Restructuring Compensation And Roles To Align For Growth

CFO News Room

NOVEMBER 8, 2022

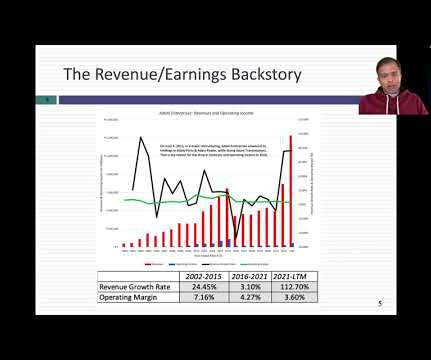

So, now, help us understand how this evolved and where the challenges had come as this was evolving that got you to the point that you had to do some restructuring to make it this. They were more on the relationship side, client-facing, whereas I was getting my CFA charter and was more on the investment side. Cean: Yeah. Pause there.

Let's personalize your content