Concentration Risk on the Buy-Side of Credit Markets: The Causes

CFA Institute

AUGUST 30, 2021

What are the effects of buy-side concentration on the structure of the corporate bond market?

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CFA Institute

AUGUST 30, 2021

What are the effects of buy-side concentration on the structure of the corporate bond market?

Fpanda Club

NOVEMBER 15, 2022

FP&A teams do not have a crystal ball… Yet, they have to answer management’s questions about the future every day. How will the competitor’s move impact our market share? Various types of uncertainty can be well illustrated by the so-called Rumsfeld matrix widely used in risk analysis and risk management.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Growth Architect: How Financial Leaders are Unlocking Potential

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

From Start to Scale: Driving Growth Through Seamless Payments Implementation

Future CFO

OCTOBER 2, 2023

Moreover, current market conditions drive private fund managers to hone in on their cash management practices , with many turning to strategies more commonly used by their corporate counterparts. Money market funds are “particularly attractive” as they generate yield on idle cash and are highly liquid, according to Quinn.

Global Finance

SEPTEMBER 9, 2024

While the job has always had a strong risk-management component, the basic task was simple: making sure the company has cash available, when and where it’s needed. Things change on a daily basis, which is very different from three or four years ago,” says Herve Carrere, chief product officer, Treasury and Capital Markets, at Finastra.

Global Finance

JUNE 14, 2024

Banks are now prioritizing four key areas: liquidity management with a balanced portfolio view including commercial real estate (CRE), enterprise protection with anti-fraud and cybersecurity, operational resiliency and sustainability with climate risk and green products. Overall, balanced risk management is the ultimate goal for banks.

E78 Partners

NOVEMBER 7, 2024

Outsourcing also enables internal teams to concentrate on essential business tasks rather than getting weighed down by the challenges of telecom management. This adaptability is especially beneficial in today’s market where flexibility is essential for lasting success.

Global Finance

JULY 26, 2024

Nordea , which wins two awards this year, as both Best Fraud Detection Solution and Best Bank for Treasury FX Services, has developed a new secure Cash Management self-service request. Enhancing Treasury With Technology Tailoring treasury management tools requires a nimble approach, owing to the diversity of client needs.

Future CFO

DECEMBER 18, 2020

FutureCFO spoke to three executives for their expressed views on the impact of COVID-19 on the Asia Pacific’s (APAC) credit market: Mike San Diego, chief financial officer at JK Capital Finance; James Ponsford, regional director & growth leader, Credit Solutions, Asia at Aon; and Matthew Wells, APAC regional commercial director for Euler Hermes.

Future CFO

FEBRUARY 13, 2023

He also recommends continuing dialogues with banks that offer market insights to craft good strategies for funding and risk management. Read market updates daily and try to assess the potential impact on the group, be proactive vs reactive. Constant analysis of the company’s positions (cash, FX, tax, etc.)

CFO Talks

NOVEMBER 21, 2024

As a CFO, you will need to manage and inspire teams, work with other executives, and communicate financial insights in a way that non-financial stakeholders can easily understand. This requires clear communication and the ability to influence decision-making at the highest levels. Risk management and problem-solving are critical as well.

Global Finance

DECEMBER 6, 2024

Over the past year, QNB Privates strategic investment approach has significantly increased return on investment, reflecting its commitment to maximizing client value while maintaining prudent risk management practices. The private bank offers a comprehensive service suite of traditional banking and modern financial solutions.

PYMNTS

DECEMBER 14, 2020

Whether it's the power grid, banking and financial markets, transportation, communications or even the highly generalized “internet of things,” the list of digital inroads that penetrate our daily lives has never been higher. has at the very least focused the world’s awareness on this growing problem.

E78 Partners

NOVEMBER 7, 2024

Outsourcing also enables internal teams to concentrate on essential business tasks rather than getting weighed down by the challenges of telecom management. This adaptability is especially beneficial in today’s market where flexibility is essential for lasting success.

E78 Partners

NOVEMBER 7, 2024

Outsourcing also enables internal teams to concentrate on essential business tasks rather than getting weighed down by the challenges of telecom management. This adaptability is especially beneficial in today’s market where flexibility is essential for lasting success.

PYMNTS

FEBRUARY 14, 2020

Venture capital funding rounds this week showed some concentration on the continent, with several announcements tied to Europe. Shippeo said it has 50 large corporate customers across 40 countries, and estimated the market it serves to be worth $6 billion. Starling Bank. In the U.K., CybelAngel.

Global Finance

DECEMBER 6, 2024

Over the past year, QNB Privates strategic investment approach has significantly increased return on investment, reflecting its commitment to maximizing client value while maintaining prudent risk management practices. The private bank offers a comprehensive service suite of traditional banking and modern financial solutions.

Global Finance

OCTOBER 11, 2024

The US Federal Deposit Insurance Corporation’s quick response to the banks’ failures stemmed additional contagion and has left businesses with an object lesson in concentration risk. The bank is known for developing inaugural and subsequent green and social bonds for the European and Latin American markets.

The Finance Weekly

JULY 7, 2022

The word “risk” has taken on a whole new meaning in the past few years. Regulations, supply chain disruptions, and fast changing markets have created very unstable and constantly changing consumer sentiments. At the same time that elements of risk are constantly there, investors are demanding more disclosures and a deeper analysis.

Future CFO

FEBRUARY 18, 2024

In the office, I will try to block time each day, first thing in the morning, before any meetings or appointments to work on something which requires uninterrupted concentration, deeper thought or greater creativity. The experience in my 20’s of working overseas in an international and dynamic market like Singapore was extremely stretching.

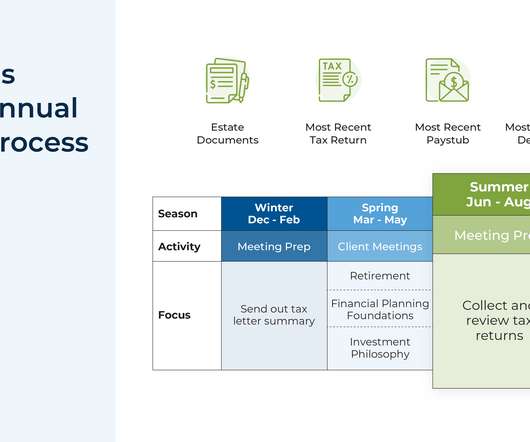

CFO News Room

NOVEMBER 21, 2022

As such, client meeting seasons are held in both the spring (March through May) and the fall (September through November), with most meetings currently concentrated in April and October. Which is why we make sure to discuss this with them, year in and year out, regardless of the market environment. software changes).

Future CFO

MARCH 23, 2023

Few Fitch-rated banks in APAC have the sort of depositor concentration profiles that left SVB particularly vulnerable to a run, the firm observed. “We We believe the risk of deposit volatility could be significant for digital banks in APAC,” Fitch said.

Spreadym

NOVEMBER 3, 2023

Debt Management: If you have debt, like credit card debt or student loans, develop a plan to manage and pay down your liabilities efficiently. Risk Management: Assess your insurance needs, including health, life, disability, and property insurance, to protect against unexpected events that could impact your financial well-being.

PYMNTS

AUGUST 30, 2018

Although Deutsche Bank says it knows it cannot return to the market domination it enjoyed before the 2008 financial crisis, according to Reuters reports on Wednesday (Aug. It would be “too risky” to allow non-European banks to lead the way of financing and risk management in Europe, Sewing added.

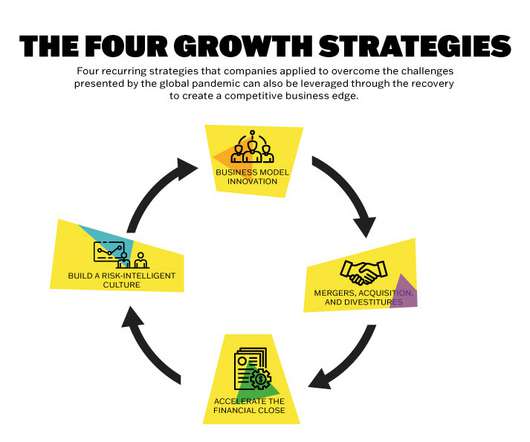

The Finance Weekly

OCTOBER 13, 2021

This past year has magnified challenges for organizations and their respective industries in unique ways, but there's one common theme we've noticed across the board: Those who were able to adapt quickly found new, unexpected ways to thrive and grow in the midst of one of the most difficult market environments in modern history.

Future CFO

JANUARY 10, 2024

Among such challenges in the market include insolvencies, denoting the state of financial distress wherein a business is unable to pay its debts. Edmond Lee , CEO of Hong Kong, Taiwan, and South Korea for credit insurance company Allianz Trade , delves deep into the insolvency challenges and climate being dealt with in Asian markets.

Spreadym

JUNE 15, 2023

By identifying the key drivers, organizations can concentrate their efforts and resources on those areas that have the most significant impact on achieving their goals. For instance, understanding how changes in marketing expenditure affect revenue growth.

CFO Talks

MARCH 20, 2024

Without a CFO fully focused on the future and driving strategic financial planning, the company risks becoming stagnant, unable to adapt to changes in the market or capitalize on new opportunities. It involves trusting your team, delegating effectively, and concentrating on strategic financial planning.

Global Finance

OCTOBER 31, 2024

Miao described a variety of initiatives designed to strengthen management, accelerate innovation, and improve both wealth management and fintech risk management. That level of concentration defines ICBC, the world’s largest bank by assets and winner of this year’s Best Corporate Bank award. trillion.

Barry Ritholtz

SEPTEMBER 12, 2022

She really has an incredible background in everything from capital markets to derivatives, to wealth management. You’ve been involved with capital markets for your entire career. I was very lucky to have amazing mentors, amazing people around me who really taught me about the business, taught me about markets.

Barry Ritholtz

MARCH 7, 2023

She worked with George Soros, she worked with Steve Cohen at SAC Capital, and ultimately ends up joining Goldman Sachs Asset Management Group, as co-CIO, a fascinating approach to macro, very quantitatively driven and very academic research-oriented. The market microstructure has changed. When do you own growth? When do you own equity?

Barry Ritholtz

DECEMBER 19, 2023

There are about 13 different portfolio managers each focused on a different sub-sector. It’s beta neutral, market neutral. So they were not offering paid in internships ’cause the market was still recovering from the tech bubble crash. ’cause there’s 00:02:52 [Speaker Changed] No, no escape than that guy.

CFO News Room

NOVEMBER 8, 2022

directly via email: Resources Featured In This Episode: Looking for sample client service calendars, marketing plans, and more? And we’re going to talk about what’s going on in the markets, briefly talk about the portfolio. Get notified of the latest episodes (and all our research as it’s released!) Cean: Thanks, Michael.

CFO News Room

NOVEMBER 22, 2022

directly via email: Resources Featured In This Episode: Looking for sample client service calendars, marketing plans, and more? ” Matthew: It’s very risk management based. Matthew: So, in general, let’s say, the Russia-Ukraine war is happening and the market drops 15%. Check out our FAS resource page !

Barry Ritholtz

DECEMBER 6, 2022

I did in 2013 the largest banking transaction that the market had seen since the financial crisis, it was a $2.4 First of all, I think the amount of investors that participate in the financial markets is much smaller than it is in the U.S. So fast forward to where we are today, we have over $40 billion in assets under management.

Barry Ritholtz

JULY 4, 2023

And we’ve talked about whether we go deeper on existing strategies, we build new businesses, we find somebody who can help him more as almost a co-CIO with risk management, with the investment process. It’s mark to market. As you pointed out, I worked at Goldman. I worked in consulting. And teams are small.

Barry Ritholtz

AUGUST 15, 2023

I didn’t know a whole lot about markets or stocks. ” But I really had an interest in trying to work directly in markets. So I worked at a private equity firm, that middle market private equity firm Yale had money with. SEIDES: But market returns across — RITHOLTZ: The past decade, 2010 to 2020, we were what?

CFO Talks

FEBRUARY 20, 2024

An experienced CFO with a strong ack record in financial leadership and strategic planning, skilled in financial analysis, risk management, compliance , and financial reporting, a nd excels in team management and fostering a collaborative environment. And do you see that market growing and expanding? Farhaan: Sure.

Barry Ritholtz

AUGUST 16, 2022

If you’re all interested in macro investing, trend following, commodities, currencies, fixed income, various types of quantitative strategies, and most important of all, risk management, you’re going to find this conversation to be absolutely fascinating. RITHOLTZ: That’s pretty early in the managed futures history.

Barry Ritholtz

APRIL 4, 2023

BARRY RITHOLTZ, HOST, MASTERS IN BUSINESS: This week on the podcast, I have an extra special guest, Ken Kencel of Churchill Asset Management, CEO, Founder, President. Ken was there at the beginning of the private credit markets when he was working at Drexel. KENCEL: So — RITHOLTZ: Why are they investing in mid-market U.S.

CFO Talks

NOVEMBER 1, 2024

Risk Management: A CFO must identify potential risks and ensure robust internal controls are in place to safeguard the organization.

Barry Ritholtz

NOVEMBER 4, 2024

And in terms of the market, it was a new burgeoning area, and you didn’t have to be a PhD. I would say that the IPO market is not as, you know, it is so cyclical, it’s just not, for example, it’s not friendly right now and it’s hard to get exits. Not a friendly IPO market. White sheet. Pretty robust.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content