Weekend Reading For Financial Planners (June 1-2)

Nerd's Eye View

MAY 31, 2024

Going beyond FPA’s existing PlannerSearch tool, the narrowed-down list is meant to help consumers identify a focused subset of the most reputable planners.

Nerd's Eye View

MAY 31, 2024

Going beyond FPA’s existing PlannerSearch tool, the narrowed-down list is meant to help consumers identify a focused subset of the most reputable planners.

CFO News Room

DECEMBER 20, 2022

And one of the flyers that came out said that I did estate planning, and tax planning, and business succession planning, and all these things I didn’t know anything about. And so, ultimately, I… Michael: Not actually that deep on your business succession planning experience as a 20-year-old.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CFO News Room

FEBRUARY 2, 2022

Michael Kitces is Head of Planning Strategy at Buckingham Wealth Partners , a turnkey wealth management services provider supporting thousands of independent financial advisors. Estate planning is commonly a big point of discussion, as well. Author: Michael Kitces. Team Kitces. Is that basically the cycle?

CFO News Room

NOVEMBER 22, 2022

” It’s constant communication through the year. And then we got the transition done, and then were able to get right back into financial planning mode where we’re doing the systematic reviews and getting everyone on board and used to the new systems. I know our education plan is on track for retirement.”

CFO News Room

DECEMBER 30, 2022

For instance, a 2022 Vanguard study found that consumers have different preferences for the planning services they want to be completed by a human and those to be done by a digital solution. The firms’ self-categorization was also reflected in the value they receive from using different types of advisor technology.

The CFO College

APRIL 8, 2021

Another key aspect of becoming a Valuable Expert is enhancing your education. Instructor : While continuing your education may seem obvious, many people overlook the importance of the “Instructor” aspect of “VIP.” You can do this through accumulating CPE credits and attending college or online training.

CFO News Room

NOVEMBER 30, 2022

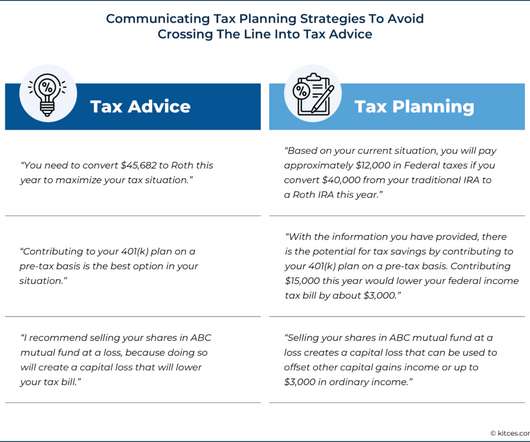

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong. When Tax Advice Is Restricted To Designated Tax Professionals.

Let's personalize your content