Once you have your consulting firm set up, the next big task is to find an innovative system that you can use to streamline your operations and enhance your workflows. Today, the popular choice for most consulting firms is an enterprise resource planning (ERP) system. With a specialized ERP solution, you can integrate all your business processes and related data so that departments can operate from a centralized and synchronized location.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

CFO Dive

MARCH 28, 2023

The audit watchdog aims to update and unify interim standards created 20 years ago, aligning its rules with new independence requirements and advances in technology.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

The Reformed Broker

MARCH 27, 2023

This is it. The only chart you need to concern yourself with now if you’re trying to figure out where the economy is heading. Construction and Industrial (C&I) loans are a $2.8 trillion business (approximately) for banks all over the country. If they roll over, we have a soft landing. If they roll over hard, we have a hard landing. It’s not complicated, the only thing that’s up in the air is the tim.

CFO Dive

MARCH 29, 2023

The proposed expense disclosures could be costly for companies. The FASB has been considering the more stringent standards for at least two decades.

Navigator SAP

MARCH 31, 2023

The life sciences is a heavily regulated industry for obvious reasons: the drugs and devices a life sciences firm manufactures or distributes must be consistently safe and reliable for consumers. To ensure that happens, the FDA regulates life science firms according to regulations specified in 21CFR. Part of that regulation is validation of the software used by life sciences businesses.

Fpanda Club

MARCH 27, 2023

FP&A is the sexiest job in finance… While this may seem like an overstatement, FP&A positions are becoming incredibly popular and sought-after. Many finance professionals are starting to feel that they are too focused on historical data, reporting, compliance, etc. Moving into FP&A from other fields of finance, such as accounting and audit, has recently become very trendy.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

MARCH 25, 2023

And if you haven’t subscribed yet, don’t wait. Check it out below or wherever fine podcasts are played. . The post This Week on TRB appeared first on The Reformed Broker.

CFO Dive

MARCH 30, 2023

As AI and automation continue to advance, the digital skills of finance staffs are outstripping those of senior executives — leading to challenges managing and engaging skilled talent.

Navigator SAP

MARCH 31, 2023

It is difficult for a management consulting business to grow and succeed if it’s operating with unreliable data. In this scenario, anyone would have trouble understanding where the business is headed and making important business decisions.

Barry Ritholtz

MARCH 30, 2023

Yesterday I discussed all the reasons why the return to office was not going so well here in the US (even as RTO does much better in Europe). I spent a lot of time criticizing the sorry state of U.S. infrastructure as one of the many factors driving the reluctance to give up WFH. It doesn’t have to be this way. Back in 2018, I mentioned my personal infrastructure was improving.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Global Finance

MARCH 30, 2023

With rising interest rates, out-of-control inflation and declining government support, 2023 marks the return of bankruptcies.

CFO Dive

MARCH 27, 2023

As AI swiftly extends the finance function’s potential for efficiency, audit leaders are concerned about the lack of skilled workers to support new advancements.

Navigator SAP

MARCH 27, 2023

With the growing competition in the business world, companies are constantly under pressure to enhance the quality of their products and services while simultaneously improving their competitiveness. This is why so many companies staff internal research departments or work closely with external Research Organizations to develop new and improved products.

CFA Institute

MARCH 31, 2023

"Neither the Financial Analysts as a whole nor the investment funds as a whole can expect to ‘beat the market,’ because in a significant sense they (or you) are the market.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Barry Ritholtz

MARCH 28, 2023

My Two-for-Tuesday morning train WFH reads: • The Fed’s anti-inflation work is almost done, with an assist from the banking crisis. the economic turmoil created by the collapse of three banks this month and the impairment of a fourth gave it a bit of breathing room in its increasingly unpopular campaign to subdue inflation with a series of sharp interest rate hikes. ( Los Angeles Times ) • Schwab’s $7 Trillion Empire Built on Low Rates Is Showing Cracks : Company faces pressure from bond losses

CFO Dive

MARCH 28, 2023

Despite reports of fewer ransomware-related cyber insurance claims and decelerating premiums in 2022, experts say the threat is still serious and evolving.

Navigator SAP

MARCH 25, 2023

To get and keep clients, a modern and forward-thinking tax consulting firm needs to be proactive. Are you investing in the right technologies that will keep your company relevant? To continue to outperform and stay ahead of the competition, you must provide great customer and employee experience.

Tips Watch

MARCH 29, 2023

You don’t want to miss out on three months of 6.48% interest (or more). By David Enna, Tipswatch.com For years, my constant advice about redeeming I Bonds has been this: “Don’t do it until you really need the money.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

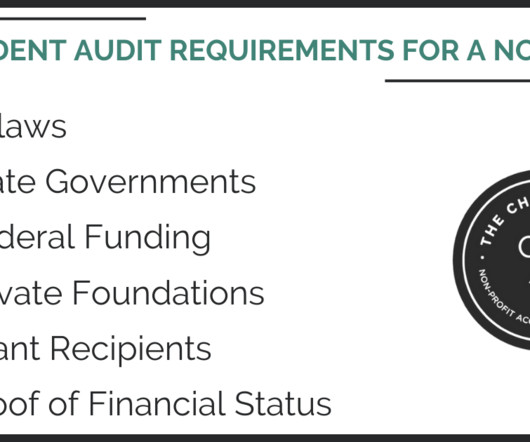

The Charity CFO

MARCH 31, 2023

The word audit can invoke instant fear and dread. Whether it’s an IRS audit, external audit, or even an internal audit, the process can feel burdensome and worrying. However, with the right tools and preparedness, there’s no need to worry. Contrary to popular belief, most audits are not conducted to detect a problem. They are actually useful tools to ensure that an organization is in compliance and can also be used to identify potential problems before they become too big.

CFO Dive

MARCH 31, 2023

Turbulence in the banking system will likely tighten a credit squeeze and worsen a downturn in initial public offerings.

Global Finance

MARCH 30, 2023

Tenaris CFO Alicia Mondolo spoke with Global Finance about the changing role of the CFO.

CFO News

MARCH 30, 2023

Will the elevated retail inflation and the recent action taken by central banks of the developed nations especially the US Federal Reserve will push RBI to increase repo rate or the banking turmoil in US and focus on growth will restrain it?

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Let's personalize your content