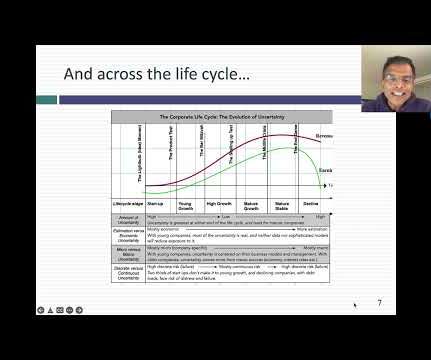

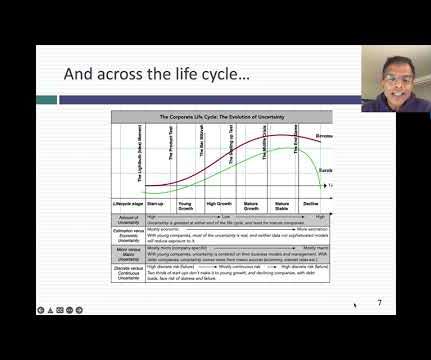

The Corporate Life Cycle: Corporate Finance, Valuation and Investing Implications!

Musings on Markets

AUGUST 19, 2024

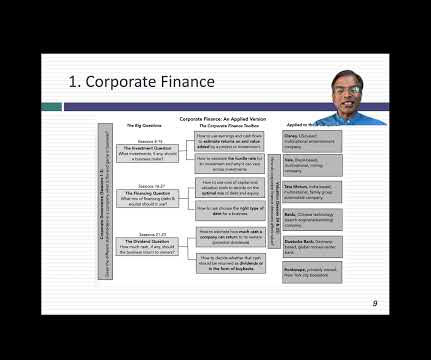

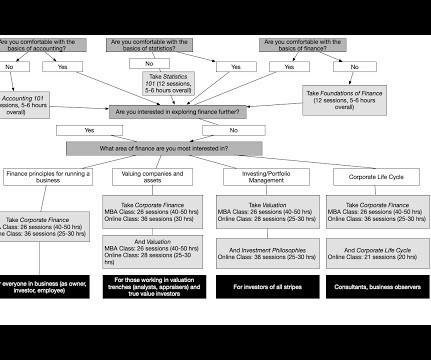

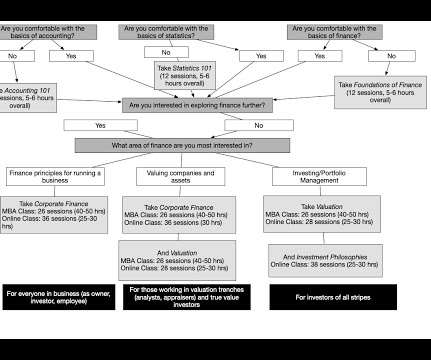

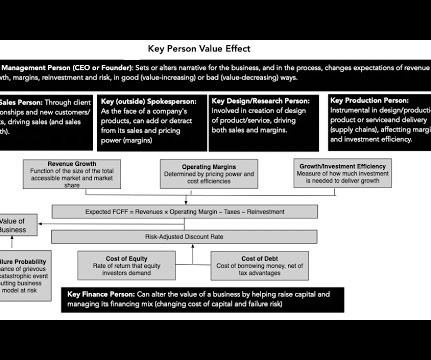

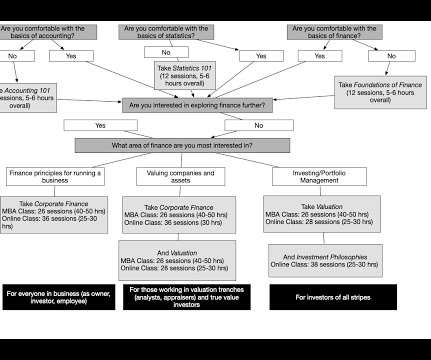

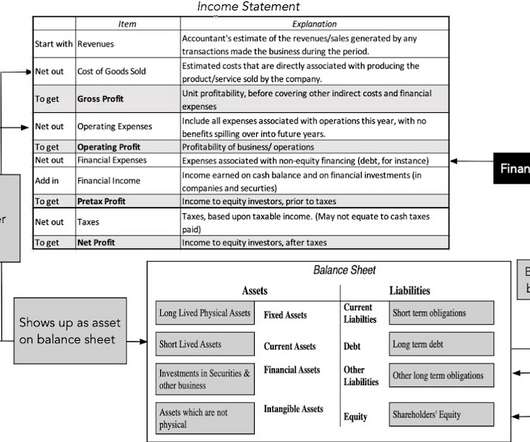

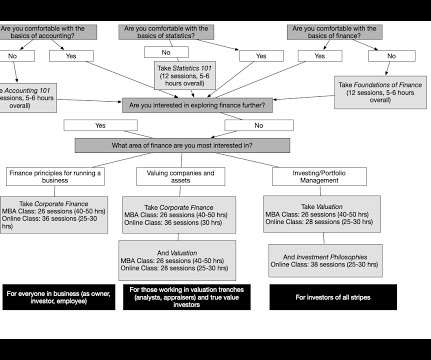

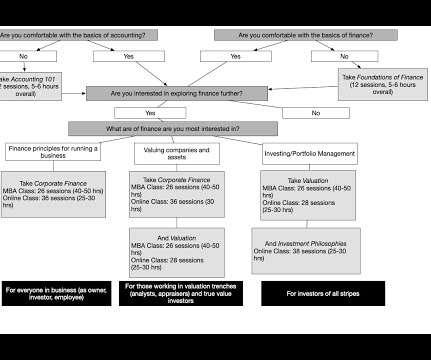

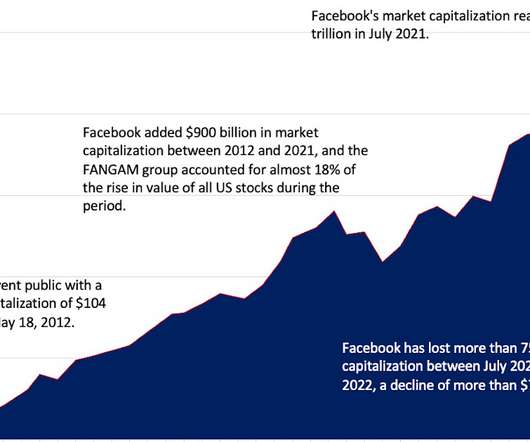

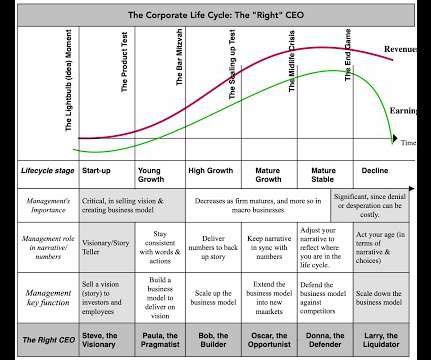

In fact, the business life cycle has become an integral part of the corporate finance, valuation and investing classes that I teach, and in many of the posts that I have written on this blog. Tech companies age in dog years, and the consequences for how we manage, value and invest in them are profound.

Let's personalize your content