Data Update 5 for 2023: The Earnings Test

Musings on Markets

FEBRUARY 15, 2023

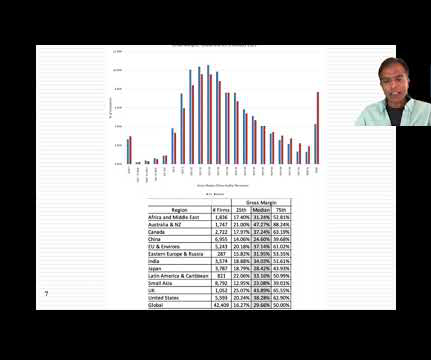

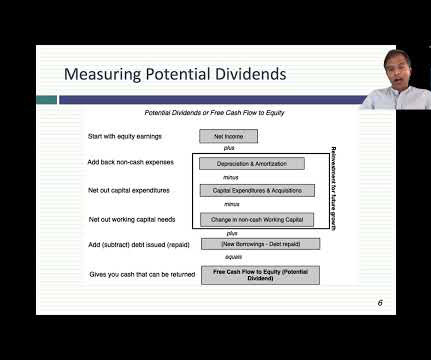

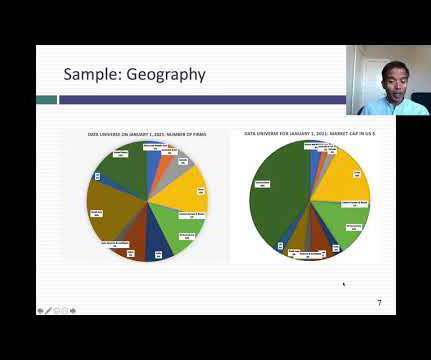

During the course of the year, investors also rediscovered that the essence of business is not growing revenues or adding users, but making profits from that growth. In this post, I will focus on trend lines in profitability at companies in 2022, with the intent of addressing multiple questions.

Let's personalize your content