As margins tighten, CFOs are split on FinOps: CloudBolt

CFO Dive

JULY 13, 2023

FinOps has gone mainstream as a way to reduce complexity and cost of cloud management. Finance leaders are still waiting to see benefits from implementing the practice.

CFO Dive

JULY 13, 2023

FinOps has gone mainstream as a way to reduce complexity and cost of cloud management. Finance leaders are still waiting to see benefits from implementing the practice.

Jedox Finance

JULY 11, 2023

Jochen Heßler, Senior Director, Product Management, Jedox Environmental, social, and governance (ESG) has emerged as an important initiative for organizations worldwide as they strive to implement sustainable practices, achieve compliance, and demonstrate substantive value to customers, employees, and investors. According to KPMG, 65% of international dealmakers believe ESG is a key consideration when making investments and in merger and acquisition decisions, 1 and EY reports that 99% of invest

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

JULY 9, 2023

AI and analytics will be will be critical to corporate success over the next two years, according to a survey by Gartner. Survey results indicate that strategists believe that, on average, 50% of strategic planning and execution activities could be partially or fully automated though only 15% are currently the case, Gartner pointed out. In addition, 79% of corporate strategists said that technologies such as AI, analytics, and automation will be critical to corporate success over the next 24 mon

Navigator SAP

JULY 12, 2023

Navigator Business Solutions has been named to the Bob Scott’s Top 100 VARs for 2023.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

CFO Dive

JULY 11, 2023

A sudden spike in oil prices poses the biggest threat to U.S. economic growth, Moody’s Analytics Chief Economist Mark Zandi said.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Barry Ritholtz

JULY 8, 2023

The weekend is here! Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • The Physics of Kaizen: Why Somebody Should Get Credit for Fixing Problems That Never Happened : Toyota’s culture of Kaizen: continuous improvement. It is an obvious statement: companies should be continually improving. Companies that are able to successfully adopt a culture and practice of Kaizen have the ability to establish a dominant position in their market. ( Taylor P

Navigator SAP

JULY 14, 2023

Most professional services organizations have completed digital transformation, which is the trendy way of saying that they’ve moved operations to the cloud. Now that most of these businesses are in the cloud, though, the next evolution has arrived: using the advantages of digital transformation to actually drive intelligent decision-making. Forget digital transformation.

CFO Dive

JULY 10, 2023

Business executives worldwide see growing risks from income inequality and shifts in political leadership, McKinsey said.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors whose social media archiving tools do not yet cover the new app.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Barry Ritholtz

JULY 14, 2023

Jim Reid of Deutsche Bank notes the pattern of gradual downgrades before earnings season begins is back to normal. As the rest of the quarterly earnings roll out, we should expect earnings to improve as we roll deeper into earnings season and as “later estimate beats” come in. This quarterly earnings pattern is shown above in the chart from his colleague Binky Chadha.

CFO News

JULY 13, 2023

In order to ensure that companies are mindful of how they are integrating their value chain into the sustainability and ESG policies of their organization SEBI has introduced the BRSR Core Framework for assurance and ESG disclosures for top 1000 companies in a phase-wise manner in the next three financial years.

CFO Dive

JULY 14, 2023

The majoriy of finance departments studied were about as efficient as a “monster truck,” a Hackett Group researcher said. There are steps companies can take to make them run more like Priuses.

Nerd's Eye View

JULY 13, 2023

Establishing successful client relationships as a financial advisor relies on good communication skills not just to present information persuasively and with confidence, but also to establish client rapport that allows meaningful and engaging relationships to be built. For many who are new to the financial planning profession and who have no experience working with clients, participating in client meetings can trigger feelings of anxiety, especially for those who share the common fear of public

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Barry Ritholtz

JULY 13, 2023

The Consumer Price Index was up 3% year over year in June, as reported by BLS yesterday. The FRED chart above shows the near round trip from the prior decade’s range of 0-2% up to the 9% peak, and now back down to 3%. Over the past year, I have been writing a lot about inflation — what people get wrong about it, why the FOMC is always late to the party, and what the various causes of inflation — real, modeled, and imagined — actually are.

CFO News

JULY 12, 2023

Retail inflation accelerated for the first time in five months in June on the back of a jump in vegetable prices.

CFO Dive

JULY 12, 2023

The electric vehicle maker’s new interim CFO, Jonathan Maroko, is replacing Yun Han, who resigned from the top finance role. The company announced it will also be restating certain financial reports.

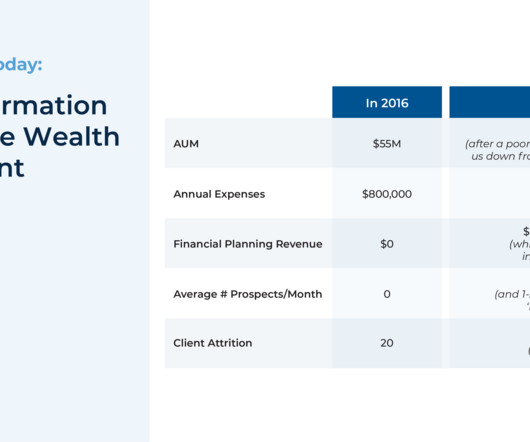

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Sometimes, this succession plan can include the owner's child, providing an opportunity to keep the business in the family. At the same time, the business strategies that worked for the original owner might not be suitable or as successful for their successor, which can force the 2nd-generation owner to take a different path to ensure the firm

Advertisement

Finance teams are balancing more than ever, but manual processes shouldn’t slow you down. In this ebook from BILL, discover how AI is transforming finance—automating AP, expense tracking, and document management to reduce errors, increase efficiency, and improve financial control. Learn how real companies are using AI-powered automation to streamline workflows, detect anomalies, and gain deeper insights.

Future CFO

JULY 9, 2023

Without a doubt, artificial intelligence (AI) is now a topic of interest among CFOs. How to properly channel this interest into the finance function remains to be seen. Gartner says to build an AI-driven finance organisation for the future will require a combination of technical and business skills that many finance teams do not have today. Mark D McDonald , a senior director analyst in the Gartner Finance practice , observes that there remains scepticism over AI's impact on the finance function

CFO News

JULY 11, 2023

The council has recommended to notify the rules for GST appellate tribunal by August 1, 2023 for setting up of tribunal at the earliest.

CFO Dive

JULY 12, 2023

The company and former Amazon executive Tim Stone mutually agreed to scrap plans for him to take over as CFO.

Barry Ritholtz

JULY 13, 2023

My morning train reads: • Stocks Took an 18-Month Round Trip From Tech Bear to AI Bull : The same handful of megacap names that led the market down have been powering the latest surge. ( Businessweek ) • Inflation Cools Sharply in June, Good News for Consumers and the Fed : The Consumer Price Index climbed far more slowly in June, a relief for shoppers and a hopeful — though inconclusive — sign that America might pull off a “soft landing.” ( New York Times ) see also Inflation drops to lowest le

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, emails, and shared drives no longer need to slow you down. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Centage

JULY 11, 2023

While the rest of the world is ensconced in 2023, CFOs are already looking toward next year. Budget season is just around the corner, and being prepared is integral. Planning 2024 budgets takes forethought and considerable prep work. CFOs drive the success of next year’s budgets with the prep work they do today. Why It’s Important to Prep for Budget Season The old adage “if you fail to plan, you plan to fail” is alive and well in the business world.

CFO News

JULY 11, 2023

Finance Minister Nirmala Sitharaman announced the outcome of the 50th Goods and Service Tax (GST) Council meeting on Tuesday. The Council met on 11 July in New Delhi agreed that there should be no distinction between game of skill and game of chance and decided to impose a 28 per cent tax on the turnover of online gaming companies, horse racing and casinos.

CFO Dive

JULY 11, 2023

CFOs can use predictive analytics to avoid panic buying, anchor price bias and overpaying suppliers, Edmund Zagorin, an executive with the procurement platform Arkestro, writes.

Barry Ritholtz

JULY 12, 2023

Source: Reventure Let’s get to the caveats up front: Re:Ventures has been pretty bearish on housing the past few years, even forecasting a crash; their landing page claims “ The US Housing Market is in a record Bubble in 2023 ,” and this post “ 90% Chance: RECESSION in 2022? ” has not panned out and stands inapposite of my views.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Let's personalize your content