CFO optimism rises on outlook for 2024 economy: Fed

CFO Dive

JANUARY 2, 2024

Financial executives expect solid business performance in 2024, forecasting on average 5% revenue growth and a 2.7% expansion in payrolls.

CFO Dive

JANUARY 2, 2024

Financial executives expect solid business performance in 2024, forecasting on average 5% revenue growth and a 2.7% expansion in payrolls.

Future CFO

JANUARY 3, 2024

With the new year now up and running, finance leaders must be able to keep up with the trends that will dominate the market to be able to plan and strategise ahead. Among such trends are artificial intelligence, talent retention and upskilling , and ESG. Artificial intelligence Finance tools that are boosted by artificial intelligence are being adopted at an exceedingly rapid rate across various sectors.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO News

DECEMBER 31, 2023

Explore the optimistic financial forecast for India in 2024 by seasoned finance expert Robin Banerjee. From increased loan availability to a rising stock market, Banerjee provides insights into the potential economic landscape. However, he cautions against global risks that could impact India's trajectory.

Barry Ritholtz

JANUARY 4, 2024

Source: Visual Capitalist The post 60 Years of Stock Market Cycles appeared first on The Big Picture.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

Tips Watch

DECEMBER 31, 2023

For investors seeking safety and inflation protection, volatility brought strong opportunities. By David Enna, Tipswatch.com All things considered (financially speaking, that is) 2023 was a pretty good year. Maybe even very good. The U.S. inflation rate dropped from 6.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

The Charity CFO

JANUARY 4, 2024

Imagine this: your nonprofit is busier than ever with fundraising events and field work to help make your community a better place. So busy, in fact, it’s time to hire a few new employees. But despite your job postings, you’re not recruiting as many candidates as you hoped. If this sounds like your organization, it might be time to analyze why your recruiting efforts aren’t paying off.

CFO Dive

JANUARY 4, 2024

In a post-AI world, companies must retool their digital transformation approaches from large-scale to piece by piece, and CFOs play a critical role.

Future CFO

JANUARY 3, 2024

The decision to outsource certain functions within the organisation has become a strategic choice for many companies seeking to optimise their operations. In a bid to maximise resources, be it funds or the people themselves, it is a business imperative for finance leaders and chief financial officers to determine whether outsourcing is the right fit for the business.

CFO News

JANUARY 1, 2024

ETCFO explores the vision of India Inc CFOs for 2024 – a journey from financial innovation to societal impact. Dive into their transformative resolutions on upskilling, sustainability, and personal growth. Read what top CFOs have to say.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Navigator SAP

JANUARY 5, 2024

There are many enterprise resource planning solutions (ERP) on the market today. For most businesses, SAP automatically makes the shortlist during the selection process because the company is one of the largest ERP vendors with wide industry adoption and some of the deepest understanding of the ERP space. Nobody ever gets fired for choosing an SAP solution.

CFO Dive

JANUARY 4, 2024

The rise in business failures was one of the darker pieces of last year’s economic puzzle.

Barry Ritholtz

JANUARY 2, 2024

I am popping out of book leave to share this single data point that snuck out over the holidays: The Federal Reserve Bank of Philadelphia’s State Coincident Indicators for November 2023. I like the SCI – its broad, consistent, and does not operate with too big of a lag. Over the past three months, the indexes increased in 25 states, decreased in 21 states, and remained stable in four, for a three-month diffusion index of 8.

CFO News

JANUARY 2, 2024

India's manufacturing sector sustained growth at 54.9 in December, an 18-month low. Despite this dip, softer increases in orders, controlled inflation and stable employment showcase resilience. Optimistic outlook prevails for the future.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Musings on Markets

JANUARY 5, 2024

In January 1993, I was valuing a retail company, and I found myself wondering what a reasonable margin was for a firm operating in the retail business. In pursuit of an answer to that question, I used company-specific data from Value Line, one of the earliest entrants into the investment data business, to compute an industry average. The numbers that I computed opened my eyes to how much perspective on the high, low, and typical values, i.e., the distribution of margins, helped in valuing the co

CFO Dive

JANUARY 3, 2024

To stem a talent shortage, accounting firms need to reach out to potential CPAs well before they select their college majors, according to a CPA association.

Barry Ritholtz

JANUARY 1, 2024

Happy New Year! Kick it off right with our first day of the year reads: • Everything Wall Street Got Wrong in 2023 : Stocks were supposed to slump and bonds rally as the Fed drove the US into a recession. It didn’t play out as strategists expected. ( Bloomberg ) • Crypto Animal Spirits Are Back. What’s Ahead for 2024. Bitcoin backers are looking forward to an ETF and other catalysts that could lift prices in 2024. ( Barron’s ) see also Stocks Beat the Odds This Year.

CFO News

JANUARY 3, 2024

Supriya Lifescience, charts an ambitious path to achieve Rs 1000 crores in revenue by FY27. CFO Krishna Raghunathan outlines robust growth strategies, capital positions, and a keen focus on innovation in this comprehensive update.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Nerd's Eye View

JANUARY 5, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that comment letters submitted regarding the Department of Labor's (DoL) proposed Retirement Security Rule, which is intended to strengthen standards regarding the provision of certain retirement-related advice, reflect the contentious nature of the proposal, with brokerage and insurance industry groups arguing that existing regulations are sufficient to protect investors

CFO Dive

JANUARY 5, 2024

Among the states with lower tax burdens is Arkansas, where corporate income tax rates are dropping to 4.80% this year from 5.30%.

Future CFO

JANUARY 2, 2024

Malaysia Aviation Group ’s (MAG) post-pandemic balance sheet is healthier than before COVID-19. The company reported a post-tax profit of RM1.146 billion for the fourth quarter of 2022, its best-ever quarter performance in the past two decades, according to its group chief financial officer Boo Hui Yee. The cash balance stood at RM4.6 billion at the end of December 2022, and the full-year net loss after interest and tax dropped 79% to RM344 million from RM1.65 billion a year ago.

CFO News

JANUARY 5, 2024

In 2023-24, India's economy anticipates a robust 7.3 per cent growth, driven by thriving sectors, notably construction and manufacturing. However, agriculture's modest 1.8 per cent growth diverges from the trend.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

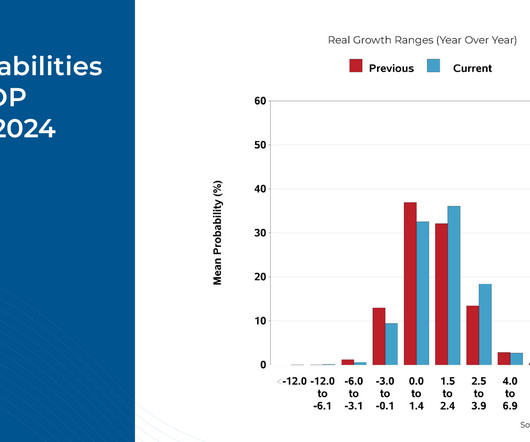

Nerd's Eye View

JANUARY 3, 2024

Niels Bohr famously observed that "Prediction is very difficult, especially if it's about the future!" The sentiment is especially poignant when it comes to economic forecasting, as it's nearly impossible to get an accurate picture of the current state of the economy at any given moment. As a result, uncertainty about how the economy may unfold, even along the shortest time frames, is the default.

CFO Dive

JANUARY 2, 2024

M&A activity could be on the verge of a rebound this year, with artificial intelligence playing a key role, analysts say.

Barry Ritholtz

JANUARY 3, 2024

At The Money: Contrarian Investing. (January 3, 2024) Is contrarian investing a solid strategy, or a fool’s errand? In this episode, I speak with Michael J. Mauboussin. Head of Consilient Research at Counterpoint Global, Morgan Stanley Investment Management We discuss why it is so difficult to fight the crowd, and identify when the crowd is right and when they have gone mad.

CFO News

JANUARY 4, 2024

India's service sector ended 2023 on a resounding high, with the HSBC India Services PMI survey revealing a remarkable rebound in growth, marked by a surge in output and robust new business, buoyed by positive economic conditions and global demand.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content