CFOs to boost IT, tech budgets in face of inflation: Gartner

CFO Dive

AUGUST 5, 2022

Forty percent of CFOs are planning to hike up IT spending in the next 12 months, with many seeking to tap automation to collect key financial insights.

CFO Dive

AUGUST 5, 2022

Forty percent of CFOs are planning to hike up IT spending in the next 12 months, with many seeking to tap automation to collect key financial insights.

The Reformed Broker

AUGUST 29, 2022

Is this chart going up or down? It’s not a trick question. Just look at it and tell me what primary the trend is. You’d be amazed at how many financial advisors, insurance brokers acting as financial advisors, financial planners, wirehouse wealth managers, financial consultants and other assorted intermediaries in this business could not for the life of them look at this chart and give you a straight answer.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Barry Ritholtz

AUGUST 26, 2022

I had a fascinating conversation with an old friend who has been working in a giant bulge bracket firm his entire multi-decade career. What made this particular conversation so intriguing was his sudden epiphany about the Sell-side. Our previous discussions (debates really) were over the traditional model of brokerage I push back against versus the fee-based fiduciary asset management I embrace.

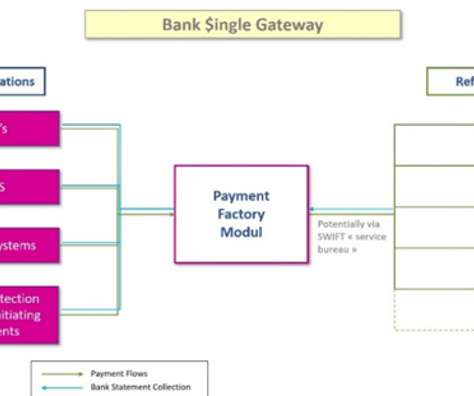

Simply Treasury

AUGUST 3, 2022

Automated bank connectivity through a single secure channel has become essential to reduce costs, facilitate on-boarding by banks, secure transactions, speed up and automate reconciliations and reduce staff workload. A “Bank Single Gateway” is no longer a "plus", but a "must" that every fund servicer or fund should have. It's the key to finally having better cash management, as multinational companies do.

Speaker: Claire Grosjean

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Navigator SAP

AUGUST 12, 2022

Small business cloud ERP may seem like a recent trend, but that’s not really the case. Enterprise resource planning software, with its ability to manage production, planning, purchasing, accounting, manufacturing, sales, distribution, customer service, and every other aspect of business, used to be a privilege reserved only for big corporations. After all, the word “enterprise” doesn’t exactly connote a mom-and-pop operation.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO Dive

AUGUST 3, 2022

The persisting CFO gender disparity could shrink in the coming years as more women head into the financial field.

The Reformed Broker

AUGUST 8, 2022

Why did the stock market bounce this summer? Everyone has their explanation: The Fed might pivot! Inflation readings have now peaked! Oil prices are down 25%! China is ending the lockdowns! The labor market is staying strong! Earnings are still coming in better than expected! All true. But there’s an even better reason that doesn’t invalidate any of the ones I’ve posted above.

Barry Ritholtz

AUGUST 30, 2022

Source: AgWeb. If you are interested (as I am) in Real Estate , then allow me to suggest you consider exploring the world of Farmland. It is something I have done for a while, and it is a fascinating rabbit hole to fall into. Not so much as an investor, but as someone interested in how agriculture works (but yes, there is an investor angle here as well).

Corporate Finance

AUGUST 30, 2022

EV makers Nikola and Lucid both announced secondary stock offerings today. As we mentioned in the textbook, SEOs often have a negative effect on stock prices, and these announcements were not exceptions. Nikola announced a $400 million stock offering, to be sold at the market price. The stock price dropped about 10 percent on the announcement. For Lucid, the company announced an $8 billion shelf offer to be sold over the next three years.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Navigator SAP

AUGUST 19, 2022

These are interesting times for business. The Covid-19 pandemic shook almost every industry around the world, and the new normal is different than what came before. But part of what makes the new normal different is that uncertainty and disruption haven’t gone away any more than the Covid virus itself. Beyond just the pandemic, the world is in flux.

Simply Treasury

AUGUST 2, 2022

DEBRA, a new acronym that could cause nightmares for tax managers but also for corporate treasurers. It is a new proposal from the EU that could have significant impacts to consider, although its objectives are laudable and logical. The idea is not new to encourage companies to increase their capitalization and reduce their bank debt (partly through more recourse to the capital market - CMU project).

CFO Dive

AUGUST 4, 2022

CFOs are wrestling with how much to spend on office real estate as the shift to hybrid work has accelerated.

The Reformed Broker

AUGUST 27, 2022

I like the way Ari Wald at Oppenheimer frames the current technical set-up for the S&P 500. Now we’re caught between the declining 200-day and the rising 50-day – the latter might be the next major pivot point for short-term traders and for general sentiment depending on what happens if and when we get there: Here’s Ari: A Bullish Base vs. a Resuming Bear The S&P 500’s rejection from its 200-d.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Barry Ritholtz

AUGUST 25, 2022

Over the years, I have been involved in a fair share of investment conferences. This began with the Big Picture Conference at the New York Athletic Club, post-GFC. I had flipped bullish in March 2009, but I have vivid recollections that Fall of listening to Jim O’Shaughnessy of OSAM explain the history of markets following a 50+% crash. He was even more bullish than I was, and had the data to back it up.

Corporate Finance

AUGUST 12, 2022

"Going dark" typically means that a company delists its stock from an exchange. Today, three Chinese companies announced plans to go dark from the New York Stock Exchange. What is interesting is that the companies will still be listed on the Stock Exchange of Hong Kong. The reason for delisting from the NYSE is that American regulators have warned Chinese companies that they would be forced to leave U.S. exchanges unless they allowed regulators to see the records of the company auditors.

Navigator SAP

AUGUST 24, 2022

Automate and Simplify e-Commerce and Marketplace Connections.

CFA Institute

AUGUST 25, 2022

Eric Sim, CFA, explains how human capital, financial capital, and social capital helped build his career in finance.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CFO Dive

AUGUST 5, 2022

Evidence of loose internal controls related to environmental, social and governance (ESG) data comes as the potential cost of companies getting ESG reporting wrong are rising.

The Reformed Broker

AUGUST 29, 2022

You don’t have to go checking to see all the other performances from last night’s Music Video Awards on MTV, you can just take my word for it – RHCP was the highlight. Nice to see Generation X is still in the conversation <laugh cry emoji>, very quietly being talented and capable while the Boomers and Millennials continue their culture war blood feud.

Barry Ritholtz

AUGUST 17, 2022

Yesterday I spent some time with Eric Balchunas recording a Masters in Business podcast. Balchunas is Senior ETF Analyst for Bloomberg Intelligence and the author of “ The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions.”. It’s a fun conversation I’m sure everybody will enjoy. There are parts of our discussion I thought were obvious, but he convinced me as underappreciated: First and foremost, the intense disruption of low-c

Corporate Finance

AUGUST 10, 2022

The Senate recently passed the Inflation Reduction Act of 2022. Major components of the Act include spending on climate change, increased IRS spending, and measures to lower the cost of prescription drugs. In order to pass the Act, a last minute change to get the necessary votes was a 1 percent excise tax on stock repurchases. As we showed in the text, dividends and stock repurchases affect a company and investors in much the same way.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Navigator SAP

AUGUST 5, 2022

The pharmaceutical industry has been transformed in recent years by pressure from intensely competitive markets and the need to comply with new regulations that mandate the highest quality standards across all processes. The industry is a complex one and highly regulated as well, as it deals with the safety of people’s lives. It requires not just R&D capability, talent, and strong capital investment over the long term, but also the need for a strong digital infrastructure.

CFA Institute

AUGUST 19, 2022

“How many here think the next 10-year equity returns are going to be below the long-run average? I certainly do. Is there anyone here who doesn’t?”.

CFO Dive

AUGUST 1, 2022

CFOs globally are asking for added transparency and more consistency as regulatory bodies gear up to publish sustainability reporting standards later this year.

The Reformed Broker

AUGUST 22, 2022

Sharing this chart from Guggenheim showing that the S&P 500’s bear market bounce literally stopped on a dime and was turned away at the 200-day moving average. It’s almost too perfect. We manage our tactical portfolio based on technically-oriented rules not because it always works (it doesn’t!) but because it eliminates feelings like fear or fear of missing out from the decision-making process.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Let's personalize your content