Most CEOs expect full return-to-office in 3 years: KPMG

CFO Dive

SEPTEMBER 20, 2024

There is a “widening gap” between how executives and employees think about their workplace environments that needs to be taken into account, the report warned.

CFO Dive

SEPTEMBER 20, 2024

There is a “widening gap” between how executives and employees think about their workplace environments that needs to be taken into account, the report warned.

Navigator SAP

SEPTEMBER 13, 2024

When consumer products companies are asked about their most important priority for reducing risk, supply chain fragility is mentioned first. A recent poll conducted by SAP found that fully 47 percent of consumer products executives surveyed indicated that strengthening their supply chain against fragility was a top priority. With barriers rising from geopolitical instability, and globalization in retreat, the consumer products supply chain has never looked more tenuous.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Tips Watch

SEPTEMBER 1, 2024

By David Enna, Tipswatch.com If you’ve been overpaying estimated taxes all through 2024 with the intention of purchasing paper U.S. Series I Savings Bonds in 2025 … it’s time for a new plan.

Barry Ritholtz

SEPTEMBER 19, 2024

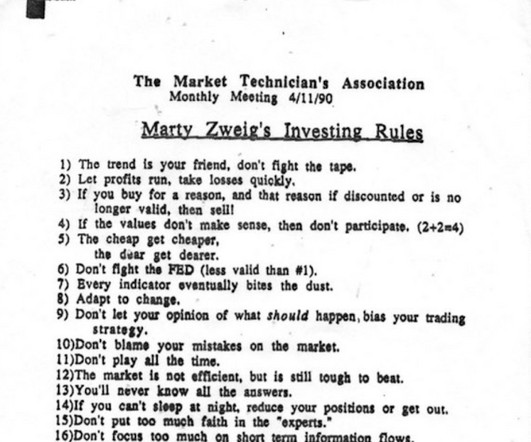

Marty’s Zweig’s Trading rules 1) The trend is your friend; don’t fight the tape hard return; 2) Let profits run take losses quickly; 3) If you buy for a reason and that reason if discounted or is no longer valid then sell 4) if the values don’t make sense then don’t participate (2 + 2 = 4) 5) The cheap get cheaper the deer get deer; 6) Don’t fight the Fed (less valid than #1); 7) Every indicator eventually bites the dust; 8) Adapt to change; 9) Don’t let your

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Future CFO

SEPTEMBER 5, 2024

Finance leaders are wedged into a position of not only overseeing the implementation of financial controls and risk management strategies to safeguard their organisations throughout the transformation journey, but also in spearheading the company to find and implement initiatives to drive value. Chief financial officers indeed play a pivotal role in the company’s digital transformation as they are in charge of aligning financial goals with technological advancements, but as the Finance function

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

Nerd's Eye View

SEPTEMBER 23, 2024

Starting a new firm can be a nerve-wracking time for an entrepreneurially minded financial advisor, as making the jump involves a significant amount of professional and financial risk. Nonetheless, after a year or 2 in business, some firm owners will find that their plate is becoming full and their available time is shrinking as they balance servicing current clients with marketing for new ones and also possibly managing staff.

Navigator SAP

SEPTEMBER 20, 2024

The idea is a simple one: an end-to-end backend software solution that is simple enough for startups and fast-growing businesses to roll out quickly and affordably but is modular and flexible enough that the software will continue supporting the business as it grows The less simple part is how to buy SAP S/4HANA Cloud Public Edition.

Global Finance

SEPTEMBER 4, 2024

Call it “the CFO shuffle.” Top finance leaders are shifting from one company or position to another—or opting for retirement—at a faster rate. That’s according to the latest data from Russell Reynolds Associates, which specializes in executive searches. This year saw increased levels of turnover, with the proportion of outgoing finance chiefs reaching 8.9% globally from January to June.

Musings on Markets

SEPTEMBER 20, 2024

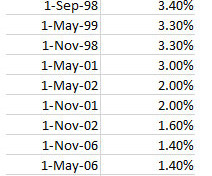

The big story on Wednesday, September 18, was that the Federal Reserve’s open market committee finally got around to “cutting rates”, and doing so by more than expected. This action, much debated and discussed during all of 2024, was greeted as "big" news, and market prognosticators argued that it was a harbinger of market moves, both in interest rates and stock prices.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

CFO Dive

SEPTEMBER 19, 2024

Finance chiefs are “uniquely positioned” to take point on AI’s adoption ahead of its coming strategic impact, Thomson Reuters’ interim head of data and analytics said.

Barry Ritholtz

SEPTEMBER 26, 2024

In celebration of Abbey Road being released 55 years ago today (September 26, 1969), here is a short, Beatles-related excerpt from my upcoming book: “ How Not To Invest: The ideas, numbers, and behaviors that destroy wealth – and how to avoid them.” The book is being published ~March 18, 2025, and is available for pre-ording today.

Future CFO

SEPTEMBER 2, 2024

The convergence of AI and ERP offers the potential to overcome traditional barriers to efficiency and accuracy in financial management, enabling Asian companies to compete more effectively on a global scale. AI-powered ERP systems can help address regional challenges such as complex regulatory environments, diverse currencies, and rapidly changing market conditions by providing more agile and responsive financial tools.

Navigator SAP

SEPTEMBER 27, 2024

A new ERP solution can dramatically upgrade a business with added visibility, automation, and more efficient operational processes among many other benefits. However, when buying ERP software, some essential implementation questions should be asked before purchase.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Global Finance

SEPTEMBER 3, 2024

Bankruptcy filings are piling up all over the world now that government emergency supports linked to the Covid-19 pandemic have diminished. In the US, the world’s largest economy, more corporations went under in the first half of 2024 than in any comparable period since 2010. In total, 346 companies filed for Chapter 11 bankruptcy, according to Standard & Poor’s Global Market Intelligence.

Musings on Markets

SEPTEMBER 9, 2024

A few weeks ago, I posted on the corporate life cycle , the subject of my latest book. I argued that the corporate life cycle can explain what happens to companies as they age, and why they have to adapt to aging with their actions and choices. In parallel, I also noted that investors have to change the way they value and price companies, to reflect where they are in the life cycle, and how different investment philosophies lead you to concentrated picks in different phases of the life cycle.

CFO Dive

SEPTEMBER 10, 2024

Inflation persisted last month as the top concern among small businesses, the National Federation of Independent Business said.

Barry Ritholtz

SEPTEMBER 27, 2024

This week, we speak with Kyla Scanlon , creator, host of YouTube’s,“Let’s Appreciate” podcast , writer of daily short-form videos about economy + markets. She has been published at Bloomberg, New York Magazine, FT, and the NYT. Her new book “ In This Economy?: How Money & Markets Really Work ” just came out this Summer. We discuss how she came up with the idea of a “ Vibecession ” and how it became a popular New York Times guest essay.

Advertiser: GEP

2025 will feel familiar, in some regards. The procurement and supply chain category management landscape will remain turbulent, with geopolitical tensions, worries over fresh tariffs, rising costs, and supply chain disruptions posing significant challenges. But you should also expect some lightning-fast changes in 2025 as artificial intelligence continues to upend the way enterprises and procurement, supply chain, and category management professionals operate.

CFO Talks

SEPTEMBER 30, 2024

Why IAS 38 is Hindering South Africa’s Growth: A Call for Change In an era where innovation, intellectual property (IP), and intangible assets drive economic success, South Africa finds itself at a critical crossroads. Our financial statements reveal a stark reality—South Africa has one of the lowest representations of intangible assets compared to other countries.

Navigator SAP

SEPTEMBER 12, 2024

SAP Business ByDesign is a robust ERP solution built as a Suite-in-aBox solution, that can handle your core business operations. As businesses change and grow, you may need additional functionality and integrations with partners, clients, or third-party software. Expand your capabilities by integrating with specialized industry solutions.

Global Finance

SEPTEMBER 5, 2024

Canadian convenience store giant Alimentation Couche-Tard (ACT) has set its sights on Seven & i wHoldings, the Tokyo-based parent company of 7-Eleven. If the deal goes through—ACT submitted an offer to buy all outstanding shares of Seven & i last month—it will mark a significant step into Japan’s retail market by a foreign firm, but it wouldn’t be ACT’s first show of interest in the company or Japan.

Nerd's Eye View

SEPTEMBER 25, 2024

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. However, with the national debt expanding rapidly, observers of U.S. tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

CFO Dive

SEPTEMBER 26, 2024

Amid a high-profile backlash, many businesses are scrutinizing their policies. But the vast majority end up sticking with DEI, in part because it’s key to growth.

Barry Ritholtz

SEPTEMBER 18, 2024

At the Money: Can You Have Too Much Money? Brian Portnoy, Shaping Wealth (September 18, 2024) Can money buy you happiness? How much money is too much? Does wealth offer diminishing returns? In this edition of At the Money, I sit down with Brian Portnoy to explore these questions. Full transcript below. ~~~ About this week’s guest: Brian Portnoy is founder and CEO of Shaping Wealth , which helps advisors and their clients to achieve “funded contentment,” and operates as an outsourced Chief Beha

CFO Talks

SEPTEMBER 28, 2024

Translating Financial Performance into Tangible Results: A CFO’s Guide In the dynamic world of finance, one of the greatest challenges for CFOs is translating financial performance into tangible results. It’s not just about numbers on a spreadsheet; it’s about making those numbers work in the real world, driving business growth, and making a measurable impact.

Navigator SAP

SEPTEMBER 6, 2024

Being a consumer products company is not easy today. From changing consumer patterns to market uncertainty and volatility, brands are rethinking how to continue revenue growth and add efficiency. For many brands, ERP for the consumer products industry is the path forward.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Let's personalize your content