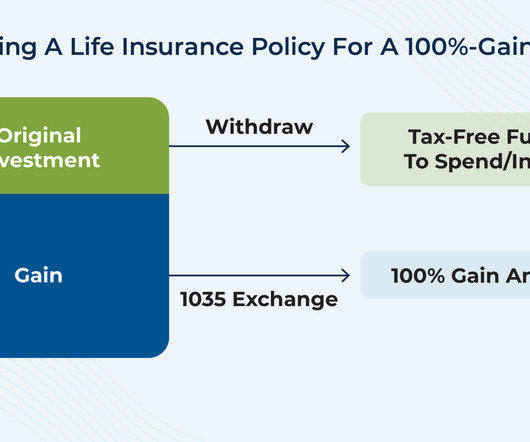

Using A 1035 Exchange To Turn An Unneeded Life Insurance Policy Into An Annuity

Nerd's Eye View

JANUARY 1, 2025

Occasionally, an owner of a permanent life insurance policy may decide that they no longer need their policy – either because the death benefit is no longer necessary or because they simply want to access the policy's underlying cash value for their living expenses in retirement. Unlike term life insurance, permanent life insurance doesn't simply lapse when the owner stops paying premiums.

.jpg)

Let's personalize your content