WHITE PAPER - Enterprise Payment Optimization

Simply Treasury

JULY 16, 2021

Download the White Paper here

Simply Treasury

JULY 16, 2021

Download the White Paper here

Anaplan

JULY 14, 2021

This is the final blog in our three-part series that explores how intelligent forecasting tools can optimize business outcomes.?Our first blog shared the important role of artificial intelligence (AI), and machine learning (ML) in intelligent forecasting and the challenges that business leaders face around adoption. The second installment detailed the aspects of intelligent planning that […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future CFO

JULY 16, 2021

The AR modules offered by ERP systems are good for many things. But it is what they cannot do that often makes the difference between a top-performing AR department and one that’s just skating by. This Esker ebook explores how AR automation can make your processes run more efficiently that translate into strategic business benefits like: New opportunities due to an improved customer experience.

Planful

JULY 16, 2021

Looking forward has become the trend as CFOs start to solidify office reopening plans and focus more on non-pandemic concerns. Issues like data quality, getting better aligned with Sales, and surprisingly, climate change are taking up more FP&A bandwidth, which underscores the need for Finance to have a deeper understanding of more areas of the […].

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

Simply Treasury

JULY 12, 2021

Although the large IT vendors are necessary to properly serve large MNCs, we must accept that they cannot solve every single problem and that fintech’s may be solutions to problems often faced. There is a bias consisting of over-sizing solutions, perceived as sort of kitchen robots by treasurers and CFOs. The solution can be often found in emerging fintechs, for those who take time to contemplate existing and performing solutions to complete and fulfil their IT panoply of tools.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Future CFO

JULY 16, 2021

Customer service shouldn’t be conditional — if a customer is involved in any capacity, providing an optimal customer experience should be a top priority. Yes, that includes the often-taxing collections processes. Customer service doesn’t stop when companies are dealing with outstanding customer accounts. When it comes to the collections process, companies that remain focused on delivering exceptional service, having honest and consistent communication, and treating every customer with respect —

The CFO Centre

JULY 14, 2021

Life through a lens One of the toughest challenges for owners of SMEs is to be able to stand back, to look at their business through a wide-angle lens and identify what it is they really have. Because quite often, the day-to-day distractions and diversions that inevitably surround the running of a successful business – […]. The post Don’t Call it Your Dream, Call it Your Plan appeared first on CFO Center USA.

CFA Institute

JULY 14, 2021

Financial Analysts Journal managing editor Heidi Raubenheimer, PhD, CFA, provides a synopsis of the latest issue.

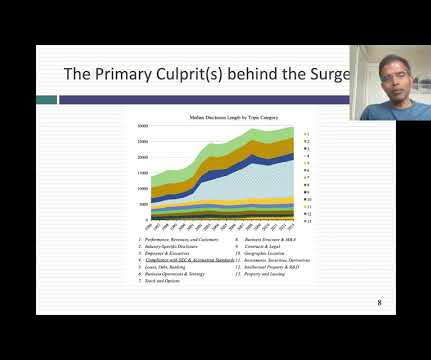

Musings on Markets

JULY 14, 2021

In the last few decades, as disclosure requirements for publicly traded firms have increased, annual reports and regulatory filings have become heftier. Some of this surge can be attributed to companies becoming more complex and geographically diversified, but much of it can be traced to increased disclosure requirements from accounting rule writers and market regulators.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Future CFO

JULY 15, 2021

Scholastic, one of the world’s largest publisher and distributor of children’s books and educational materials with $1.6 billion in annual revenue. Products are distributed through retail and online sales and through schools via reading clubs and fairs. Looking to centralise accounting and achieve global efficiency, the company set up a Shared Services Centre (SSC) in Kuala Lumpur, Malaysia.

Michigan CFO

JULY 13, 2021

It should be a fairly straight-forward answer, right? But if you’re Uber, the answer is seemingly “someday… hopefully”. Uber lost $2.8 Billion in 2016. $2.8 BILLION. And in Q1 of 2017, investors were pleased the company reduced its quarterly loss to $708M from the Q4 2016 loss of $991M. From CNNtech: “To many readers, the loss is nothing short of staggering.

Planful

JULY 13, 2021

A few months ago, I was a guest on the RecruitingLive podcast, which is produced by William Tincup, president of RecruitingDaily. It’s always fun to talk about people operations from a strategic standpoint and to share my insights with the broader HR community. But, even as our discussion segued from workforce modeling to people operations […].

Accountancy Today

JULY 12, 2021

CFOs across the UK are readying themselves for a surge in spending over the coming months, according to Deloitte’s UK CFO Survey Q2 2021. . The move marks a shift away from last year’s top priority of cost reduction, according to the survey, as over three-quarters of CFOs (71%) expect rises in capital expenditure. In addition, 76% anticipate increases in hiring over the year ahead, with expectations for both at their highest levels in almost seven years.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Future CFO

JULY 15, 2021

Building and sustaining a successful enterprise demands a keen understanding of when and how to address potential issues — turning what could be a critical weakness into a value-added strength. As a Pepsi-Cola franchisee with 25 years in the distribution business, LinPepCo had the intuition to make a change in their accounts receivable (AR) collections process.

CFA Institute

JULY 12, 2021

The Index Industry Association (IIA) surveyed 300 asset managers about how they perceive ESG.

Planful

JULY 12, 2021

The larger an organization, the greater the need for better financial planning and analysis (FP&A). You’re dealing with massive amounts of data, and you’re often under intense pressure to provide timely insights. Any delays or mistakes in financial planning could have catastrophic consequences. Many companies today are struggling to meet these expectations in their financial […].

Future CFO

JULY 15, 2021

Today’s business landscape is ever-evolving, tech-driven and increasingly competitive, making it even more important for organizations to become as efficient and agile as possible. But strangely enough, a majority of businesses have yet to realize the strategic value and competitive edge that could be achieved by digitally transforming procure-to-pay (P2P) functions.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Future CFO

JULY 15, 2021

In a time like this, maintaining strong cash flow is of utmost importance for businesses. Unfortunately for many organisations, large amounts of cash are being tied up in inefficient, back-office finance functions, and they are quickly realising that digitising accounts payable (AP) processes is the first step in building a robust continuity plan that frees up that cash and promotes future profitability.

Future CFO

JULY 15, 2021

The cost of failed payments is estimated to have cost the global economy US$118.5 billion in fees, labor and lost business in 2020, said Accuity recently when releasing results of a survey. A failed payment is a payment rejected by a beneficiary bank or an intermediary bank in the payment flow, said the firm, adding that payments can fail for several reasons including inaccurate or incomplete information, data entry issues due to human error or poor reference data and validation tools.

Future CFO

JULY 13, 2021

Ineffective contracting processes on average lead to more than 9% contract value erosion, said KPMG recently when releasing results of a jointly conducted global survey of more than 340 executives by the firm and World Commerce & Contracting (WorldCC) in Q1 of 2021. While almost 90% of organisations have ineffective and fragmented contracting processes, 76% of organisations want to prioritise the digitalisation of contracts, survey results indicate.

Future CFO

JULY 11, 2021

SWIFT recently announced the launch of its new Payment Pre-validation service, saying it’s a core building block in its strategy to drive instant and frictionless transactions worldwide. . Most cross-border payments are processed without issue, but one of the leading causes for those that fail or lose time is incorrect beneficiary information — from misspelled names to transposed account numbers, the cooperative noted.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CFA Institute

JULY 11, 2021

Are low-volatility or high-volatility strategies the better choice when it comes to equity returns?

Future CFO

JULY 15, 2021

The smartphone in your hand, the curated playlist you’re streaming, the electronic payslip you receive every month — Robotic Process Automation (RPA) and Artificial Intelligence (AI) are almost unavoidable in our everyday lives. And soon, the same will be said about the business landscape overall. This short and to-the-point eBook from Esker explores the technology behind digital transformation — RPA and AI.

Future CFO

JULY 15, 2021

Esker Anywhere is a mobile application that gives managers the ability to review, approve, and reject purchase requisitions and supplier invoices while out of the office. It enables purchase requisition approval capabilities in addition to supplier invoice approvals. Esker Anywhere provides on-the-road accessibility for managers who approve invoices and purchase requisitions before payment, enabling them to quickly resolve exceptions and approvals, resulting in excellent supplier relationships a

Future CFO

JULY 15, 2021

CFOs are generally hands-off when it comes to leading the charge for AP and AR automation initiatives. The COVID-19 pandemic, however, raised the critical issue of cashflow from both the buyer and supplier side. As a result, CFOs need to be taking matters into their own hands. In a recent study, Chief Analyst at Kisaco Research , Michael Azoff stated, “I have always found that when C-level executives are behind a technology initiative then it is more likely to succeed.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content