Market Bipolarity: Exuberance versus Exhaustion!

Musings on Markets

OCTOBER 4, 2023

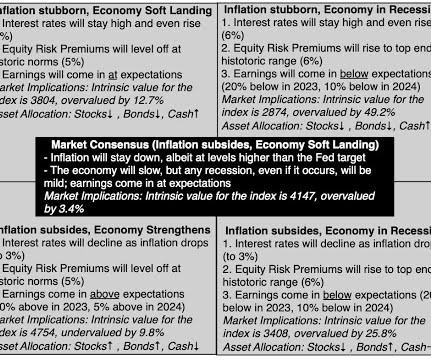

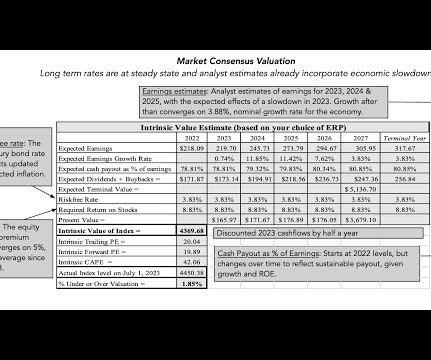

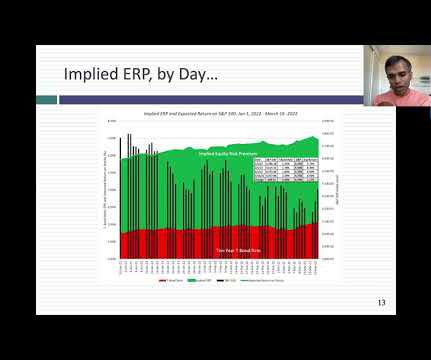

While the rise in treasury rates has been less dramatic this year, rates have continued to rise across the term structure: US Treasury While short term rates rose sharply in the first half of the year, and long term rates stabilized, the third quarter has sen a reversal, with short term rates now stabilizing and long term rates rising.

Let's personalize your content