7 CFO tips for yielding high ROI during the rush into generative AI

CFO Dive

JULY 26, 2024

Financial executives willing to chance big spending on generative AI can take steps to reduce risk and seize the payoffs.

CFO Dive

JULY 26, 2024

Financial executives willing to chance big spending on generative AI can take steps to reduce risk and seize the payoffs.

Navigator SAP

JULY 26, 2024

As a man of the Millennial generation, I rarely visit brick-and-mortar retail stores. But there I was at a shoe store in New York City because Nike was letting me design a custom red shoe via its Nike by You retail program. I was making the shoe through Nike’s website, but I was getting ideas and visualizing how my creation would look through virtual reality technology at one of the company’s brick-and-mortar stores.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO Dive

JULY 26, 2024

Forcing banks to reimburse authorized payments could encourage bad behavior and would not deter scammers, bank executives said in a Senate hearing.

Global Finance

JULY 26, 2024

Treasury keeps up with the dynamic payments environment. As the dynamic payments landscape presents both challenges and opportunities for corporate treasury, it’s unsurprising that financial institutions are finding new ways to help treasurers leverage new payments trends to improve efficiency, manage risk, and support business growth. Banking Circle is the winner of our award for Best Embedded Treasury Solution, providing the core financial infrastructure that allows businesses to build and off

Speaker: Lee Andrews, Founder at LJA New Media & Tony Karrer, Founder and CTO at Aggregage

This session will walk you through how one CEO used generative AI, workflow automation, and sales personalization to transform an entire security company—then built the Zero to Strategy framework that other mid-market leaders are now using to unlock 3.5x ROI. As a business executive, you’ll learn how to assess AI opportunities in your business, drive adoption across teams, and overcome internal resource constraints—without hiring a single data scientist.

Nerd's Eye View

JULY 26, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that Charles Schwab's latest RIA benchmarking study shows that firms saw significant AUM growth in 2023, thanks in part to strong equity market performance, but also thanks to organic growth initiatives that brought in additional assets from new and existing clients.

Corporate Finance Brief brings together the best content for corporate finance professionals from the widest variety of industry thought leaders.

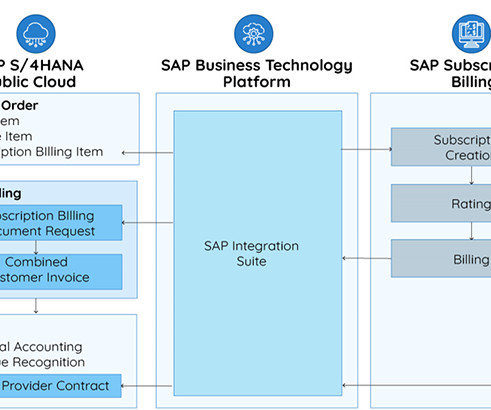

Bramasol

JULY 26, 2024

In addition to highlighting trends such as the Digital Solutions Economy (DSE), industry-focused solutions, and SAP initiatives like artificial intelligence and S/4HANA cloud, this Insights Series will also periodically provide answers to the top questions that we hear from our clients and partners. In this episode, we dive into five issues that are at the heart of optimizing Quote-to-Cash to Compliance with SAP Revenue Recognition and subscription management applications, including complex bund

Global Finance

JULY 26, 2024

In July, US global investment company and hedge fund, Citadel LLC, and Japanese energy startup, Energy Grid, announced their intent to enter a strategic partnership. Details of the deal were undisclosed, though it represents the first major step into Japan’s wholesale energy market by the Miami-based firm. The deal comes in the wake of Citadel CEO Ken Griffin’s bullish statements on Japan back in June 2023 and Citadel’s reopening of an office in Tokyo (the firm originally closed its Tokyo office

CFO News

JULY 26, 2024

In their latest analysis, Rakesh Nangia, Non-Executive Chairman, and Sandeep Jhunjhunwala, Partner at Nangia Andersen LLP, dissect Budget 2024’s strategic moves towards a "Viksit Bharat" and its economic implications.

Global Finance

JULY 26, 2024

Staying ahead of the cash management game is vital for treasurers facing multiple challenges, such as economic and political uncertainties, and our award winners are best positioned to do just that. Modern treasuries face a diverse array of demands, such as real-time payments, high inflation and interest rates, and new compliance and sustainable finance obligations.

Advertisement

Financial automation isn’t the future—it’s the now. BILL partnered with SMB Group to survey 750 US financial decision-makers and reveal how small and midsize businesses (SMBs) are using trends and insights to tackle challenges and drive growth. The responses are eye-opening! Download our 2025 State of Financial Automation report to uncover: Key automation trends for 2025 and beyond Top concerns and attitudes about automation How AI is driving smarter, faster decisions The challenges of the finan

CFO News

JULY 26, 2024

The Budget 2024 proposal to insert Section 11A in the GST Act aims to resolve legal ambiguities, ensuring it is used only in exceptional cases, said Revenue Secretary Sanjay Malhotra.

Global Finance

JULY 26, 2024

Banking partners help optimize cash flow and protect its value. Faced with high interest rates and inflation, companies in Western Europe are turning to their banking partners to find ways to optimize cash flow and protect its value. Societe Generale , our winner this year as Best Bank for Transaction Banking, has developed a Sustainable GTB (global transaction banking) Framework—one of the first dedicated to asset-based GTB solutions—to enhance the ability of the bank and its clients to assess

CFO News

JULY 26, 2024

The Federal Reserve has seen encouraging signs of decreasing inflation, sparking hopes for a potential interest rate reduction by September. June's PCE price index showed a minor rise, indicating progress toward the Fed's 2% inflation target.

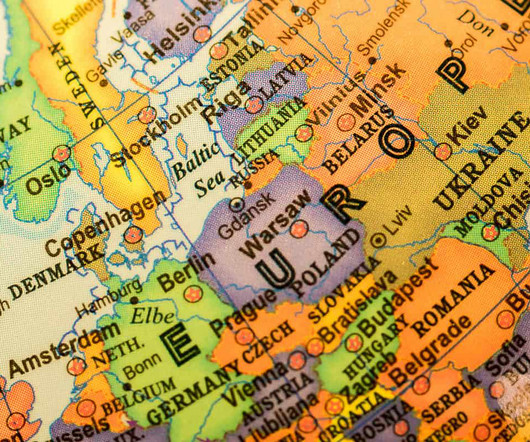

Global Finance

JULY 26, 2024

Companies operating in Central and Eastern Europe (CEE) continue to face unique challenges when it comes to cash management, due to a mix of economic development and regional variations. Inconsistencies between standardized payment systems among EU members and ad hoc systems used by non-EU members have resulted in fragmented receivables scenarios, where payment collections remain complex owing to the differences in payment practices across the region.

Advertiser: Paycor

Great leadership development is the key to sustainable business growth. Are you ready to design an effective program? HR can use Paycor’s framework to: Set achievable goals. Align employee and company needs. Support different learning styles. Empower the next generation of leaders. Invest in your company’s future with a strong leadership development program.

CFO News

JULY 26, 2024

Budget 2024: Relief for GST registered individuals and companies. "The waiver of interest and penalties for tax disputes faced by genuine taxpayers will reduce the financial burden on taxpayers, particularly benefiting small businesses and individual taxpayers who may face cash flow constraints and cannot really afford to litigate," says Siddharth Surana, Director, RSM India.

Global Finance

JULY 26, 2024

Despite a generally positive outlook, foreign exchange risks remain. Forecasts from the US Federal Reserve signaling just one modest cut this year will have far-reaching implications on how US-headquartered corporations with Latin American subsidiaries manage their liquidity flows. Although nearshoring has been a boon for Mexico, and the outlook is generally positive, risks in foreign exchange and commodity markets persist and require companies to partner with banks having regional expertise and

CFO News

JULY 26, 2024

GST: Now demand notices of GST cannot be issued beyond 42 months from the due date of filing GST annual return. Moreover, GST demand orders now have to be issued within 12 months from the date of GST demand notice. Know how this Budget 2024 amendment helps you in GST cases.

Global Finance

JULY 26, 2024

Balancing global trends with regional specificities requires an understanding of the underlying dynamics to navigate potential challenges in this ever-changing region. It requires a keen understanding of the best technological tools to automate tasks and improve efficiency. Rapid treasury transformation has been afforded a boost thanks to the regional drive for real-time payments and application programming interfaces (APIs).

Speaker: Andrew Skoog, Founder of MachinistX & President of Hexis Representatives

Manufacturing is evolving, and the right technology can empower—not replace—your workforce. Smart automation and AI-driven software are revolutionizing decision-making, optimizing processes, and improving efficiency. But how do you implement these tools with confidence and ensure they complement human expertise rather than override it? Join industry expert Andrew Skoog as he explores how manufacturers can leverage automation to enhance operations, streamline workflows, and make smarter, data-dri

CFO News

JULY 26, 2024

The Union Budget 2024 brought respite for venture investors as it abolished the decade-old Angel tax. When asked about the reason behind the move, Sitharaman said that it was one of the many steps Centre took to help Indian startups thrive. This move, however, leaves those pending to pay their previously due angel taxes in a tough spot. Sitharaman has stated that the government is working to 'sort this out'.

Global Finance

JULY 26, 2024

Partnering with banks for expertise and resources to hold on to the competitive edge. Payments innovation creates both opportunities and challenges for US treasurers; and understanding how to optimize liquidity and bring about greater operational efficiency with the ever-evolving transformations in real-time payments, open banking, and embedded finance lies at the heart of treasury’s future.

CFO News

JULY 26, 2024

Sebi's investigation is based on the findings of Financial Conduct Authority, its counterpart in UK, for the period from January 1, 2006 to March 31, 2008.

Global Finance

JULY 26, 2024

African banks are empowering clients with greater access to real-time data and greater control over their cash. A fragmented regulatory environment, uneven access to financial services, a shallow pool of readily available funds, and currency controls and limitations in some African markets can lead to trapped cash. This diversity of problems challenges companies to manage their cash flow effectively, elevating the need for data insights on cash flows to create more-accurate forecasts; requiring

Speaker: Cheryl J. Muldrew-McMurtry

Distributed finance teams are rewriting how the back-office runs, and attackers are taking notes. Disconnected workflows, process blind spots, and rising cyber threats are more than just growing pains—they’re liabilities. The challenge isn’t just going remote. It’s building resilient systems that protect accuracy, control, and speed across every transaction and touchpoint.

CFO News

JULY 26, 2024

The Department for Promotion of Industry and Internal Trade (DPIIT) has recognised 1,40,803 entities as startups as of 30th June 2024 said Minister State for Commerce and Industry minister Jitin Prasdada in a written reply to the Rajya Sabha. The minister also informed under the Startup India Seed Fund Scheme, Rs 90.52 crore was approved to startups by incubators as of June 30 as against Rs 186.19 crore in 2023.

Global Finance

JULY 26, 2024

Protecting profits across the board. In the Asia-Pacific region, geopolitical risks and supply chain diversification require contingency planning by corporates, and banking partners who can help treasurers mitigate foreign exchange risk to protect profit margins. “Businesses navigate an increasingly complex environment and confront a shift in trade patterns and supply chains across Asia,” says Lim Soon Chong, group head of Global Transaction Services at DBS, Global Finance ’s winner both as Best

CFO News

JULY 26, 2024

The so-called "Pillar 1" arrangement, part of a 2021 global two-part tax deal, aims to replace unilateral digital services taxes (DSTs) via a new mechanism to share taxing rights on multinational companies, such as U.S. tech giants Alphabet's Google and Amazon and Apple.

CFO News

JULY 26, 2024

"Banks led by State Bank of India had come in to support the reconstruction scheme. As per regulations, banks cannot remain invested in other banks," managing director and chief executive Prashant Kumar told ET in an exclusive interaction.

Advertiser: GEP

The race to dominate AI is no longer about who has the smartest algorithms — it's about who can build and scale faster. Behind every AI breakthrough lies a battle for resources: data centers, compute hardware, power, and telecom infrastructure. And right now, even tech giants are hitting a wall. Our latest white paper reveals the six critical supply chain elements that are increasingly separating AI leaders from the rest.

CFO News

JULY 26, 2024

The global shipping industry faced significant challenges, with spot freight rates increasing by around 105% in three months. Companies like Bajaj Auto and CEAT experienced disruptions similar to the pandemic era, highlighting severe container shortages affecting various sectors, including agriculture and automotive.

CFO News

JULY 26, 2024

The cabinet was set to decide on expanding the production-linked incentive (PLI) schemes in sectors like textiles, food processing, and pharmaceuticals to include more products. Meanwhile, the budget for PLI schemes increased to `16,092 crore for FY25. Textile PLI might see a lower investment threshold, with more man-made fabric products and apparel possibly being added.

CFO News

JULY 26, 2024

In an order sheet of the hearing held on July 11, the division bench of technical member Anu Jagmohan Singh and judicial member Kishore Vemulapalli asked the parties to serve a fresh notice of final hearing to the central/state governments, tax authorities, and regulatory bodies like the Competition Commission of India (CCI) and the Ministry of Information and Broadcasting.

Let's personalize your content