Deepseek AI Takes Root In China’s Banks

Global Finance

MARCH 1, 2025

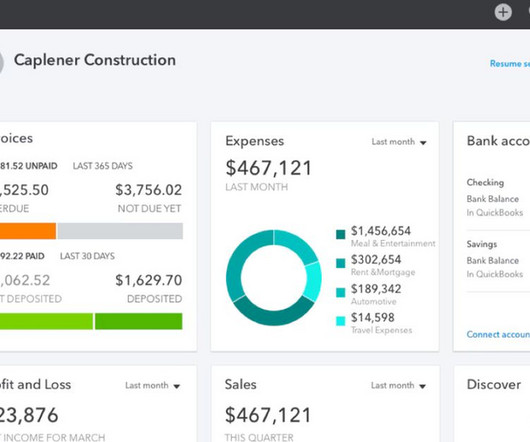

Chinas financial sector, from banks to brokerages, is rapidly incorporating DeepSeek, the nations champion in AI, for customer service, data analysis, and email sorting. Brokerages including Sinolink Securities, Industrial Securities, and GF Securities quickly followed suit.

Let's personalize your content