Women hang back from CFO aspirations, trickle into finance

CFO Dive

AUGUST 3, 2022

The persisting CFO gender disparity could shrink in the coming years as more women head into the financial field.

CFO Dive

AUGUST 3, 2022

The persisting CFO gender disparity could shrink in the coming years as more women head into the financial field.

Beacon CFO Plus

AUGUST 4, 2022

by Rob Joseph, Director, BeaconCFO Plus. In 2021, according to data from the Bureau of Labor Statistics (BLS), 68.9 million workers left their jobs. 70 percent of those individuals left voluntarily. Why are workers leaving their jobs in droves? The specific reasons will be different depending on industry and role, but Grant Thornton’s State of Work in America cites the top concerns aside from compensation as: The benefits package didn’t fit their needs (roughly ?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Navigator SAP

AUGUST 5, 2022

The pharmaceutical industry has been transformed in recent years by pressure from intensely competitive markets and the need to comply with new regulations that mandate the highest quality standards across all processes. The industry is a complex one and highly regulated as well, as it deals with the safety of people’s lives. It requires not just R&D capability, talent, and strong capital investment over the long term, but also the need for a strong digital infrastructure.

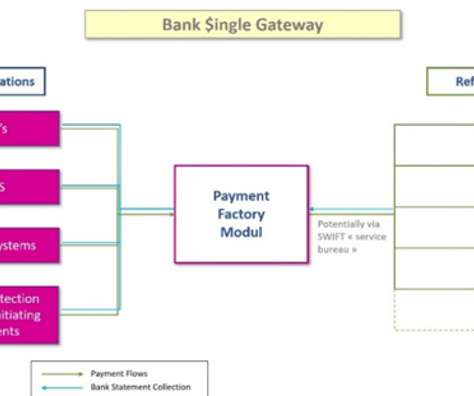

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. A “Bank Single Gateway” is no longer a "plus", but a "must" that every fund servicer or fund should have. It's the key to finally having better cash management, as multinational companies do.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

CFO Dive

AUGUST 5, 2022

Forty percent of CFOs are planning to hike up IT spending in the next 12 months, with many seeking to tap automation to collect key financial insights.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

The Reformed Broker

AUGUST 2, 2022

When you’re the size that Amazon is and you’re looking for growth, the only thing that could really move the needle for you is to attack a massive market opportunity. How does $4 trillion sound? That’s about what Americans spend directly on healthcare each year. Consider this past week’s acquisition as the solidifying piece of the story.

One to One

AUGUST 2, 2022

The post María José Martínez, is named leader in TTR and Datasite’s ranking of female financial advisors. appeared first on ONEtoONE Corporate Finance.

CFO Dive

AUGUST 4, 2022

CFOs are wrestling with how much to spend on office real estate as the shift to hybrid work has accelerated.

CFA Institute

JULY 31, 2022

Just how out of whack are hedge fund fees?

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

Nerd's Eye View

AUGUST 3, 2022

For financial advisors, dealing with issues concerning clients’ children, from education costs to legacy goals, is a common part of the planning process. But a growing number of individuals are going through life without ever having children. And no matter the reason, clients without children have unique planning needs that are important for advisors to recognize.

Anaplan

AUGUST 2, 2022

Re-Live Anaplan Live! 2022 On-Demand One of the most nerve-wracking things any of us encounter in life is going first. As a child – the first to read out loud in class, the first to jump off a diving board, the first to give up your stuffed animals – being first always added an extra […].

CFO Dive

AUGUST 5, 2022

Evidence of loose internal controls related to environmental, social and governance (ESG) data comes as the potential cost of companies getting ESG reporting wrong are rising.

FISPAN

AUGUST 2, 2022

On June 23 & 24, FISPAN’s Business Development Manager, Mara McGoey was found in Chicago at the premier Marcus Evans Open Finance, APIs, & Partnerships two-day conference. Bringing together leaders in Open Banking and Digital Innovation, the event explored opportunities enabled by Open Finance, including how strategic partnerships can accelerate open API initiatives.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

Nerd's Eye View

AUGUST 5, 2022

Enjoy the current installment of “Weekend Reading For Financial Planners” - this week’s edition kicks off with the news that the SEC has issued a new bulletin clarifying the responsibilities of brokers under Regulation Best Interest (Reg BI). The guidance indicates that, despite early fears that Reg BI was ‘overly accommodating’ to the brokerage industry, the Commission is expecting that reducing conflicts of interest should be an ongoing task for broker-dealers rat

https://trustedcfosolutions.com/feed/

AUGUST 5, 2022

With world-class financial management software and tools, subscription automation, and service, Sage Intacct is the number one financial software trusted by leading private equity firms and their portfolio companies to build more profitable businesses. Sage Intacct offers a best-in-class approach to partnering with private equity firms to drive portfolio-wide EBITDA growth by delivering shorter time to value, predictable implementations, consistent pricing, and a single point of contact.

CFO Dive

AUGUST 1, 2022

CFOs globally are asking for added transparency and more consistency as regulatory bodies gear up to publish sustainability reporting standards later this year.

FISPAN

AUGUST 5, 2022

Bring the bank to your Oracle NetSuite environment with FISPAN’s bank-branded embedded app. FISPAN delivers a seamless commercial banking experience, allowing you to directly manage your payables, view all bank account and transaction details, eliminate manual uploads, automate your reconciliation, and more, all from within NetSuite.

Advertisement

Finance teams are balancing more than ever, but manual processes shouldn’t slow you down. In this ebook from BILL, discover how AI is transforming finance—automating AP, expense tracking, and document management to reduce errors, increase efficiency, and improve financial control. Learn how real companies are using AI-powered automation to streamline workflows, detect anomalies, and gain deeper insights.

Nerd's Eye View

AUGUST 2, 2022

Welcome back to the 292nd episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Matthew Topley. Matthew is the Founder and CIO of Lansing Street Advisors, an independent RIA based in Ambler, Pennsylvania that oversees $160 million in assets under management for 60 client households. What’s unique about Matthew, though, is how he differentiates his firm by offering his high-net-worth clients opportunities to diversify their investment portfolios by syndicating pr

CFA Institute

AUGUST 3, 2022

Many pension funds are exploring allocations to cryptoassets. What does that mean for the future of trust in the financial services industry?

CFO Dive

AUGUST 2, 2022

The PayPal CFO's new-hire bonus comes as some companies are using more cash-rich compensation packages to land finance chiefs.

Capital CFO LLC

AUGUST 5, 2022

Are you a business owner or nonprofit Executive Director frustrated with running day-to-day operations and spending additional weekends and evenings attempting to be both bookkeeper and CFO? A part-time or […]. The post Part-Time or Fractional CFO for Small Businesses appeared first on Capital CFO+.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, emails, and shared drives no longer need to slow you down. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Strategic Treasurer

AUGUST 4, 2022

Session 66. Coffee Break Session: What Is Alpha Investing? What is alpha investing? Coffee Break Session Host Jason Campbell catches up with Strategic Treasurer’s Senior Advisor, Paul Galloway, to continue their conversation on the Greeks with alpha investing. They discuss what alpha investing is and how the model is used by companies for investing.

Future CFO

AUGUST 4, 2022

Credit trends in Asia Pacific for most non-financial companies in the rest of 2022 remain stable with the exception of Chinese property developers, said Moody's Investors Service recently. However, slowing economic growth, rising inflation and hawkish monetary policies globally pose risks when it comes to credit trends in Asia Pacific, the firm noted.

CFO Dive

AUGUST 1, 2022

Despite mounting signs of a recession, the labor market remains robust and CFOs should consider digitalizing employee recognition programs to retain talent.

Beacon CFO Plus

AUGUST 4, 2022

by Rob Joseph, Director, BeaconCFO Plus. In the life of any business owner, decisions are around every corner—some will be quick and reactive and others will take more time. Should you hire that person? Are you choosing the right funding sources for your startup? Is that new joint venture with a partner a good idea? From personnel and business structure to strategy, decisions can involve every aspect of your business.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Let's personalize your content