Perpetual Debt Is Already Here

CFA Institute

SEPTEMBER 8, 2021

The costs and risks associated with debt have shifted from the borrower to the lender.

CFA Institute

SEPTEMBER 8, 2021

The costs and risks associated with debt have shifted from the borrower to the lender.

Planful

SEPTEMBER 6, 2021

In an ideal world, financial reports should build shareholder trust by offering accurate data about the performance of the company. In reality, a company’s financial report can be more flimsy—involving estimates and judgment from leadership that’s far from the truth. Valuations are a classic example of hole-filled financial reporting. History is riddled with companies that […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Driven Insights

SEPTEMBER 7, 2021

Why do startups flop? In 2011, the team at Startup Genome found a common thread. A survey of 3,200 startups showed that, of the companies which crumbled, 70% of them tried to scale too quickly.

Global Finance

SEPTEMBER 7, 2021

Spare a thought for corporate treasurers as they mull where to invest their excess cash.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CFA Institute

SEPTEMBER 10, 2021

How have equal- and market-cap weighted US equity portfolios performed relative to one another during downturns?

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Anaplan

SEPTEMBER 7, 2021

There are many ways to allot your marketing and trade spend, but only a few will lead to reaching revenue goals. Find them using “what-if” scenarios.

BlueLight

SEPTEMBER 10, 2021

There are plenty of blogs that explain what net retention analysis is and the formula to calculate it. This is a good one. In this blog, I’m going to apply that math to a growing startup. You’ll see how a 1% delta in net retention could mean tens of millions in MRR for your startup. Let’s get started. Startup: Alex’s Lemonade SaaS Stand ?? Today is January 2021 Currently at $83K MRR (or $1M ARR) ??

CFA Institute

SEPTEMBER 9, 2021

William Burckart and Steve Lydenberg, CFA, argue persuasively that systemic issues have important implications for future returns.

Planful

SEPTEMBER 10, 2021

Planful Perform 2021 promises to be an unforgettable event for finance and accounting professionals. It will be full of riveting keynotes, innovative product announcements, and tips and tricks from industry experts to give you the confidence to accelerate now. Register now for Perform 2021. It’s free, online, and happening September 14-15. Of course, we couldn’t […].

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Jedox Finance

SEPTEMBER 8, 2021

Jedox is introducing one of the most anticipated new features this year with version 2021.3: Virtual Dimensions. Read more about how you can use Virtual Dimensions in Jedox and how end users can gain faster insights for better decisions.

Global Finance

SEPTEMBER 8, 2021

New technologies demand new kinds of talent and make addressing labor shortages easier.

Future CFO

SEPTEMBER 8, 2021

Hyperautomation and intelligent composable business are the top technology trends that CFOs should immediately address, said Gartner recently. These trends reflect the need for finance leaders to quickly and efficiently adjust to rapidly changing business conditions, said Alejandra Lozada, senior director, research in the Gartner Finance practice. “Hyperautomation stresses the importance of moving away from manual and onerous processes to automated processes which can be more easily adjusted to

Centage

SEPTEMBER 7, 2021

We’ve all been there. You’re reviewing the results with your sales team, and you find that one of the team members is 20% below their sales goal for the quarter – and you want to know why. While you may know what went wrong – “Several orders pushed”, “I lost an important deal”, or “My pipeline wasn’t very strong” – you need to know why.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The SaaS CFO

SEPTEMBER 7, 2021

As SaaS companies scale, there is an important function that must be added to your finance org chart. This function is the financial planning and analysis (FP&A) department. I rose through the ranks of the FP&A in public companies, so I have experienced all shapes and sizes of this critical department. Fundamentally, an FP&A team […].

Global Finance

SEPTEMBER 8, 2021

Six-month lockup periods used to be the strong recommendation from banks that underwrote traditional IPOs; no longer.

Future CFO

SEPTEMBER 7, 2021

The fluctuating pandemic has changed many organisations when it comes to the perception of the finance function—the stronger appreciation for finance professionals and their contributions. At the same time, the finance function also needs to address new challenges rising out of the pandemic. A recent report 'Finance functions: seizing the opportunity' — based on a joint ACCA-PwC survey of more than 3,000 finance professionals globally including around 300 from South East Asia (SEA) discerned bo

Castle Corporate Finance

SEPTEMBER 5, 2021

The South-East Dealmakers awards are a prestigious event for the Corporate Finance industry and after the non-event of 2020, it was lovely to be able to get together and celebrate in person on the evening of the 2 nd September 2021. Hosted at the stunning Epsom Down Racecourse and compered by the legend that is Martin Bayfield, it was a night to remember.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

ION Group

SEPTEMBER 10, 2021

Expanding ION’s XTP offering with real-time margin and risk management and monitoring solutions for both cleared and uncleared OTC derivatives. The post ION acquires Clarus Financial Technology appeared first on ION.

Global Finance

SEPTEMBER 8, 2021

Decentralizing finance can unlock capital in cryptocurrencies, but will it last?

Future CFO

SEPTEMBER 7, 2021

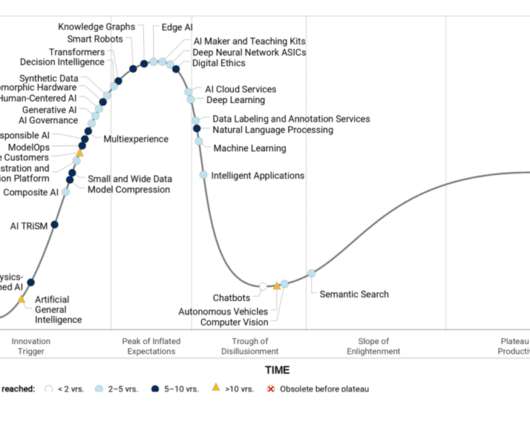

The four trends that are driving near-term AI innovation include responsible AI, small and wide data approaches, operationalisation of AI platforms, and efficient use of data, model and compute resources, said Gartner recently. AI innovation is happening at a rapid pace, with an above-average number of technologies on the Hype Cycle reaching mainstream adoption within two to five years, said Shubhangi Vashisth, senior principal research analyst at Gartner.

Planful

SEPTEMBER 6, 2021

In an ideal world, financial reports should build shareholder trust by offering accurate data about the performance of the company. In reality, a company’s financial report can be more flimsy—involving estimates and judgment from leadership that’s far from the truth. Valuations are a classic example of hole-filled financial reporting. History is riddled with companies that went public based on inflated valuations and false narratives.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Global Finance

SEPTEMBER 7, 2021

If you cannot measure it, you cannot manage it.

Future CFO

SEPTEMBER 5, 2021

Global CEO confidence returns to pre-pandemic levels, said KPMG recently when releasing results of a recent survey of more than 1,300 CEOs of the world’s largest businesses. Survey results indicated that 60% of leaders are confident about the global economy's growth prospects over the next three years, up from 42% in the January/February survey by KPMG.

Future CFO

SEPTEMBER 10, 2021

Asia Pacific covered bond issuers comprise high-quality financial institutions that can support the credit quality of their covered bonds through coronavirus-related economic disruptions, said Moody’s recently. "The strong and stable credit quality of covered bond issuers in Australia, Japan, Korea, New Zealand and Singapore will support the credit quality of covered bonds in these Asia Pacific countries,” said Joe Wong, a Moody's Vice President and Senior Analyst.

Future CFO

SEPTEMBER 5, 2021

Financial reporting specialist and lecturer Adam Deller explains the basic principles of IAS 19 in this short video. The post The fundamentals of IAS 19 appeared first on FutureCFO.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content