Does My Business Debt Need Restructuring?

CFO Share

MARCH 16, 2021

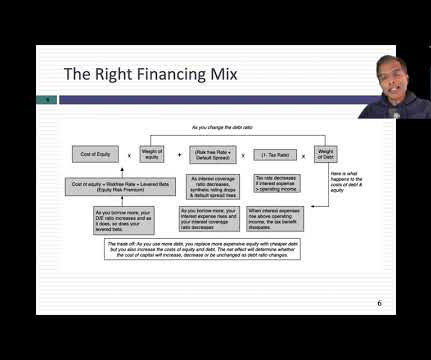

Then I am hired to negotiate with lenders to help small businesses restructure debt and avoid folding. Does your small business need debt restructuring? Private equity groups use mezzanine debt financing with 18% interest rates to facilitate leveraged buyouts. . Here’s a common scenario: Joe owns a construction company.

Let's personalize your content