Musings on Markets: META Lesson 2: Accounting Inconsistencies and Consequences

CFO News Room

NOVEMBER 11, 2022

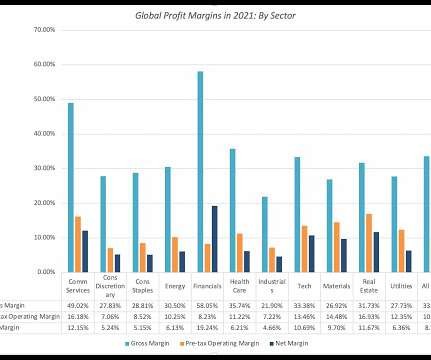

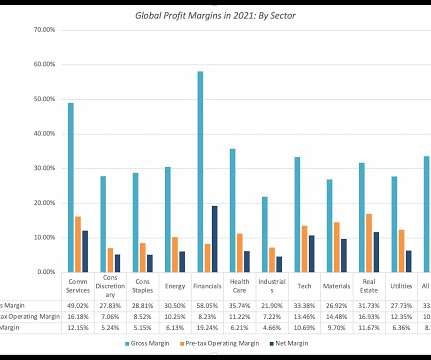

That skewing can affect valuation and pricing judgments about these firms, and correcting accounting inconsistencies is a key step towards leveling the playing field. For a manufacturing company, these can take the form of plant and equipment. I believe it is, since failure to do so can have both valuation and pricing consequences.

Let's personalize your content