AI dominates CFOs’ 2024 budget hike plans

CFO Dive

FEBRUARY 13, 2024

The vast majority (90%) of finance leaders are projecting higher AI budgets in the coming year, with none planning a reduction, Gartner found.

CFO Dive

FEBRUARY 13, 2024

The vast majority (90%) of finance leaders are projecting higher AI budgets in the coming year, with none planning a reduction, Gartner found.

Future CFO

FEBRUARY 6, 2024

In recent years, the role of chief financial officer (CFO) has never been more challenging as it is fulfilling for those who hold this position. From geopolitical uncertainties to changing market dynamics, from technological innovations that are paving the way for new business models, and from calamitous weather disturbances that are reminding business leaders about the importance of addressing climate change today for a sustainable future tomorrow, the CFO has an important seat in directing the

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Corporate Finance

FEBRUARY 28, 2024

In 2014, Apple was rumored to have approved Project Titan, Apple's development of an electric car. In 2015, Apple formally introduced the new project. At its height in 2018, Project Titan employed 5,000 people. Now, nearly a decade later after it started, Apple announced that it is shutting down Project Titan, the option to abandon. With shrinking demand for electric cars, Apple must have believed that spending more money on the new car isn't worth the payoff, even though Apple has probably alre

CFO News

FEBRUARY 8, 2024

RBI has defended its action against Paytm Payments Banks and the countdown has begun. But why did Paytm payments Bank board members keep quiet? What if RBI would have invited a board and chosen a different path? Here is my note.

Speaker: Frank Taliano

Document-heavy workflows slow down productivity, bury institutional knowledge, and drain resources. But with the right AI implementation, these inefficiencies become opportunities for transformation. So how do you identify where to start and how to succeed? Learn how to develop a clear, practical roadmap for leveraging AI to streamline processes, automate knowledge work, and unlock real operational gains.

CFO Dive

FEBRUARY 1, 2024

Finance chiefs need to be sure they are opening communication channels between other executive leaders to tell ‘the right digital transformation story.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Musings on Markets

FEBRUARY 8, 2024

I was planning to finish my last two data updates for 2024, but decided to take a break and look at the seven stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla) which carried the market in 2023. While I will use the "Magnificent Seven" moniker attached by these companies by investors and the media, my preference would have been to call them the Seven Samurai.

Barry Ritholtz

FEBRUARY 22, 2024

A quick note to answer this question: What happens after markets make a new all-time high (after a year w/o one)? Check out the table above, via Warren Pies. He spoke with Batnick and Josh earlier this month. Going back to 1954, markets are always higher one year later – the only exception was 2007. That was after housing had peaked, subprime mortgages were defaulting, and the great financial crisis was about to start.

Corporate Finance

FEBRUARY 11, 2024

Normal 0 false false false EN-US X-NONE X-NONE Banks stocks are generally affected by interest rates and New York Community Bancorp (NYCB) is no different. NYCB has a large amount of loans tied to New York City apartments and commercial real estate. With high interest rates, New York City rent control policies, and changing demand for commercial real estate in New York City, investors are concerned about the bank's future performance.

CFO News

FEBRUARY 27, 2024

IndusInd International Holdings had submitted its plan in June 2023 in the second round of bidding for the debt-laden company that was originally promoted by Anil Ambani.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

CFO Dive

FEBRUARY 9, 2024

More than one out of three top executives believe the economic outlook will brighten during the next six months, according to a Conference Board and Business Council survey.

Navigator SAP

FEBRUARY 16, 2024

Lean manufacturing requires strong process control and organization. Whether making industrial product solutions or consumer goods, manufacturers benefit from master records that track batch production and the key elements required for the process. One manufacturing resource planning method that is critical for this organization is the batch manufacturing record.

Fpanda Club

FEBRUARY 5, 2024

Finance business partnering is not a new concept and has been around for a while. Well, not just for a while, for more than 60 years. “ The success …depends on the extent to which finance men are capable of looking outside finance and playing an active, rather than a passive, role in the business. ” — S. R. Harding, F.C.A., (Royal Dutch/Shell Group), 1963.

Barry Ritholtz

FEBRUARY 29, 2024

A century of tech adoption in 30 seconds click for animation Source: Blackrock The post U.S. Technology Adoption, 1900-2021 appeared first on The Big Picture.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Tips Watch

FEBRUARY 4, 2024

By David Enna, Tipswatch.com U.S.

CFO News

FEBRUARY 7, 2024

The RBI maintains another pause and keeps the rates unchanged at 6.5 per cent in the monetary policy which began on February 6 and concluded on February 8.

CFO Dive

FEBRUARY 13, 2024

Futures traders now see a 52% probability that policymakers in June will cut the federal funds rate from its current peak level between 5.25% and 5.5%.

Navigator SAP

FEBRUARY 2, 2024

Some startups grow over time. Others move fast and chase the unicorn status of a $1 billion valuation like sustainable shoe manufacturer, Rothy’s. For slow-growth businesses, there are many options for backend IT systems. But for fast-growing companies that are growth-focused, there really is only one path: cloud-based ERP. Enterprise resource planning solutions (ERP) are the backbone of most businesses today, and for obvious reasons.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

CFO Thought Leader

FEBRUARY 27, 2024

Looking back at his 26 years at Intel Corp., Jeff Woolard has more than a few moments of important discernment from which to choose when we ask for a single finance strategic moment. Nevertheless, without hesitation, he takes us back in time to when the giant chipmaker was experiencing a recurring mismatch between the products that it was developing and the market’s purchasing trends—specifically in the PC sector. “If you were to map both what people wanted to buy and what we were bu

Barry Ritholtz

FEBRUARY 15, 2024

Last month, I mentioned that CPI inflation measures were based on lagging BLS measures of Owners’ Equivalent Rent (OER). BLS highlighted housing prices, headlining the CPI report as “CPI for all items rose 0.3% in January; shelter up ” As the chart above shows, Shelter was 2/3rds of the increase in the most recent. ( Chart thanks to Michael McDonough ).

Tips Watch

FEBRUARY 26, 2024

By David Enna, Tipswatch.com Earlier this year, I think most I Bond investors were assuming that the I Bond’s next fixed rate would end up being lower than the current 1.30%, the highest fixed rate since November 2006.

CFO News

FEBRUARY 25, 2024

The decision to extend the scheme comes after the Union Cabinet approved an additional allocation of Rs 2,500 crore in December, ensuring the continuation of the interest equalisation subsidy scheme on pre- and post-shipment rupee export credit until the end of June.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CFO Dive

FEBRUARY 16, 2024

Corporate directors and investors differ when identifying the biggest issues this year, with directors focusing more on the economy and capital allocation, EY said.

Navigator SAP

FEBRUARY 26, 2024

Few areas impact a manufacturer more than efficient production planning, and few tools are better for production planning than an enterprise resource planning solution (ERP). Manufacturers that use an ERP for industrial manufacturing can precisely analyze and juggle the variables that go into efficient production planning, and ERP for industrial product manufacturing is a cornerstone technology for a lean manufacturing methodology.

Future CFO

FEBRUARY 7, 2024

The year 2024 brings a landscape of unprecedented challenges and opportunities for corporate treasurers. From the ongoing global conflicts to the lingering effects of high inflation, corporate finance professionals are gearing up to navigate an environment marked by volatility and uncertainty. Delving into the key trends shaping the treasury landscape in 2024, the focus is on themes such as staffing challenges, macroeconomic risks, technology adoption, and strategic financial management.

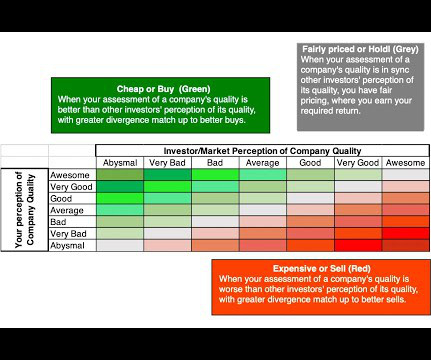

Barry Ritholtz

FEBRUARY 7, 2024

At the Money: Stock Picking vs. Value Investing with Jeremy Schwartz, Wisdom Tree. (February 7, 2024) How much you pay for stocks really matters. Should value investing be part of that strategy? To find out more, I speak with Jeremy Schwartz, Global Chief Investment Officer of WisdomTree, leading the firm’s investment strategy team in the construction of equity Indexes, quantitative active strategies and multi-asset Model Portfolios.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Let's personalize your content