C-suites see record high female CEO, CFOs, rise in black CFOs: Crist|Kolder

CFO Dive

JANUARY 20, 2022

Despite diversity gains, whites and men still hold nearly 90% of CEO, CFO and COO positions, the survey found.

CFO Dive

JANUARY 20, 2022

Despite diversity gains, whites and men still hold nearly 90% of CEO, CFO and COO positions, the survey found.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Generation CFO

JANUARY 17, 2022

Customer requirements are changing. This means you need to change with them – or get left behind. The finance industry is shifting; agility is key and value cases matter. This leaves finance professionals with a question: what is my role? This is an important question to answer, especially in an industry that is constantly adapting and growing with new technology.

Private Funds CFO

JANUARY 20, 2022

Document requests suggests SEC sees climate, ethical risks essential to fiduciary duty.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CFO Dive

JANUARY 21, 2022

Advances in technology, the rise of the cloud and COVID-19 have made financial planning and analysis a must-have function for companies' ability to act effectively in the face of change.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Generation CFO

JANUARY 21, 2022

“I like simplicity and creating winning teams,” says Bulent Semovski, Financial Director at consulting sustainable engineering group, Ramboll. “There’s a lot of complexity in finance systems but sometimes, it’s about focusing on simple solutions. Often it’s a question of trial and error with a twist without overcomplicating things.” . Bulent, who first started his finance career sixteen years ago as an auditor at Deloitte, believes simplicity is the key to overcoming issues and challenges within

Private Funds CFO

JANUARY 20, 2022

Regulators probe private funds’ ESG policies.

CFO Dive

JANUARY 18, 2022

A tight labor market has strengthened workers’ clout, compelling corporate leaders to increase pay and benefits or risk underperformance, according to BlackRock CEO Larry Fink.

CFA Institute

JANUARY 21, 2022

What effect has passive investing, including ETFs and index-tracking mutual funds, had on the US stock market?

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Generation CFO

JANUARY 17, 2022

Customer requirements are changing. This means you need to change with them – or get left behind. The finance industry is shifting; agility is key and value cases matter. This leaves finance professionals with a question: what is my role? This is an important question to answer, especially in an industry that is constantly adapting and growing with new technology.

Private Funds CFO

JANUARY 18, 2022

Business development is proving to be a key role as market activity heats up.

CFO Dive

JANUARY 19, 2022

Customers want a choice in payment plans, term lengths and discount options, among other findings from a survey of 2,000 recurring-revenue companies.

Centage

JANUARY 18, 2022

While spreadsheets have long reigned supreme as the foundation of budgeting and forecasting for many organizations, the shortcomings of this legacy, siloed tool have become too hard to ignore. Relying on archaic spreadsheets to guide complex business models automatically puts your organization at a disadvantage – sacrificing time and accuracy while stunting strategic decision making.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

CFA Institute

JANUARY 21, 2022

This book provides 10 invaluable lessons that investors can use to pick tech stocks in years to come.

Private Funds CFO

JANUARY 18, 2022

Q&A: Pam Hendrickson on the AIC’s top priorities.

CFO Dive

JANUARY 21, 2022

More work needs to be done to assure a seamless transition "when the switch is actually thrown in the middle of next year," Deloitte's Alexey Surkov said.

Anaplan

JANUARY 16, 2022

Effective demand planning can improve the accuracy of revenue forecasts, align inventory levels with peaks and troughs in demand, and enhance profitability for a particular channel or product.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

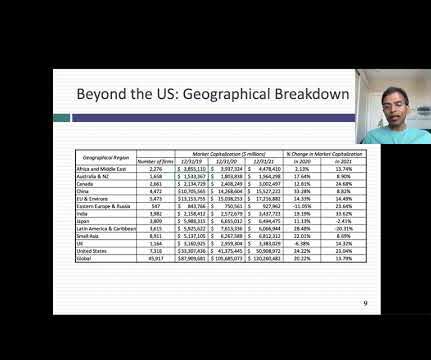

Musings on Markets

JANUARY 19, 2022

Leading into 2021, the big questions facing investors were about how quickly economies would recover from COVID, with the assumption that the virus would fade during the year, and the pressures that the resulting growth would put on inflation. In a post at the start of 2021 , I argued that while stocks entered the year at elevated levels, especially on historic metrics (such as PE ratios), they were priced to deliver reasonable returns, relative to very low risk free rates (with the treasury bon

Private Funds CFO

JANUARY 20, 2022

Survey: Most LPs don’t ask for or can’t get ESG data they need; update to tech-based service providers directory.

CFO Dive

JANUARY 21, 2022

Companies are in “savings mode” and well prepared for both M&A and riding out turbulence in financial markets, Moody’s said.

The Charity CFO

JANUARY 21, 2022

Nonprofits often receive donations or grants designated for a specific purpose–like a donation to a specific program or grant you have to spend within a calendar year. EXAMPLE: If you receive a donation that’s explicitly for purchasing computers for an afterschool program, you can’t use that money to buy office chairs. We call revenue from these sources restricted funds because you’re not free to use them however you please. .

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

The CFO Centre

JANUARY 19, 2022

Funding growing businesses is one of the major challenges any entrepreneur and business owner will face, and while there is an increasingly vast array of options available, figuring out how to access these funds can be a very time consuming, frustrating experience, even for the most seasoned business owner. Whether you need working capital to […].

Private Funds CFO

JANUARY 19, 2022

A survey by Bain & Company and ILPA showed that an overwhelming majority of LPs would walk away from opportunities that raised ESG concerns.

CFO Dive

JANUARY 18, 2022

The kind of technology that got businesses through COVID-19 won’t be the kind that gets them through the permanently reshaped landscape in which they must operate, a global business specialist says.

Future CFO

JANUARY 18, 2022

Standards of corporate integrity have stayed the same or worsened over the last 18 months, said EY recently. According to the 2022 EY Global Integrity Report, more than half (55%) of employees and leaders from companies around the world believe that standards of corporate integrity have stayed the same or worsened over the last 18 months. The survey, which canvassed the views of more than 4,700 employees, managers and board directors from 54 countries and territories, found that leaders are stru

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content