Today In Payments: ECB Outlines Use Cases For Digital Euro; Goldman To Pay $2.5B For GM’s Credit Card Business

PYMNTS

OCTOBER 2, 2020

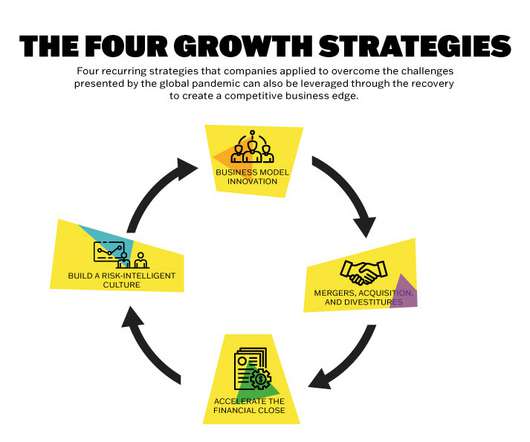

The partnership marks the retail giant's foray into privately managed Medicare Advantage plans. India is reportedly planning to launch its own app store as an alternative to Google and Apple’s app stores, in a bid by the country to become more self-reliant. Why The Pandemic Is a ‘Black Swan’ That Will Spur Payments M&A.

Let's personalize your content