How Advisors Can Create An Annual Financial Planning Process

CFO News Room

NOVEMBER 21, 2022

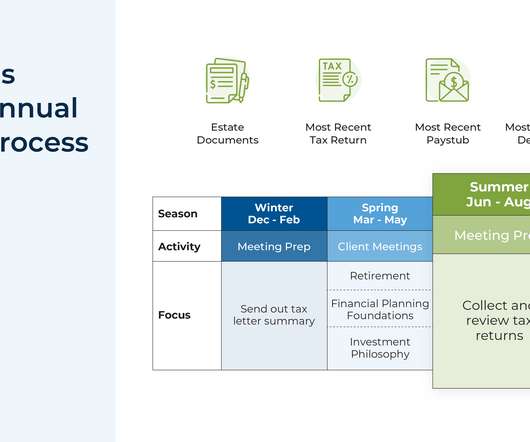

How confident are they that no year-end-tax-planning opportunities were missed across their entire client base? Our process is thoughtfully planned around tax deadlines and includes meetings with our clients twice per year. Or whether all Roth and backdoor Roth contributions were made by eligible clients?

Let's personalize your content