Considering an I Bond rollover? Do it the right way.

Tips Watch

SEPTEMBER 25, 2024

For some investors, cashing in low-fixed-rate I Bonds makes sense, combined with the gift-box strategy to add to holdings in October. By David Enna, Tipswatch.

Tips Watch

SEPTEMBER 25, 2024

For some investors, cashing in low-fixed-rate I Bonds makes sense, combined with the gift-box strategy to add to holdings in October. By David Enna, Tipswatch.

CFO Dive

SEPTEMBER 25, 2024

The hard-to-predict outcome from the presidential election in November has shown several signs of sapping business confidence.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

SEPTEMBER 25, 2024

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. However, with the national debt expanding rapidly, observers of U.S. tax policy are predicting that Congress will inevitably be forced to again increase tax rates in order to raise revenue and balance the national budget – and that the current regime of relatively low tax rates will prove to be a temporary phenomenon.

CFO Dive

SEPTEMBER 25, 2024

While controllers recognize that change is coming, and coming quickly, they “don't necessarily have a view on what that will look like,” EY’s Myles Corson said.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

CFO Talks

SEPTEMBER 25, 2024

Never Settle, Fostering a Culture of Continuous Learning in Finance In the ever-evolving landscape of finance, the role of the CFO has transformed dramatically. No longer confined to balancing books, today’s CFOs are at the forefront of shaping strategy, guiding decision-making, and steering their organisations through complex challenges. To maintain a competitive edge, it’s crucial to embed a culture of continuous learning within your finance team.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

CFO News

SEPTEMBER 25, 2024

Kaur is a strong contender for the chief financial officer role that became available after Georges Elhedery assumed the position of CEO at Europe's largest lender on September 2

Reval

SEPTEMBER 25, 2024

LONDON – 26 September 2024: ION Commodities, a leading global provider of commodity. The post Elemental selects ION’s Aspect to power its metals, battery, and commodities trading business appeared first on ION.

CFO News

SEPTEMBER 25, 2024

The Production Linked Incentive (PLI) Scheme has transformed India’s manufacturing sector, elevating output to ₹10.90 lakh crore, creating over 8,50,000 jobs, and significantly increasing exports and foreign investment, says the Ministry of Commerce & Industry.

E78 Partners

SEPTEMBER 25, 2024

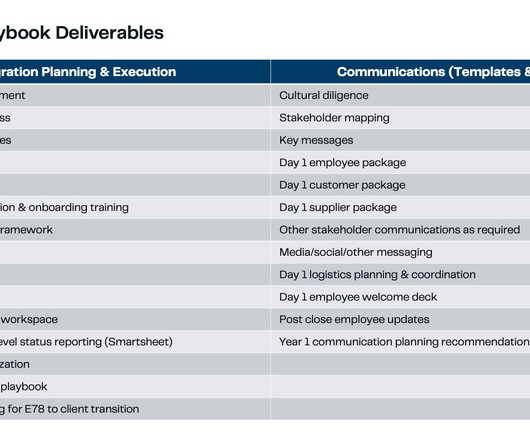

In mergers and acquisitions (M&A), integration playbooks offer a structured, cost-effective way to manage the people, processes, and technology requirements. But how do you know when it’s the right time to use them, and what should they include? We will explore the types of transactions where leveraging a playbook is beneficial and the essential elements needed for smooth and successful integration.

Speaker: Yohan Lobo

In the accounting world, staying ahead means embracing the tools that allow you to work smarter, not harder. Outdated processes and disconnected systems can hold your organization back, but the right technologies can help you streamline operations, boost productivity, and improve client delivery. Dive into the strategies and innovations transforming accounting practices.

CFO News

SEPTEMBER 25, 2024

Startup Sphere 2024 in Bengaluru turned out to be a major crowd-puller, as it debated the issues that need attention for entrepreneurs and investors to drive the next phase of growth.

E78 Partners

SEPTEMBER 25, 2024

In mergers and acquisitions (M&A), integration playbooks offer a structured, cost-effective way to manage the people, processes, and technology requirements. But how do you know when it’s the right time to use them, and what should they include? We will explore the types of transactions where leveraging a playbook is beneficial and the essential elements needed for smooth and successful integration.

CFO News

SEPTEMBER 25, 2024

After the World Bank, IMF, S&P Global, Asian Development Bank also retained India’s growth forecast projected at 7%. ADB cited India’s strong agricultural growth due to an above-average monsoon, along with robust performance in the industry and services sectors as the contributing factors.

Cube Software

SEPTEMBER 25, 2024

What is financial compliance management? Financial compliance management ensures that an organization follows all relevant regulations, laws, and standards in its financial operations.

Advertisement

Our 2025 Center Travel Survey is clear: as corporate travel increases, so does corporate credit cards distribution, and a rise in off-platform travel booking. This 61% rise causes various challenges: compliance, spend control, reporting problems, and a lack of visibility across organizations. To evolve with the ever-changing needs of travelers, decision-makers need a better solution.

CFO News

SEPTEMBER 25, 2024

Return To Office: KPMG notes that this year's findings show a growing firmness among CEOs regarding a return to pre-pandemic work practices.

Future CFO

SEPTEMBER 25, 2024

As finance professionals continue to navigate around technological advancements, the considerations on how digitalisation can affect the function and the organisation as a whole seem almost endless. In a recent report by the Association of Chartered Certified Accountants , they identified 'unique' considerations towards artificial intelligence, conceding that AI in accounting encompasses various technologies.

CFO News

SEPTEMBER 25, 2024

Ministry of Statistics and Programme Implementation (MoSPI) met economists to discuss revisions to the GDP and Consumer Price Index (CPI) frameworks. The meeting focused on addressing delays, enhancing data granularity, and improving methodologies for better measurement of growth and inflation metrics.

Beacon CFO Plus

SEPTEMBER 25, 2024

This content is password protected. To view it please enter your password below: Password: The post Protected: Navigating Business Sales appeared first on BeaconCFO Plus.

Advertisement

Finance teams are balancing more than ever, but manual processes shouldn’t slow you down. In this ebook from BILL, discover how AI is transforming finance—automating AP, expense tracking, and document management to reduce errors, increase efficiency, and improve financial control. Learn how real companies are using AI-powered automation to streamline workflows, detect anomalies, and gain deeper insights.

CFO News

SEPTEMBER 25, 2024

The Goods and Services Tax Network (GSTN) has issued an advisory, urging taxpayers to proactively manage their records as new archival policies limit GST return data availability to seven years.

Barry Ritholtz

SEPTEMBER 25, 2024

Why Stocks Are Your Best Bet with Jeremy Schwartz, WisdomTree (September 25, 2024) Are equities the best long-term investment? If so, is that always true? In this episode of At the Money, we speak with Jeremy Schwartz about why you should, or should not, go heavy on stocks. ~~~ About Jeremy Schwartz: Jeremy Schwartz is Global Chief Investment Officer of WisdomTree, leading the firm’s investment strategy team in the construction of equity Indexes, quantitative active strategies, and multi-asset M

CFO News

SEPTEMBER 25, 2024

Daljeet Singh Khatri is replacing Reva Sethi, the former CFO of Housing and Urban Development Corporation who was appointed in June this year.

Global Finance

SEPTEMBER 25, 2024

Susanne Prager, head of cash management at Raiffeisen Bank International (RBI), discusses the challenges affecting global banking services and the need for the latest tech tools to help companies succeed in CEE and around the world. Global Finance: What are the overall trends impacting international banking transactions? Susanne Prager: With the inclusion of new markets in the EU, businesses demand faster, more transparent, and compliant cross-border transactions.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, emails, and shared drives no longer need to slow you down. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

CFO News

SEPTEMBER 25, 2024

Women's representation in India Inc remains stable and the banking, financial services and insurance (BFSI) sector leads when it comes to 'women in leadership' roles, a report said on Wednesday.

CFO News

SEPTEMBER 25, 2024

Guarav Maheshwari brings about 27 years of experience, currently serving his second term at Standard Chartered Bank, he has also headed finance at Altico Capital.

CFO News

SEPTEMBER 25, 2024

India's core consumer inflation hit a decadal low of 3.14% in June, suggesting excess capacity in the economy. Jahangir Aziz from JP Morgan Chase advocates for an immediate policy rate cut by the RBI, despite geopolitical uncertainties and US election risks potentially impacting global economics.

CFO News

SEPTEMBER 25, 2024

Banks are urging changes to insolvency regulations to prevent promoters from manipulating their companies' size to qualify as MSMEs and retain control during bankruptcy proceedings. This move aims to address concerns about delinquent borrowers exploiting the system by downsizing assets and staff to benefit from special provisions for MSMEs.

Speaker: Susan Richards

Your past-due accounts are growing, cash flow is tightening, and the pressure is on. The big question: Do you handle the collections internally or outsource to experts? Both strategies come with advantages and risks - but which one delivers the best impact for your business? In this session we’ll dive deep into the in-house vs. outsourcing debate, examining cost-effectiveness, efficiency, compliance risks, and overall recovery success rates.

Let's personalize your content