Concentration Risk on the Buy-Side of Credit Markets: The Causes

CFA Institute

AUGUST 30, 2021

What are the effects of buy-side concentration on the structure of the corporate bond market?

CFA Institute

AUGUST 30, 2021

What are the effects of buy-side concentration on the structure of the corporate bond market?

Fpanda Club

NOVEMBER 15, 2022

Various types of uncertainty can be well illustrated by the so-called Rumsfeld matrix widely used in risk analysis and risk management. Unknown knowns These are risks we intentionally ignore and don’t want to acknowledge. In the well-built risk-management system this type of risks should not exist.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Global Finance

JUNE 14, 2024

Financial institutions have been facing tough challenges between economic uncertainty and an unprecedented technology-powered speed of change, especially since the Spring Bank Run of 2023. Overall, balanced risk management is the ultimate goal for banks. This strengthens financial institutions’ resiliency and security.

The Finance Weekly

OCTOBER 13, 2021

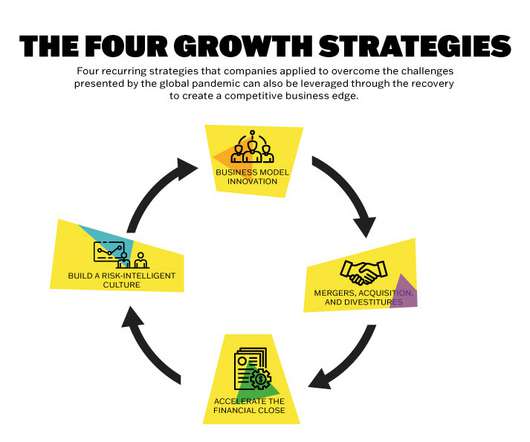

Earlier this year, Oracle identified four repeating techniques that the most ambitious and inventive organizations have used to obtain a competitive advantage and achieve significant development: business model innovation; mergers, acquisitions, and divestitures, accelerate the financial close, and developing a risk-aware culture.

Global Finance

SEPTEMBER 9, 2024

While the job has always had a strong risk-management component, the basic task was simple: making sure the company has cash available, when and where it’s needed. Predictive analytics can forecast future financial scenarios with greater accuracy, contributing to risk management and strategic planning. Not anymore.

Future CFO

SEPTEMBER 26, 2023

The primary reasons cited for these plans were fears of recession and uncertainty in the economic environment (59% of respondents) and inflationary pressures (58%).

PYMNTS

DECEMBER 14, 2020

Smart technologies have enormous potential to improve both human life and the health of the planet,” stated the World Economic Forum’s 2020 Wild Wide Web report. However, many unintended consequences have also surfaced,” the study added, noting that “cyberattacks have become a common hazard for individuals and businesses.”.

Let's personalize your content