CEOs trim hiring, capital investment plans: Business Roundtable

CFO Dive

DECEMBER 6, 2022

CEOs facing a gloomier economic outlook have pared back expansion plans but do not necessarily expect a recession in 2023.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFO Dive

DECEMBER 6, 2022

CEOs facing a gloomier economic outlook have pared back expansion plans but do not necessarily expect a recession in 2023.

Global Finance

DECEMBER 11, 2024

Global Finance spoke with Hossam Heiba, CEO of the General Authority for Investment and Free Zones in Egypt, during the 2024 World Investment Conference organized by Saudi Invest and the World Association of International Promotion Agencies (WAIPA), in Riyadh, Saudi Arabia.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Growth Architect: How Financial Leaders are Unlocking Potential

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

From Start to Scale: Driving Growth Through Seamless Payments Implementation

Global Finance

DECEMBER 3, 2024

Global Finance spoke with Laziz Kudratov, Uzbekistan’s Minister of Investment, Industry and Trade. Along with a more business-friendly environment, key reforms, such as reducing VAT from 20% to 12% and creating special economic zones, we have strengthened our position as an attractive destination for foreign investors.

CFO News Room

DECEMBER 12, 2022

Think about this illustration: if education is a way to out-earn your parents, and the cost of education is greater for the poor (many more years not working and little savings to draw on), the rich will be more likely to invest in their educations. . greater redistribution, more investment by the state in education, etc.). .

Speaker: Alex Jiménez, Managing Principal, Financial Service Consulting for EPAM

Global economic conditions are soft at best. The largest banks have increased reserves to protect against deteriorating economic conditions. Should banks delay their digital transformation investments and focus on cost reductions? Should banks delay their digital transformation investments and focus on cost reductions?

Barry Ritholtz

NOVEMBER 15, 2023

Instead, we can deploy small hacks to thwart your own worst instincts and behaviors ; by making small changes in your outlook and investment process, you can channel these behaviors into less destructive outlets. Note: We deploy many of these solutions at RWM that take advantage of our knowledge of behavioral economics.) We all are! –

CFO News Room

DECEMBER 18, 2022

People point to tax burdens and over-regulation as the reasons for economic decline. Look no further than the Fraser Institute’s latest report to see how states rank for economic freedom based on government spending, taxes, and labor market regulation. . But the real question is: why should we care about economic freedom?

CFO News Room

NOVEMBER 10, 2022

Is economic growth inflationary? Many economic and political commentators think so. Nick Timiraos of the Wall Street Journal , for example, writes that “easier financial conditions [loose monetary policy] stimulate spending and economic growth.” But what’s the balance between inflation (gP) and economic growth (gY)?

CFO News Room

NOVEMBER 20, 2022

She has been a great investment. They’re also a great chance to think about economics, specifically two of the most basic principles of economics: opportunity cost and incentives. These are, to economics, what blocking and tackling are to American football. Understanding (or victory) usually boils down to them.

CFO Dive

JULY 25, 2022

Economic pressures could lead CFOs to cut down on investments in sustainability despite a growing executive focus on ESG, Gartner finds.

CFO Dive

JUNE 13, 2022

To navigate a “constantly changing” macro-economic environment, State Street is focusing on reducing its day to day technology spend in favor of more strategic operational investments in AI, automation and like technologies, according to its CIO and CFO.

Global Finance

OCTOBER 30, 2024

The QIA (Qatar Investment Authority) is the wealth manager of the State of Qatar. It was established in 2005 with an overarching objective to create long-term value, as well as two other objectives in support of Qatar’s wealth: providing liquidity when needed to stabilize the local economy and supporting local economic development.

Barry Ritholtz

OCTOBER 2, 2023

Along those lines, here are in chronological order, the thinkers who have helped shape how I view the world view, including how I philosophically think about the economy, markets, and investing. 10 Quotes That Shaped My Investment Philosophy 1. Being right may be a necessary condition for investment success, but it won’t be sufficient.

CFO News Room

FEBRUARY 2, 2023

Investing in a guaranteed interest account is a great way to secure your money, as there is very little risk. Guaranteed interest accounts provide reliable, consistent returns and can be used for short-term savings or to supplement other investments in your portfolio. What Are The Best Investments With Guaranteed Returns?

Nerd's Eye View

APRIL 3, 2024

Yet, by taking a measured look at factors driving economic activity and influencing behavior, advisors can help clients face risks they can't control and (hopefully) position themselves to take advantage of opportunities as they develop. Meanwhile, a smorgasbord of potential risks threatens economic growth's "soft landing" narrative.

CFO News Room

JANUARY 4, 2023

Within the industry, it is estimated that Real Estate Investment Trusts (REITs) supported 3.2 million jobs in 2021 , according to a study commissioned by the National Association of Real Estate Investment Trusts (Nareit). What Are Real Estate Investment Trusts? How Many Real Estate Investment Trusts Are There in Total?

Nerd's Eye View

JANUARY 3, 2024

The sentiment is especially poignant when it comes to economic forecasting, as it's nearly impossible to get an accurate picture of the current state of the economy at any given moment. The key point is that, given the current economic uncertainty, there are several ways that advisors can help clients prepare for potential downturns.

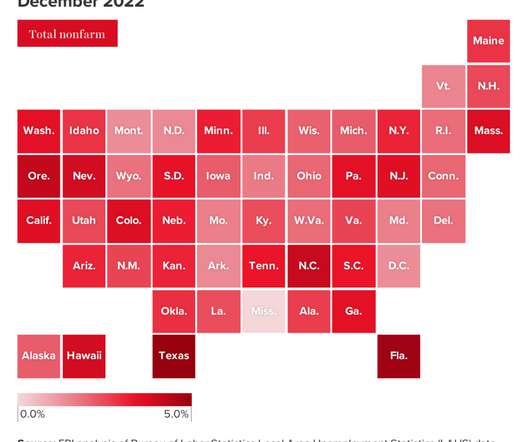

CFO News Room

JANUARY 26, 2023

The economic recovery since 2020 Private-sector employment has largely returned to pre-pandemic levels across the country, except for the leisure and hospitality sector, which faced large job losses and remains 5.5% State and local lawmakers should seize it. below February 2020 employment levels.

CFO Talks

NOVEMBER 13, 2024

Achieving the Right Balance of Risk and Return in Corporate Investments When handling corporate investments, CFOs often face the balancing act between risk and return. Know Your Comfort Zone for Risk Before diving into investments, have a clear discussion with your board or executive team about your company’s tolerance for risk.

CFO News

NOVEMBER 24, 2024

India's economy has seen an unprecedented surge in economic activity with a staggering $8 trillion being invested in the last decade, which comprises more than half of the total $ 14 trillion invested in the country since Independence, according to a new report.

Musings on Markets

AUGUST 19, 2024

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. Tech companies age in dog years, and the consequences for how we manage, value and invest in them are profound.

Global Finance

NOVEMBER 5, 2024

Global Finance spoke with Yousef Khalawi, secretary general of the AlBaraka Forum for Islamic Economy, about the role of Islamic finance and economics as a holistic and sustainable framework for all economies. The wider concepts and standards of Sharia-compliant investment by their nature lend themselves well to the sustainability agenda.

CFO News Room

JANUARY 13, 2023

The current-economic-conditions index rose to 68.6 Although the short-run economic outlook fell modestly from December, the long-run outlook rose 7% to its highest level in nine months and is now 17% below its historical average.”. The economic outlook remains highly uncertain. The increase in January totaled 4.9 points or 8.2

CFO News Room

DECEMBER 22, 2022

Business fixed investment increased at a revised 6.2 Intellectual-property investment rose at a 6.8 points to growth, while business equipment investment rose at a 10.6 Residential investment, or housing, plunged at a 27.1 The economic outlook remains highly uncertain. Durable-goods spending fell at a 0.8

CFO News Room

NOVEMBER 23, 2022

The current-economic-conditions index dropped to 58.8 Overall, economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, and the continued fallout from the Russian invasion of Ukraine. The economic outlook remains highly uncertain. The index hit a record low of 50.0 points or 5.2

CFO News Room

NOVEMBER 11, 2022

The current-economic-conditions index dropped to 57.8 Persistently elevated rates of price increases affect consumer and business decision-making and distort economic activity. The economic outlook remains highly uncertain. Bob has a MA in economics from Fordham University and a BS in business from Lehigh University.

Global Finance

OCTOBER 8, 2024

But overlending—and US initiatives to extend its security and investment footprint—are challenging its position. Accordingly, China’s involvement in Africa goes beyond trade, encompassing a mix of economic investments, geopolitical strategies, and local challenges. China continues to dominate trade with the continent.

CFO News Room

DECEMBER 23, 2022

The current-economic-conditions index rose to 59.4 Overall, economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, and the continued fallout from the Russian invasion of Ukraine. Still, the economic outlook remains highly uncertain. The index hit a record low of 50.0 points or 5.1

CFO News Room

NOVEMBER 16, 2022

While most measures of economic activity suggest the economy continues to expand, elevated price increases, weak consumer sentiment, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine remain significant threats to the economic outlook. Caution is warranted. Robert Hughes. Source link.

Global Finance

DECEMBER 18, 2024

Younger, globally minded clients are driving a shift to offshore investments, making strategic and flexible wealth planning more critical than ever. Global Finance : How is the increased demand for offshore investments in Latin America impacting high-net-worth clients long-term strategies?

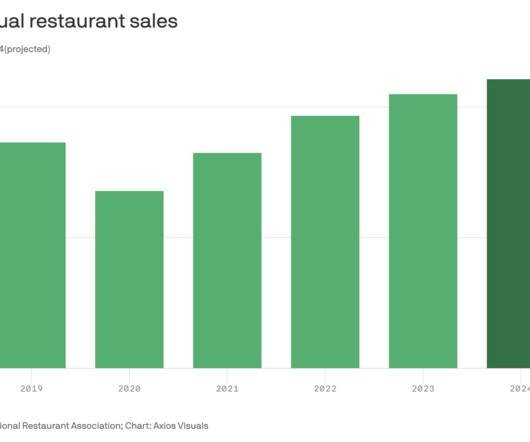

Barry Ritholtz

JUNE 6, 2024

I spend a lot of time debunking investment-related b t. Given the general innumeracy of the public, it’s easy for a dishonest publisher of economic data to create narratives that are not only false and misleading but effective at confusing the public. Axios reported yesterday that “2024 will be the U.S.

CFO News Room

DECEMBER 15, 2022

Elevated price increases, weak consumer sentiment, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine remain significant threats to the economic outlook. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Caution is warranted.

Barry Ritholtz

FEBRUARY 22, 2024

Peter Mallouk points out that investments made on days of all-time highs outperform investments made on all other days, Technicians will tell you All-Time Highs are bullish, because there is no selling resistance; behavioral economics suggests it’s bullish due to FOMO and plain old greed.

Barry Ritholtz

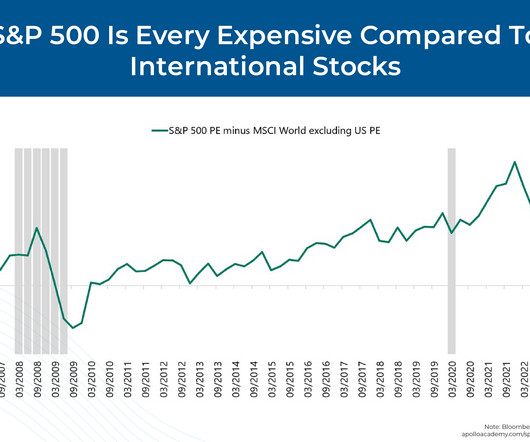

OCTOBER 24, 2024

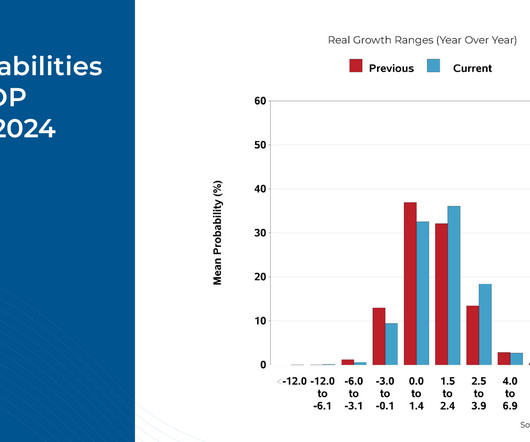

Probability Distribution of the next decade in S&P 500 returns (according to GS) Source: Goldman Sachs Investment Research My colleague Ben Carlson buried the lede when he did an examination of all rolling 10-year periods going back to 1925. He found less than 9% of those 10 year periods had returns of 3% or less.

CFO News Room

NOVEMBER 30, 2022

Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob was formerly the head of Global Equity Strategy for Brown Brothers Harriman, where he developed equity investment strategy combining top-down macro analysis with bottom-up fundamentals. Source link.

Global Finance

JUNE 4, 2024

Since then, Rajapaksa’s successor, President Ranil Wickremesinghe has presided over yet another tentative economic recovery. Currency: Sri Lankan rupee Investment promotion agency: The Board of Investment of Sri Lanka (BOI) Investment incentives: All incentives are subject to approvals and registrations. billion. .):

CFO News Room

JANUARY 6, 2023

The report states, “Employment contracted due to a combination of decreased hiring due to economic uncertainty and an inability to backfill open positions.”. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. percent over that period (see bottom of second chart).

CFO News Room

JANUARY 4, 2023

Economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, continued fallout from the Russian invasion of Ukraine, and waves of new Covid-19 cases in China. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Source link.

CFO News Room

DECEMBER 21, 2022

Elevated rates of price increases continue to drive an aggressive Fed tightening cycle, sustaining risks for the economic outlook. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Caution is warranted. Robert Hughes.

CFO News Room

NOVEMBER 29, 2022

Weak consumer attitudes and fallout from the Russian war in Ukraine further complicate the economic outlook. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob has a MA in economics from Fordham University and a BS in business from Lehigh University.

Global Finance

OCTOBER 8, 2024

Behuria, The University of Manchester: Mauritius is at a crossroads economically— and perhaps even politically. The government acknowledges the need for economic diversification. Attracting foreign direct investment remains paramount in propelling growth. Last year, the country reached an investment rate of 23.5%

CFO News Room

NOVEMBER 3, 2022

The report notes that respondents suggest, “There are still challenges in hiring qualified workers, and due to uncertainty regarding economic conditions, some companies are holding off on backfilling open positions.”. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street.

CFO News Room

NOVEMBER 1, 2022

However, economic risks remain elevated due to the impact of inflation, an aggressive Fed tightening cycle, continued fallout from the Russian invasion of Ukraine, and waves of new Covid-19 cases and lockdowns in China. Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street.

CFO News Room

NOVEMBER 17, 2022

Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob was formerly the head of Global Equity Strategy for Brown Brothers Harriman, where he developed equity investment strategy combining top-down macro analysis with bottom-up fundamentals. Source link.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content