Navigating Mergers and Acquisitions: A Strategic Guide for CFOs in South Africa

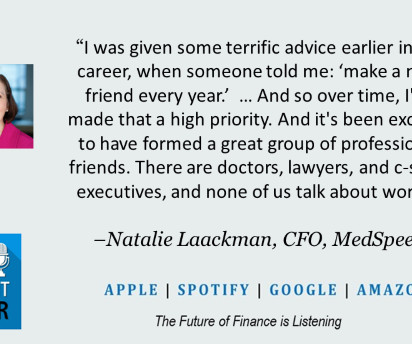

CFO Talks

SEPTEMBER 10, 2024

Navigating Mergers and Acquisitions: A Strategic Guide for CFOs in South Africa Mergers and acquisitions (M&A) are powerful tools for growth, diversification, and innovation in today’s competitive business landscape. political instability, regulatory changes, currency fluctuations).

Let's personalize your content