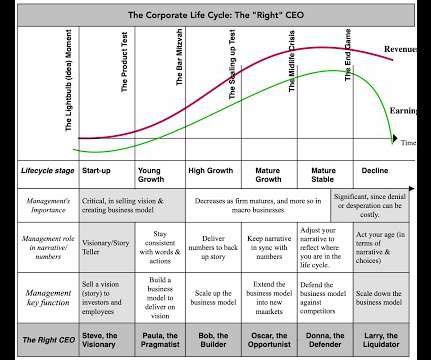

The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. With declining businesses, facing shrinking revenues and margins, it is cash return or dividend policy that moves into the front seat.

Let's personalize your content